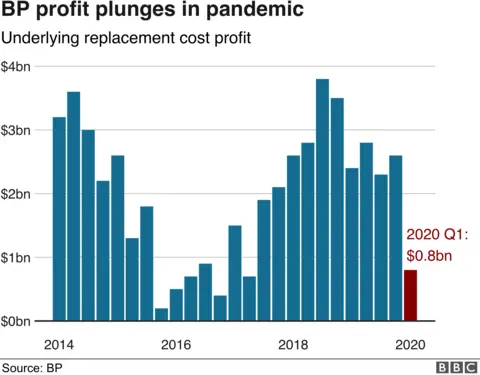

BP profits dive 66% as coronavirus hits oil demand

Getty Images

Getty ImagesBP's first quarter profit has dived by two thirds after the global coronavirus crisis hit demand for oil.

The oil giant warned it was facing an "exceptional level of uncertainty" after a sharp reduction in the need for its products.

Lockdowns around the world have been keeping people inside, slashing demand for oil.

It has sent prices to 20-year lows, with US oil turning negative briefly for the first time ever last week.

BP said that underlying replacement cost profit, its definition of net income, was $800m (£645m) in the first three months of 2020 - down from $2.4bn a year earlier.

However, it said it would keep paying shareholders a dividend.

"Our industry has been hit by supply and demand shocks on a scale never seen before, but that is no excuse to turn inward," said new chief executive Bernard Looney.

"We are focusing our efforts on protecting our people, supporting our communities and strengthening our finances."

Analysis, Andrew Walker, international business correspondent:

This is one of the industries most exposed to the impact of the coronavirus. We are not filling our cars (or we are at least doing it much less often) and airlines aren't refuelling their planes.

There is also, as the company noted, "exceptional uncertainty'" about the outlook for demand for these products. The accounts show an overall loss in the quarter, which largely reflected the dramatic fall in oil prices. The loss on the value of BP's inventories was $3.7bn (£3bn).

That is a one-off factor and on the company's preferred "underlying" measure of earnings it did make a much-reduced profit. It was by any measure a tough period for the business. Even though the financial environment is challenging, the company decided to go ahead with paying a dividend to its shareholders.

That decision has been criticised by environmental campaigners, such as Greenpeace, who say BP should prioritise investing in clean renewable energy.

Despite the challenging conditions, Mr Looney said the oil giant was still committed to its goal of cutting net carbon emissions to zero by 2050.

But Neil Wilson, chief market analyst at Markets.com, said: "If BP wants to go green and be 'carbon neutral' by 2050, it's going to require higher oil prices to do it. Oil will pay for the shift away from oil."

Brent crude oil, the international benchmark, currently costs about $19 a barrel, down from around $70 in early January. US oil is trading at just $11 a barrel.

Prices were already volatile before the pandemic due to in-fighting between producers over output - although earlier this month Opec countries and allies agreed a record deal to slash global production by about 10%.

However, many analysts say the cuts will not be enough to revive the market.

Elsewhere, the UK's oil and gas industry has warned that 30,000 jobs could be lost as a result of the coronavirus pandemic and lower oil prices.

Trade body Oil and Gas UK said many member firms would struggle to survive the effects of the pandemic, which has caused large parts of the global economy to shut down.

The predicted UK job losses represent about one in five of the 151,000 people employed directly or indirectly by the sector.

But campaign group Friends of the Earth Scotland said any government support must be conditional on the industry adopting more ambitious climate goals and not returning to "business as usual".