Brexit uncertainty 'could lead to interest rate cut'

BBC

BBCThe Bank of England may need to cut interest rates should Brexit uncertainty persist, one of its policymakers has said.

Even if the UK avoids a no-deal Brexit, rates may still need to be cut, Michael Saunders said.

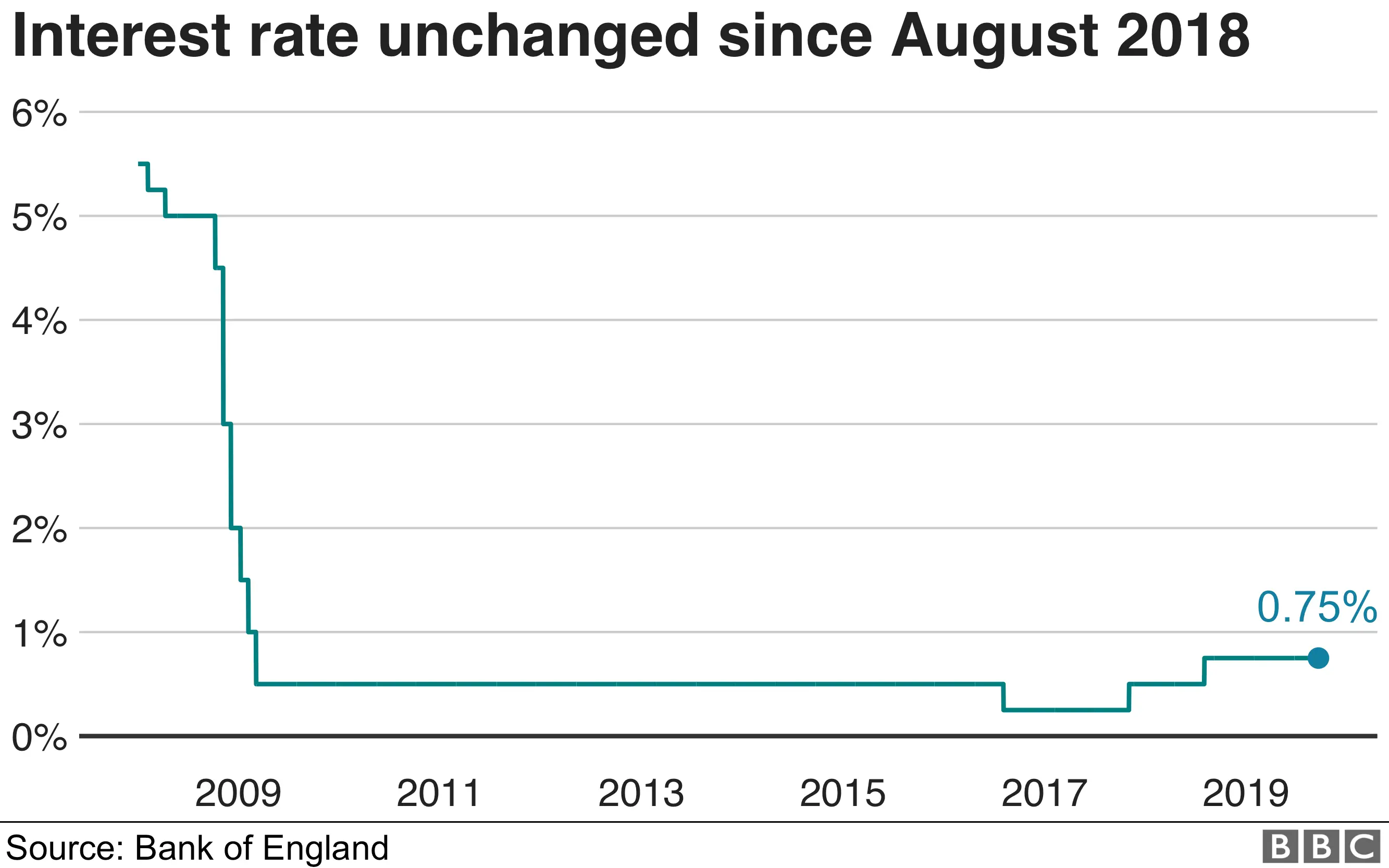

Interest rates have been on hold at 0.75% since August 2018, when they were raised from 0.5%.

Last week, the Bank said Brexit uncertainty meant the UK economy was performing below its potential.

"If the UK avoids a no-deal Brexit, monetary policy also could go either way and I think it is quite plausible that the next move in Bank Rate would be down rather than up," Mr Saunders told local businesses in Barnsley.

The pound dropped against the dollar after his comments were reported, trading down about 0.4% at $1.2277, before paring losses.

Mr Saunders, who is a member of the Bank of England's Monetary Policy Committee (MPC), said that even without a no-deal Brexit, high levels of uncertainty surrounding the UK's departure from the EU would persist and act as a kind of "slow puncture" for the economy.

"In this case, it might well be appropriate to maintain a highly accommodative monetary policy stance for an extended period and perhaps to loosen policy at some stage, especially if global growth remains disappointing," he said.

Passively waiting to see what happened with Brexit risked inappropriate monetary policy, and the cost of reversing a rate cut if the outlook improved would be low, he added at the event at the Barnsley and Rotherham Chamber of Commerce and Institute of Chartered Accountants.

"In general, I would prefer to be nimble, adjusting policy if it appears necessary to keep the economy on track, and accepting that it may be necessary to change course if the outlook changes significantly," he said.

Policy options

At its last meeting on interest rates, the MPC unanimously held rates at 0.75%.

Mr Saunders said he still agreed with recent Bank guidance that a limited and gradual increase in interest rates would be needed over the medium term, if Brexit uncertainty reduced significantly and global growth speeds up.

In the event of a no-deal Brexit, Mr Saunders repeated the Bank's position that all policy options would be open, depending on the damage to growth and how much inflation spikes from a further fall in sterling.

A disorderly no-deal Brexit could leave the Bank of England's rate setters with an unenviable dilemma.

Do they cut interest rates to boost growth - or raise them to curb inflation caused by a possible fall in the exchange rate, shortages and tariffs?

With tackling inflation at the top of its remit, the Bank's economic models assume rates would rise in such circumstances. But rates are set by nine humans, not machines.

The governor, Mark Carney, recently indicated he'd be inclined to cut in the event of a no-deal - and the vote usually goes the boss's way.

But what is remarkable is that there appears to a change of view on his panel of what to do even in the event of a deal.

Just last week, the MPC repeated its mantra that rates would likely go up slowly and gradually in the event of a deal.

But now, one of those who had previously warned of the dangers of not raising rates - Michael Saunders - says that a cut is plausible, deal or no deal.

The Bank says the economy has lost momentum; Michael Saunders likens the pace to a slow puncture. If he's shifting in his position, it's likely others are too

But how much would lower rates help in the event of a disorderly no-deal?

A cut aims to put more money in pockets. But if any hit to growth was due to shortages and disruption, a supply shock, boosting demand, may be counterproductive.

More money is great - as long as there's things to spend it on.

Earlier this month, Bank governor Mark Carney estimated that in a worst-case, chaotic scenario that a no-deal Brexit could reduce the size of the economy by 5.5%.

The Paris-based OECD has predicted a 2% hit in the case of a more managed no-deal Brexit.

Prime Minister Boris Johnson has repeatedly vowed to take the UK out of the European Union by 31 October, without a deal if necessary, but is in a stand-off with Parliament which has passed a law designed to block a no-deal Brexit.