'I recorded fraudsters stealing my money'

"I find it really hard to sleep at night because I think these people might know where I live. I feel like my privacy has been violated."

Alice, a BBC radio producer, is talking about the moment she realised that she'd become the victim of a sophisticated impersonation scam.

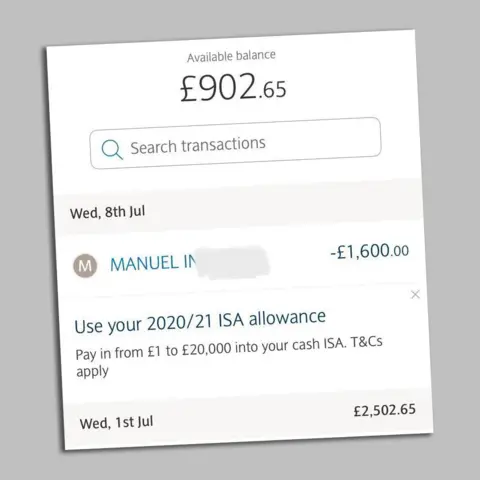

She'd had £1,600 stolen by someone she was convinced worked for Barclays.

This type of scam, also known as personal fraud, is when someone is targeted by criminals and tricked into handing over personal details.

Criminals then use those details to their advantage - in this case, accessing Alice's bank account and transferring £1,600 into an account controlled by them.

However, what the fraudster could not have known was that Alice had captured eight minutes of the call after thinking it would be easier to record the conversation on her second phone, which was close at hand, than to write down notes.

'Sense of guilt'

Personal fraud is one of a number that are defined as Authorised Push Payment (APP) fraud.

UK Finance, a group which represents the banking and finance industry, reported that people lost £455m to this type of fraud, with impersonation scams making up nearly a fifth of that figure.

This is up 29% compared to the year before. But the figure could be much worse as many frauds go unreported by victims who are too ashamed or too worried to speak out.

It's not just the financial impact that can hurt victims. It can cause tremendous harm to a person's emotional and mental wellbeing.

"There is also a really strong sense of guilt," says Alice, who is not being named in full because of fears she could be the target of identity fraud.

"I could have lost a lot of money, I could have lost all my savings," she says.

"I could have lost the money my grandparents left me so that's a lifetime of savings that I could have lost in, literally, a second."

Reverse psychology

Tamlyn Edmonds, a specialist fraud prosecutor and partner at law firm Edmonds Marshall McMahon, said criminals behind these types of fraud use classic social engineering tricks to gain their victim's trust.

"[The criminal] spends time building up this trust so that Alice has absolutely no awareness she's talking to a fraudster and she just thinks she's talking to a bank employee.

"He has a really friendly voice, he's well spoken, he's calm. He's using language that makes him sound helpful and friendly because that makes people's barriers come down.

"She's distressed, she's worried and he's playing on that."

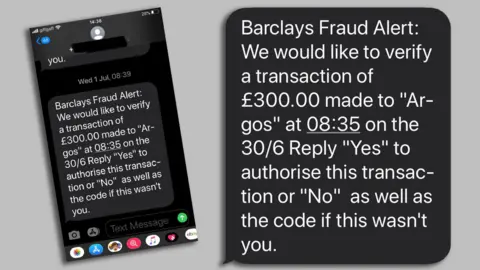

In Alice's case, the fraudster even warned her about other scams taking place at the moment - another classic reverse psychology trick, according to Ms Edmonds: "She thinks this is someone really trying to help me here, he's really concerned about me.

"He's drawing her attention to other types of frauds out of concern for her, whilst one is going on right under her nose unbeknown to her."

UK Finance has identified eight different types of scam, split into two categories, defined as APP Fraud:

- Malicious payee (purchase scam, investment scam, romance scam and advance fee scam)

- Malicious redirection (invoice and mandate scam, CEO fraud, impersonation of police or bank staff and other impersonations)

Graeme Biggar, director general of the National Economic Crime Centre, says fraudsters are also exploiting the coronavirus pandemic to target people.

"Fraudsters adapt to whatever is happening... and they've absolutely done that with Covid as well.

"We have seen Covid being used as a hook. Fraudsters are also realising there are more people sitting at home so are giving them calls earlier in the day."

Covid was mentioned in Alice's fraud too. Her bank, Barclays, said she had "been a victim of a very sophisticated and targeted impersonation fraud".

"The fraudulent withdrawal of £1,600 was immediately identified as being suspicious and swift action was taken to protect the account.

"We returned the customer's account back to the position it should have been in after concluding our customer was not liable [and] will support any further police investigation on this matter to help bring the criminals to justice."

The official advice for people to try to stop them becoming victims is never hand over any personal details to anyone who gets in touch out of the blue on a cold call or cold email and if necessary always call your bank back, ideally from a different phone.

You can hear more on BBC Radio 4's Money Box programme by listening again here.