Coronavirus: HSBC puts 35,000 job cuts on hold

Getty Images

Getty ImagesHSBC has paused plans to cut 35,000 jobs, saying it does not want to leave staff unable to find work elsewhere during the coronavirus outbreak.

The bank announced the cuts in February as part of a massive cost-cutting programme.

But boss Noel Quinn said the "the vast majority" of redundancies would now be put on hold due to the exceptional circumstances.

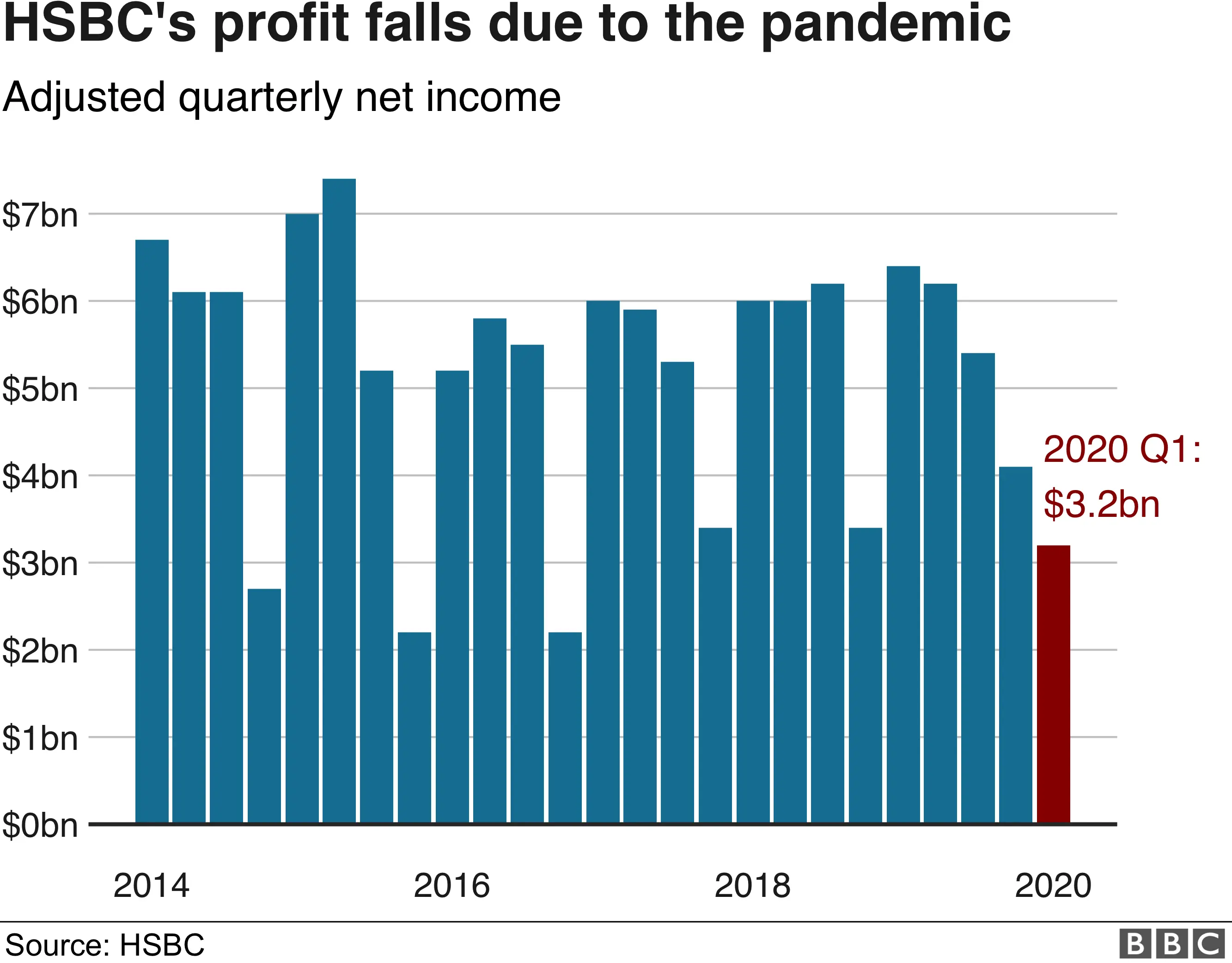

It came as HSBC reported a 50% fall in profits linked to the pandemic.

Pre-tax earnings for the first three months came in at $3.2bn (£2.6bn), down from $6.2bn a year ago.

The bank forecast bad loans would rise to $3bn due to customers not being able to repay them during the crisis. It also said earnings were likely to remain under pressure.

"The economic impact of the Covid-19 pandemic on our customers has been the main driver of the change in our financial performance," Mr Quinn said.

Earlier this year, HSBC said it planned to scale back its headcount from 235,000 to about 200,000 over the next three years.

The move is part of a restructuring programme which aimed to achieve $4.5bn (£3.6bn) of cost cuts by 2022.

Simon French, chief economist at Panmure Gordon, told the BBC's Today programme the plan to delay job cuts would provoke mixed feelings.

"This is probably the best bit of news in the whole results for employees," he said.

"But while it's good news for employees it isn't necessarily good news for shareholders and a return to higher profitability."

Analysis, Dharshini David, global trade correspondent

HSBC has suffered a dramatic halving of profits with provisions for bad loans up five-fold to $3.2bn (£2.4bn).

Yet the bosses of HSBC, its shareholders and employees may have uttered a sigh of relief: relief that the damage wasn't greater, given HSBC's exposure to some of the worst affected markets - and relief that plans to cut up to one in eight jobs have been paused.

But that relief may be fleeting. The bank's bosses have warned that provision for bad loans could hit $11bn this year, resulting in "materially lower profits" . They, like governments worldwide are bracing for a severe recession, especially in Europe and the US. And while HSBC sees signs of recovery in China as factories fire back up, it acknowledges that will be hit by weaker demand from the West.

That makes HSBC's massive restructuring plan, which relies on pivoting towards Asia, even more arduous. As the tough times hit, it's curbing costs - cutting the size of the bonus pool and keeping the 2020 dividend under review. But when the job cuts do resume, they may be more severe than initially envisaged.

Separately, in a note to employees earlier this month, HSBC's chief executive Noel Quinn said he would donate a quarter of his base salary, about £160,000, for the next six months to charity.

He will also not take his annual cash bonus, which would have been up to £1.2m.

Chief financial officer Ewen Stevenson said he would take similar action, donating £93,000 and forgoing £706,000, while chairman Mark Tucker will donate his entire 2020 fee to charity, about £1.5m.

It came as senior executives and board members at other major UK banks, including RBS and Lloyds, agreed to give up their bonuses for this year.

The announcements were in response to calls from the Bank of England to restrict bonuses during the pandemic.