Coronavirus: 'Under-25s and women financially worst-hit'

Getty Images

Getty ImagesYoung workers, the worst-paid and women will be most affected economically by the coronavirus, a study has found.

A "remarkable concentration" of those groups are employed in sectors that have shut down, the Institute for Fiscal Studies (IFS) discovered.

It said its research raised serious worries" about the longer-term effect of the crisis on young people especially and inequality.

Those with the lowest earnings were particularly hard hit, the IFS said.

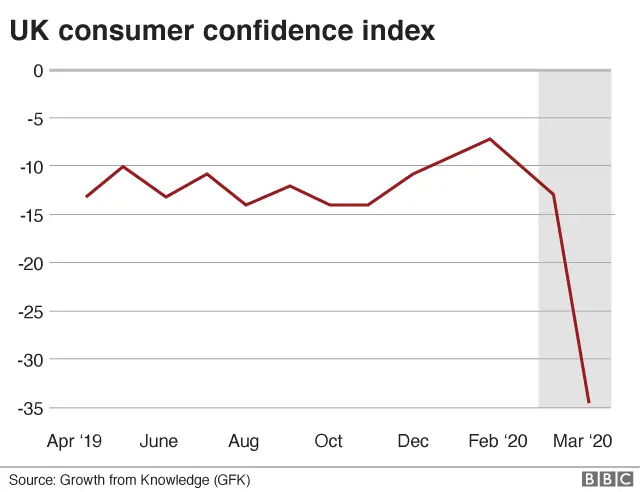

The research comes as the UK's confidence in the economy has fallen to its lowest in 12 years as the COVID-19 crisis drains consumer confidence.

The last time such a decline happened was during the 2008 economic downturn.

Market research firm GfK's consumer confidence gauge dropped to -34, a decline of 25 points compared to just two weeks earlier.

It suggested record grocery sales were not enough to counteract the "stark" outlook for the retail industry.

The IFS found that the virus lockdown was likely to hit younger workers the hardest, being nearly two-and-a-half times more likely to work in a shutdown area.

But it also found that the virus was likely to have a bigger effect on women's earnings because of a disproportionate amount of women working in retail and hospitality, with 17% of female employees working in shutdown sectors compared with 13% of men.

However, it was also found that the majority of the affected younger workers and lower earners live with parents, or other household members, whose earnings are not directly affected by the lockdown.

In mitigation, "in the short run, many will have the cushion of the incomes of parents or other household members," it said.

IFS director Paul Johnson told the Today programme said young people aged 25 years old and under tend to work in the leisure, retail and hospitality sectors, which have been heavily impacted by the Covid-19 lockdown.

Looking ahead to the future, he said there were two particular problems facing young people.

"There are those young people who are in those jobs at the moment or were in those jobs before Covid hit, and if they're not able to get back into work then there may be longer term consequences for them.

"We know that periods of unemployment when you're young can have long-term effects," he said.

The second problem is younger people coming into the labour market after finishing school or university. Mr Johnson said they are making their entry "in probably the most difficult time in living memory".

"Traditionally you're going to be looking to start work in September, [but] now couldn't be a worse moment to be doing it."

'Falling confidence'

GfK asked people in mid-March and at the end of March how confident they were about a number of areas such as personal finance and the general economic situation.

Data showed that many are now expecting their personal and household's financial position to worsen over the next 12 months.

"Our falling confidence in our personal financial situation and the wider economy reflects the new concern for many across the UK," said Joe Staton, GfK's Client Strategy Director.

The UK's supermarkets had their best month on record as shoppers rushed to stockpile ahead of the coronavirus lock-down.

Market data provider Kantar revealed last week that overall sales were up 20.6% in March.

It said that the average household spent £63 more than usual during this period.

However, Mr Staton warned the latest data shows that consumers plan on withholding from making many unnecessary purchases during the current period of economic uncertainty.

He suggested it could spell disaster for many high-street chains which are already under pressure due to the forced closure of stores.

Universal Credit spike

"Despite record grocery sales, and recent peaks for purchases of freezers, TVs and home office equipment as people prepared for a long period in the home, the Major Purchase Index is down 50 points - a stark picture for some parts of the retail industry in the short to medium term," added Mr Staton.

It was claimed this week that that 20% of small businesses could fold in April due to the collapse in consumer demand, despite unprecedented government intervention to support jobs.

The Department for Work and Pensions revealed a record number of people had applied for universal credit benefits in the past fortnight as a result of the coronavirus pandemic.

It said 950,000 successful applications for the payment were made between 16 March, when people were advised to work from home, and the end of the month.

The department said it would normally expect around 100,000 claims in a two week period.

Meanwhile, thousands of people are calling on the government to close a loophole in its plans to help workers during the coronavirus outbreak.

Chancellor Rishi Sunak announced help for companies to pay staff - but only those on the payroll on 28 February.