Pandemic pushes US into official recession

Getty Images

Getty ImagesThe economic downturn in the US triggered by the pandemic has been officially declared a recession.

The National Bureau of Economic Research made the designation on Tuesday, citing the scale and severity of the current contraction.

It said activity and employment hit a "clear" and "well-defined" peak in February, before falling.

The ruling puts a formal end to what had been more than a decade of economic expansion - the longest in US history.

Meanwhile, US markets continued their rebound on Monday, as investors remained optimistic that the downturn will be short-lived.

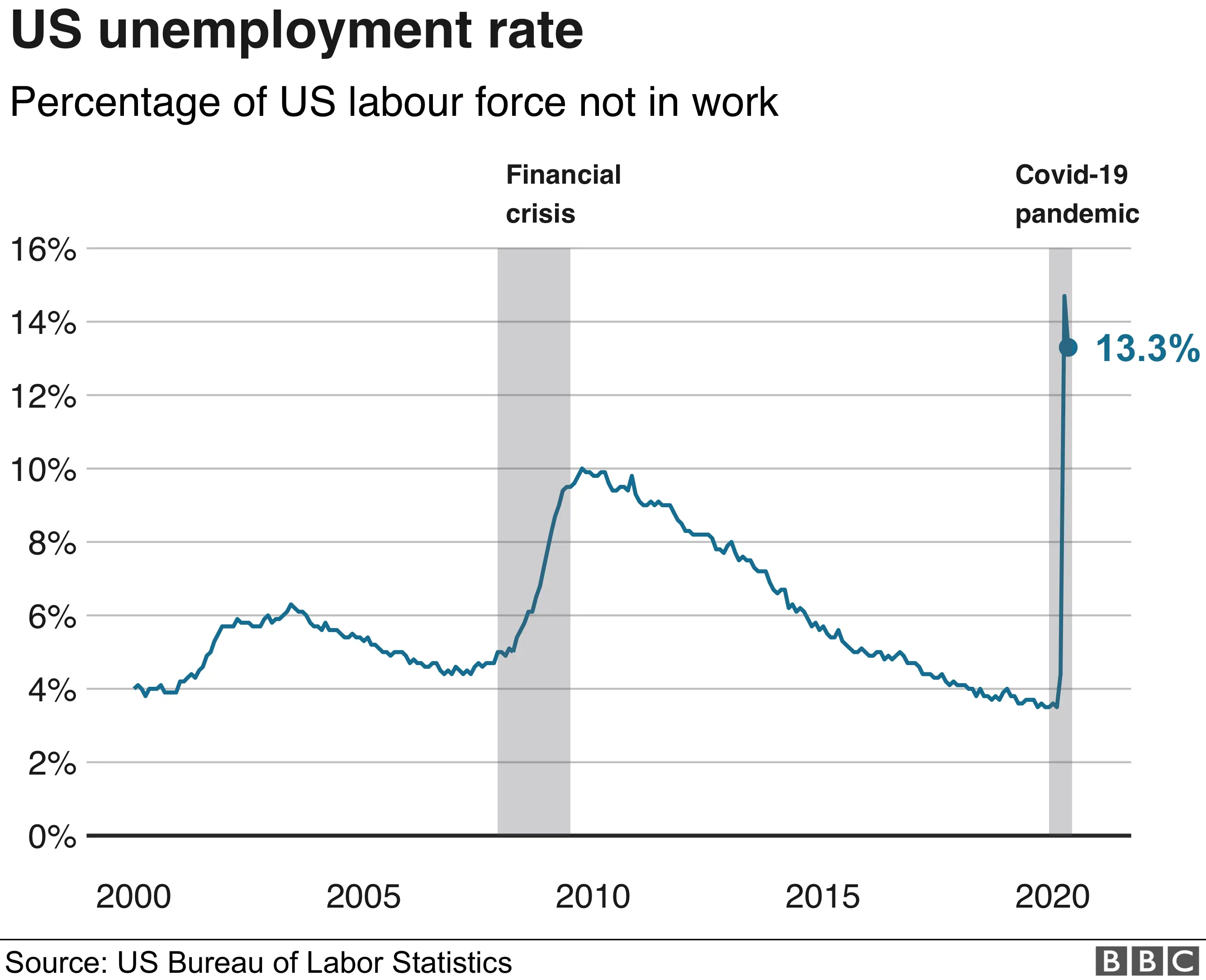

A recession was expected after the US economy contracted 5% in the first three months of the year.

Employers also reported cutting roughly 22 million jobs in March and April, as restrictions on activity intended to help control the virus forced many businesses to close.

Some economists are hopeful that the job losses have now stopped, and a rebound has begun. In May, US employers added 2.5 million jobs, as states started reopening.

The National Bureau of Economic Research, a private research organisation, said it viewed the scale of the decline that started in February as more significant than its duration.

"The unprecedented magnitude of the decline in employment and production, and its broad reach across the entire economy, warrants the designation of this episode as a recession, even if it turns out to be briefer than earlier contractions," it said.

The bureau typically defines a recession as an economic contraction that lasts "more than a few months".

It has declared 12 recessions since 1948, the longest of which was the Great Recession, which lasted 18 months, from December 2007 to June 2009.

Markets recover

US financial markets, which tumbled in February amid signs of the economic collapse, have been on the upswing since March, due to investor hopes that economic damage will be limited, thanks to emergency relief from Congress and the central bank.

On Monday, the Nasdaq index closed at 9,924.7, gaining 1.1% to top its pre-pandemic record.

Getty Images

Getty ImagesThe S&P 500 rose 1.2% to close at 3.232.3 - returning to where it started the year - while the Dow Jones Industrial Average climbed 1.7% to 27,572.4. The two indexes are now less than 10% lower than their pre-pandemic peaks.

US President Donald Trump has celebrated the rebound.

"Big day for Stock Market. Smart money, and the World, know that we are heading in the right direction. Jobs are coming back FAST. Next year will be our greatest ever," he wrote on Twitter on Monday morning.

Allow X content?

Many economists have warned that the economic pain is likely to linger, even if the worst has passed.

The World Bank on Monday said it expected the global economy to shrink by 5.2% this year, in the deepest recession since World War Two.

It said it expected the US economy to contract by 6.1% and the Euro area to shrink by 9.1%.

While global growth of 4.2% is expected to return next year, the bank warned that the outlook is "highly uncertain and downside risks are predominant, including the possibility of a more protracted pandemic, financial upheaval and retreat from global trade and supply linkages".