Pound volatile in further Brexit turmoil

Getty Images

Getty ImagesThe pound has made gains on currency markets after Prime Minister Boris Johnson lost his majority in the House of Commons.

Tory MP Phillip Lee's defection to the Liberal Democrats lifted sterling to above $1.20 and €1.10.

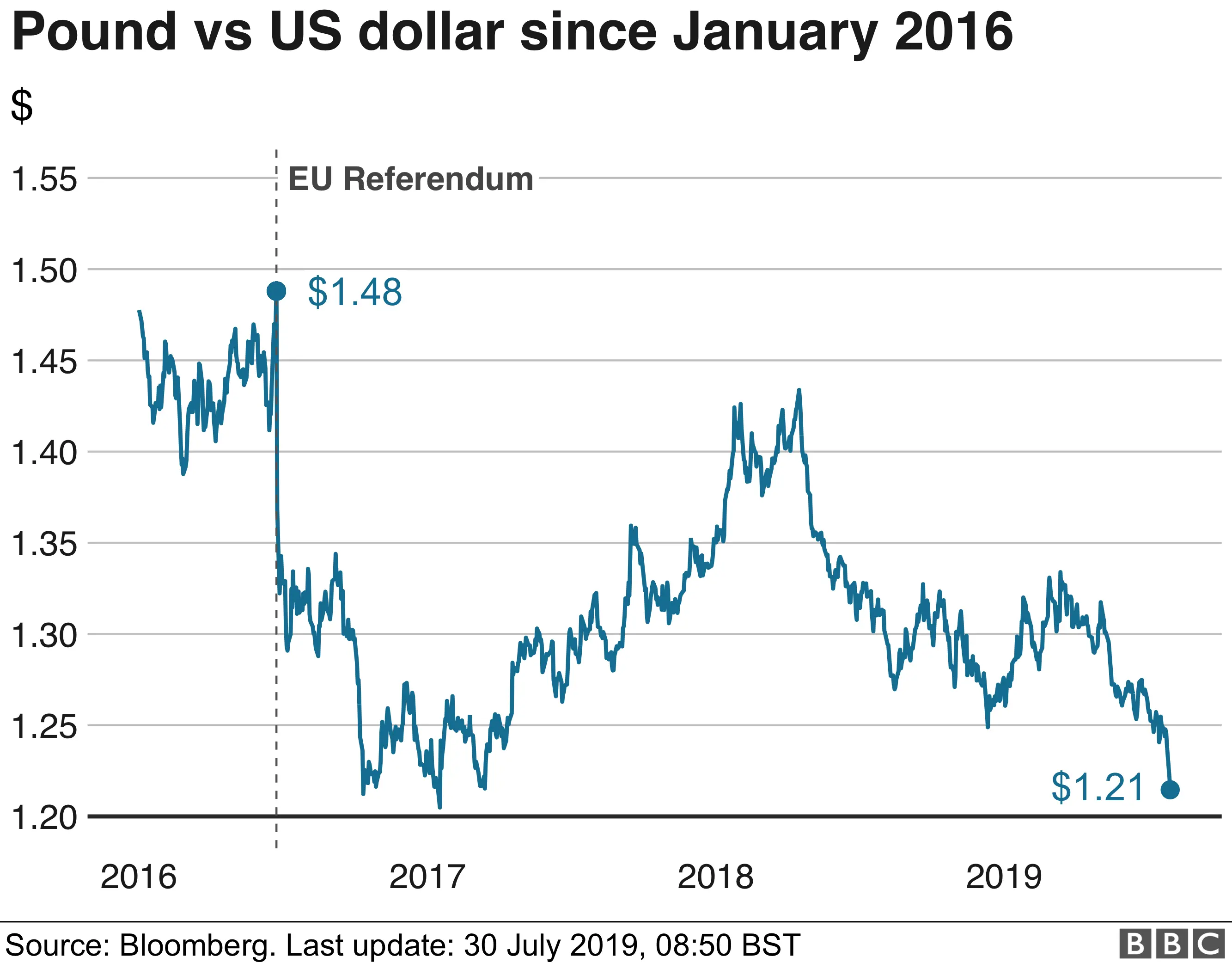

Earlier, the pound had touched its lowest level since October 2016 before recovering to erase the day's losses.

Rebel Tories and Labour MPs want to pass a bill to stop the UK leaving the EU on 31 October without a deal.

No 10 has threatened a snap general election on 14 October if MPs succeed in seizing control of Commons business.

Addressing Parliament on Tuesday afternoon, Mr Johnson that if they managed to block a no-deal exit, it would "destroy any chance of negotiating a new deal".

The bill would force the prime minister to ask for Brexit to be delayed until 31 January, unless MPs had approved a new deal, or voted in favour of a no-deal exit, by 19 October.

Under Mr Johnson, the government has toughened its stance on a no-deal Brexit, which it has said is "now a very real prospect".

Excluding the so called "flash crash" in October 2016, when the pound briefly fell sharply to $1.15 against the dollar before rapidly rebounding, the pound has not traded regularly below $1.20 since 1985.

The pound was trading at about $1.50 against the dollar before the EU referendum in June 2016.

Pound v Dollar

Jane Foley, senior currency strategist at Rabobank, told the BBC's Today programme that while anything that made a no-deal Brexit less likely would boost sterling, an election would have the opposite effect.

"Currencies, as a rule, do not like uncertainty. The idea is that there could of course be a no-deal Brexit, which investors do not like. They do not like the idea of the uncertainty or the potential chaos that that could bring," she said.

Pound v Euro

"If the members of Parliament do manage to block a no-deal Brexit at the end of next month, then that is likely to push sterling up," Ms Foley added.

"That said, political uncertainty and a general election will likely push sterling down.

"Sterling will remain a very vulnerable currency."

Political earthquakes inevitably cause tremors in the currency markets. After all, the value of the currency broadly reflects the faith investors have in the prospects of a country. And with the City just a mile or two from Westminster, it's physically impossible for traders to ignore the turmoil.

But do wobbles on foreign exchange markets matter to the rest of us? They do - and perhaps more than we want to know. A weaker pound, of course, makes holidaying abroad more expensive (but cheaper for overseas tourists to visit the UK).

But it also makes imports dearer, bumping up the cost of our shopping list. Take food, for instance. About half of what we eat comes from overseas. The pound has fallen over 10% against the euro and about 20% against the dollar since 2016.

Big companies tend to try to insure or "hedge" against currency movements, but within a matter of a few months, those changes in price tend to feed through. It's enough to make everyday staples or impulse buys feel a bit more like little luxuries.