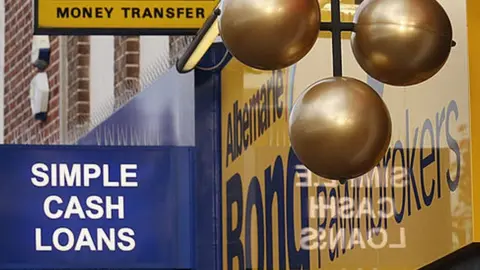

Pawnbroker shuts shops as it seeks lifeline

Getty Images

Getty ImagesCustomers of a High Street pawnbroker are being left in the dark after branches were closed and calls unanswered.

A&B Pawnbrokers (Albemarle & Bond) and Herbert Brown stores have closed their doors, while its website says "this store" has ceased trading.

Owner Speedloan Finance told the BBC all its 116 stores had been closed because of "significant losses".

The firm said it was "exploring options available to it".

These included finding a buyer for some or all of the stores, it said.

"Speedloan is due to enter into a period of consultation with employees concerning its proposal and has in the meantime offered its employees voluntary redundancy," it added.

The pawnbrokers' trade body hit out at the firm's unanswered helpline.

"Their decision to downscale UK operations is a strategic matter for the company but [we have] expressed concern that the communication of their actions to their customers falls below the standards expected of its members," the National Pawnbrokers Association (NPA) said.

"In particular, we are most unhappy with the fact that customers cannot get through to the helpline. We have demanded that the management of the company resolve this as a matter of urgency."

Analysis

Katie Prescott, business reporter

Industry insiders are shocked at the way Albemarle & Bond has handled its abrupt closure.

Many say that moving the pledges (the goods secured against the loan) to a central location is unfair, as most of their customers like to deal with things in their local branch.

One said that many of these clients don't have easy access to standard forms of credit, explaining that one option offered by A&B, to pay their loan online using a debit card, was often not appropriate, although they can also use cash in a NatWest branch.

The main concern now is what happens to those customers.

The BBC understands from a source close to one of the UK's biggest pawnbroker chains, Harvey & Thompson, that they are talking to A&B about the situation and are making every effort to offer their support and help for customers and staff. However, what that support looks like is yet unclear.

It's a sentiment echoed by the National Pawnbrokers Association.

Albemarle & Bond has a chequered history. Business boomed in the aftermath of the 2008 financial crisis, but it fell victim to a plunging gold price.

In 2013, it announced it was melting down gold in order to pay its debts. A few months later, it fell into administration.

It changed hands twice, to be bought in 2015 by the Japanese pawnbroking company Daikokuya Holdings. In 2016, it was given a £10m cash injection from the investment firm Gordon Brothers.

Four years on and it is once again on the market. Its latest set of accounts show that it lost £3.3m last year - as against £1.6m the year before.

Apology

Pawnbrokers allow customers to offer something valuable as security for a loan, or buy items such as jewellery and antiques. They lend money quickly, but usually at a worse rate than banks.

Stores also often offer other financial services such as currency exchange and buying gold.

The company said that any items pawned in A&B stores will be transferred to a central store, and can be redeemed or sold through this operation.

"If your items are expired or due to expire, please note we will not take any action with your items until we speak to you," the website said.

"Unfortunately, we were unable to contact all customers prior to the closure date. We apologise for any inconvenience this has caused."

Letters have been sent by Albemarle & Bond, which was established in 1840, to customers as stores closed.

Helplines

The regulator, the Financial Conduct Authority (FCA), said it was aware that companies operated by Speedloan had closed stores.

"We are engaging with the firm and asking them to ensure this process is carried out in an orderly manner and to minimise disruption to Speedloan's customers," the FCA said.

Speedloan said it was keeping the FCA informed.

The Financial Ombudsman Service said it had received calls from frustrated customers unable to get through to the company and were worried about their items.

Customers can contact the company on 01865 798114, which is a dedicated hotline, or by email at [email protected].

If customers are not happy with the response from the company, they can contact the Financial Ombudsman Service to complain on 0800 023 4567, or the FCA customer helpline on 0800 111 6768.

How does pawnbroking work?

- Customer "pledges" an item, such as a gold ring for a set period of time, usually six months

- Pawnbroker gives 50% to 60% of the item's value as a cash loan

- Customer pays 7% to 8% interest every month

- An item can be redeemed during the loan period by paying back the original loan and any interest up to that point

- If the customer cannot repay the loan at the end of the deal the pawnbroker sells the item and returns any surplus to the customer

More information is available from the National Pawnbrokers Association. Consumer advice on pawnbroking is available from Citizens Advice and the Money and Pensions Service