Coronavirus: Branson offers Caribbean island to secure Virgin bailout

Virgin

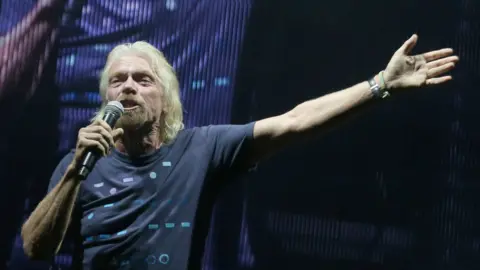

VirginSir Richard Branson has pledged his luxury island resort as collateral to help get a UK government bailout of his stricken airline Virgin Atlantic.

The billionaire Virgin Group boss said in an open letter to staff he was not asking for a handout, but a commercial loan, believed to be £500m.

The airline's survival was in doubt, and his Necker Island home in the Caribbean could be mortgaged, he said.

It comes as Virgin Group's airline in Australia enters administration.

Both airlines have been hit hard by the global coronavirus lockdown, and Sir Richard has appealed to governments in both countries for help.

However, he has been criticised for appealing for taxpayer aid rather than drawing on his huge wealth. Sir Richard's fortune is thought to be well over £4bn. The large US airline Delta owns 49% of Virgin Atlantic.

Sir Richard said in his letter to staff: "Many airlines around the world need government support and many have already received it." The crisis facing airlines, and the staff they employ, was "unprecedented," he said.

Despite his wealth, this did not mean he had "cash in a bank account ready to withdraw". And he hit back at criticism that he was a tax exile who did not deserve help, saying he and his wife "did not leave Britain for tax reasons but for our love of the beautiful British Virgin Islands and in particular Necker Island".

He said Necker would be offered as security for any loans. "As with other Virgin assets, our team will raise as much money against the island as possible to save as many jobs as possible around the group," Sir Richard said.

Allow X content?

Government support

In his letter to staff, Sir Richard said: "We will do everything we can to keep the airline [Virgin Atlantic] going - but we will need government support to achieve that in the face of the severe uncertainty surrounding travel today and not knowing how long the planes will be grounded for.

"This would be in the form of a commercial loan - it wouldn't be free money and the airline would pay it back (as EasyJet will do for the £600m loan the government recently gave them)."

He pointed out that Virgin Atlantic started with one plane 36 years ago, before adding: "Over those years it has created real competition for British Airways, which must remain fierce for the benefit of our wonderful customers and the public at large."

Sir Richard offered to inject £250m into the Virgin Group last month, with most of that going to the airline.

Earlier this month, Rolls-Royce, Airbus, Heathrow airport and Manchester Airports Group sent letters to the government highlighting the importance of Virgin Atlantic to the UK's manufacturing supply chain.

Australia struggles

Meanwhile, Virgin Australia - in which Sir Richard holds a stake of around 10% - is going into administration.

The carrier has been forced to cancel nearly all of its flights during the coronavirus crisis and been unable to restructure its debts.

The Australian government offered some support, but refused a request from the company for a A$1.4bn (£720m) loan.

The airline is part-owned by Sir Richard along with Etihad, Singapore Airlines and China's HNA.

"The brilliant Virgin Australia team is fighting to survive and need support to get through this catastrophic global crisis," Sir Richard said.

"We are hopeful that Virgin Australia can emerge stronger than ever, as a more sustainable, financially viable airline."

He warned: "If Virgin Australia disappears, Qantas would effectively have a monopoly of the Australian skies. We all know what that would lead to."

Getty Images

Getty ImagesSir Richard also addressed the fierce criticism he has faced in recent weeks over his tax situation.

Critics have pointed out he has paid no UK income tax since moving to the tax-free British Virgin Islands 14 years ago.

Sir Richard is the 312th richest person in the world with an estimated $5.2bn fortune, according to the Bloomberg billionaires index.

"I've seen lots of comments about my net worth - but that is calculated on the value of Virgin businesses around the world before this crisis, not sitting as cash in a bank account ready to withdraw," he said.

"Over the years significant profits have never been taken out of the Virgin Group, instead they have been reinvested in building businesses that create value and opportunities."

Turning to the question of living abroad he said: "Joan and I did not leave Britain for tax reasons but for our love of the beautiful British Virgin Islands (BVI) and in particular Necker Island, which I bought when I was 29 years old, as an uninhabited island on the edges of the BVI.

"Over time, we built our family home here. The rest of the island is run as a business, which employs 175 people."