Being black in business is being 'on your own'

Align Brooklyn

Align BrooklynPam Brown and her husband Christopher know they will need help if the yoga studio they own in New York is going to survive the pandemic.

But they don't think they will get it, at least not from the government. The reason? They're black.

As Ms Brown says: "Being a black business owner is really being out on your own."

The Browns, who founded their Align Brooklyn studio in 2014, applied for low-cost government loans offered as part of the trillions of dollars the US government has spent to help business.

But although they received some funds to help cover wages for their staff, their other applications were rejected.

Ms Brown hasn't been told why, but she suspects the value of their assets to act as security for loans - a category that would include homes or other investments - weren't substantial enough to qualify.

"We've done an exceptional job running our business," she says. "And I think that when the evaluation comes down to having a basis of wealth - having a house, having a lot of money in the bank to be able to sustain something like this - it's just obviously going to impact African American people significantly more."

On the face it, giving loans to people based on the size of their assets is not racial discrimination.

But the net worth of the typical black family in the US was $17,150 in 2016 - one-tenth that of whites, according to the Brookings Institution. That means it's almost inevitable that black small businesses like the Browns are less likely to get the government lifeline of a loan, than their white counterparts.

"The key problem here is a lot of African American-owned, Latin American-owned, immigrant-owned businesses - they don't have a lot of capital," says economist Robert Fairlie, a professor at the University of California, Santa Cruz. "How long can you last dipping into your savings, when you're starting at a point that's so low?"

Disparate impact

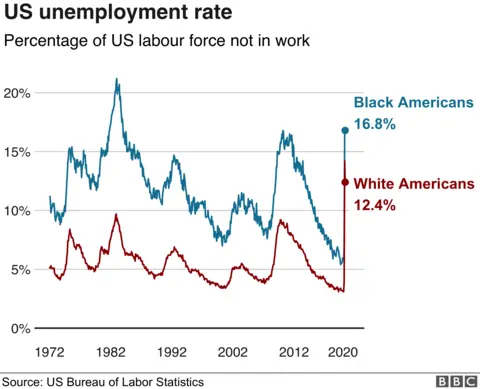

As coronavirus has whipped through the US, it has resurfaced America's longstanding racial disparities. They have reappeared not just in the sickness and death caused by the virus - black Americans are more likely to die from Covid-19 than their white counterparts - but also in unemployment levels and business distress.

More than 40% of black-owned small businesses in the US were shut in April, compared to 17% of those with white owners and 22% overall, according to a study by Prof Fairlie.

By the end of March, black-owned firms had 26% less cash on hand than the prior year, investment bank JP Morgan Chase reported, more than double the rate of decline for all firms.

Despite the disproportionate impact, surveys suggest they are less likely to have received help from the government.

The number of black business owners in the US was already unusually small - roughly 1.1 million or about 7% of the total by Prof Fairlie's count, even African Americans make up more than 13% of the country's population. That lag contributes to gaps in areas such as wealth and unemployment.

Without adequate help, "the disparities in business ownership are going to get even bigger," Prof Fairlie warns. "That's a big problem."

Government aid

Analysts say the difficulties accessing aid reflect longstanding injustices, which have left African Americans with less robust ties to the banks charged with distributing pandemic money and fewer personal resources to call on in a crisis.

In Congress, Democrats have called for an investigation of the emergency relief programmes, and why administrators are not tracking distribution of the funds by race, as required.

The Federal Reserve, which has mounted its own emergency response to the virus, is also under fire, as critics argue that its support for financial markets - and by extension, wealthy, mainly white investors - is exacerbating the country's economic divisions.

Getty Images

Getty ImagesAt a recent hearing in Washington, Senator Bob Menendez said the inequities would undermine the economy's ability to bounce back.

"You cannot have that whole segment of the economy ultimately doing so much worse than everybody else and believe that the economy is going to do well," he said.

Early signs suggest the recovery is already uneven. Last month, the overall unemployment rate fell to 13.3%, but among black workers it ticked up to 16.8%.

Driving the protests

The differences have helped fuel the demonstrations set off by George Floyd's death in police custody.

"I see all this 'unemployment has gone down' and 'oh jobs is opening up now' and it's like, I don't see that in my own community," says New York protester Christo Braz, who has lost his job and found himself queuing at food banks since the pandemic.

"I only saw people that look like me in my line. And that just made me so angry," he says.

As companies across the country responded to the protests with an unusual flood of statements decrying systemic racism, the Browns wrestled with their own response.

"Pre-Covid we didn't necessarily assess the fact of being black in relationship to being a business owner," says Ms Brown.

But she came to feel that staying silent was a form of complicity. She also wanted her customers - the majority of whom are white - to see the way that allowing such injustices to go unresolved hurts them as well.

Eventually, the couple sent a letter to the 11,000 people on their mailing list, highlighting their own story as an illustration of the way "the system is set up to maintain the racial divide".

"Our business may or may not survive the pandemic," she says. "But we did have an opportunity to speak some truth to people and to allow them to hopefully be changed."