High Street: How many UK shops have closed?

Getty Images

Getty ImagesHardly a month goes by without news of another wave of shops shutting or of stores losing money.

Retailers are holding on to more space than they can pay for, and costs are shooting up, reports suggest. So, what is behind the High Street crisis?

1. Shops are empty, and too big

Fashion chains Karen Millen and Coast recently announced closures. They had more than 100 outlets and concessions between them.

The fast-growing online fashion chain Boohoo snapped up the brands following their collapse. But Boohoo isn't interested in owning and running physical stores and so relaunched them as online-only retailers.

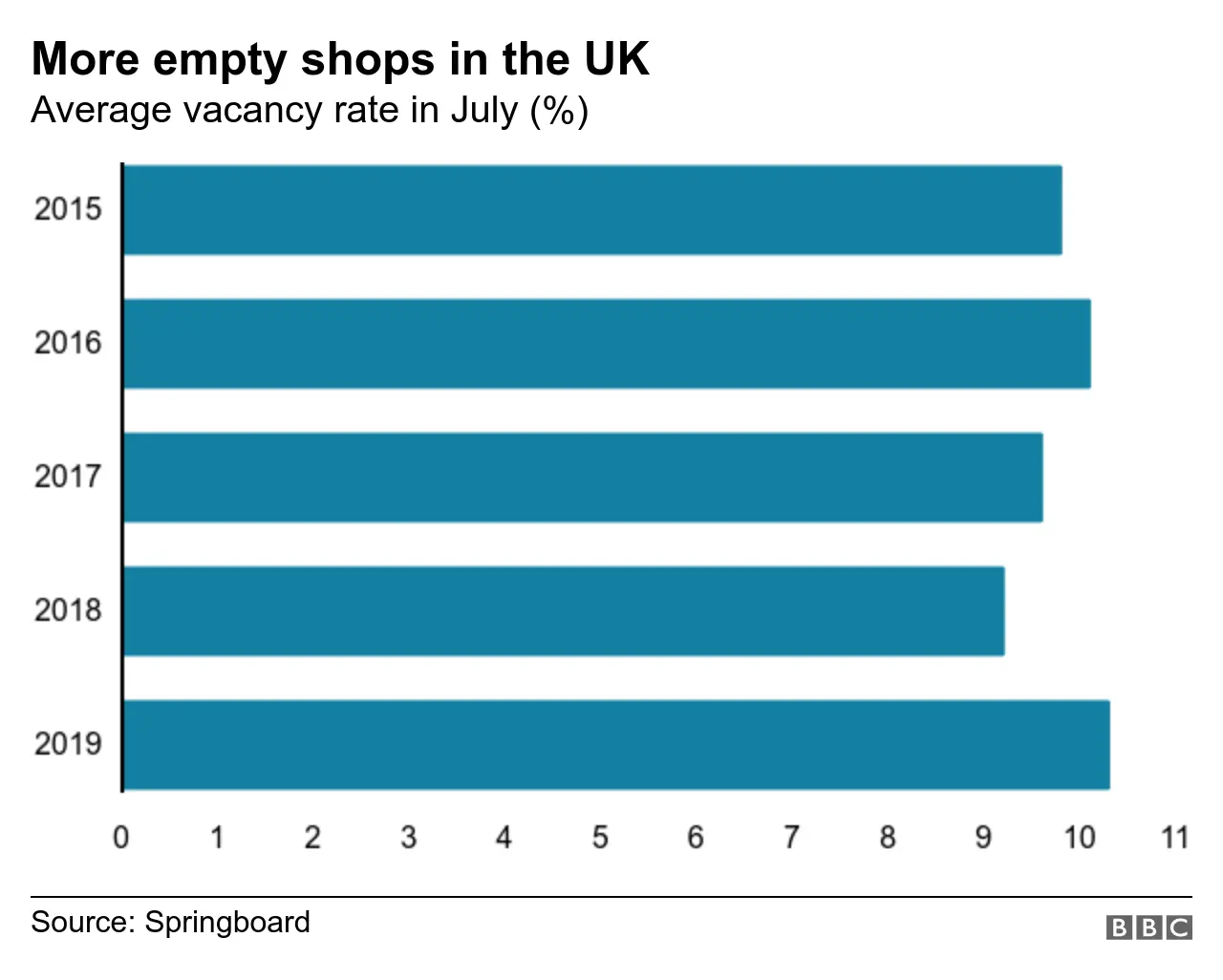

The number of empty shops already stands at a record high.

In July the proportion of all shops that are empty reached 10.3%, its highest level since January 2015.

Last year, big chains such as Toys R Us, Maplin and Poundworld went bust and vanished altogether.

New research also indicates the top 150 UK retailers have 20% more store space than they need and can afford.

Some shops such as Homebase, Mothercare, Carpetright and New Look have done restructuring deals with their landlords, closing hundreds of shops between them.

2. Shopping habits are changing

In many ways, retail is a pretty simple business. You have to sell things for more than you paid for them

But in the past few years, things have become a lot harder for traditional retailers.

Getty Images

Getty ImagesCompanies have had to deal with rising costs. Researchers at A&M and Retail Economics suggest during the past five years, companies have had to spend 10.8% more on things such as business rates, increasing wages and rents.

And, at the same time, retailers are trying to adapt to rapidly changing shopping habits.

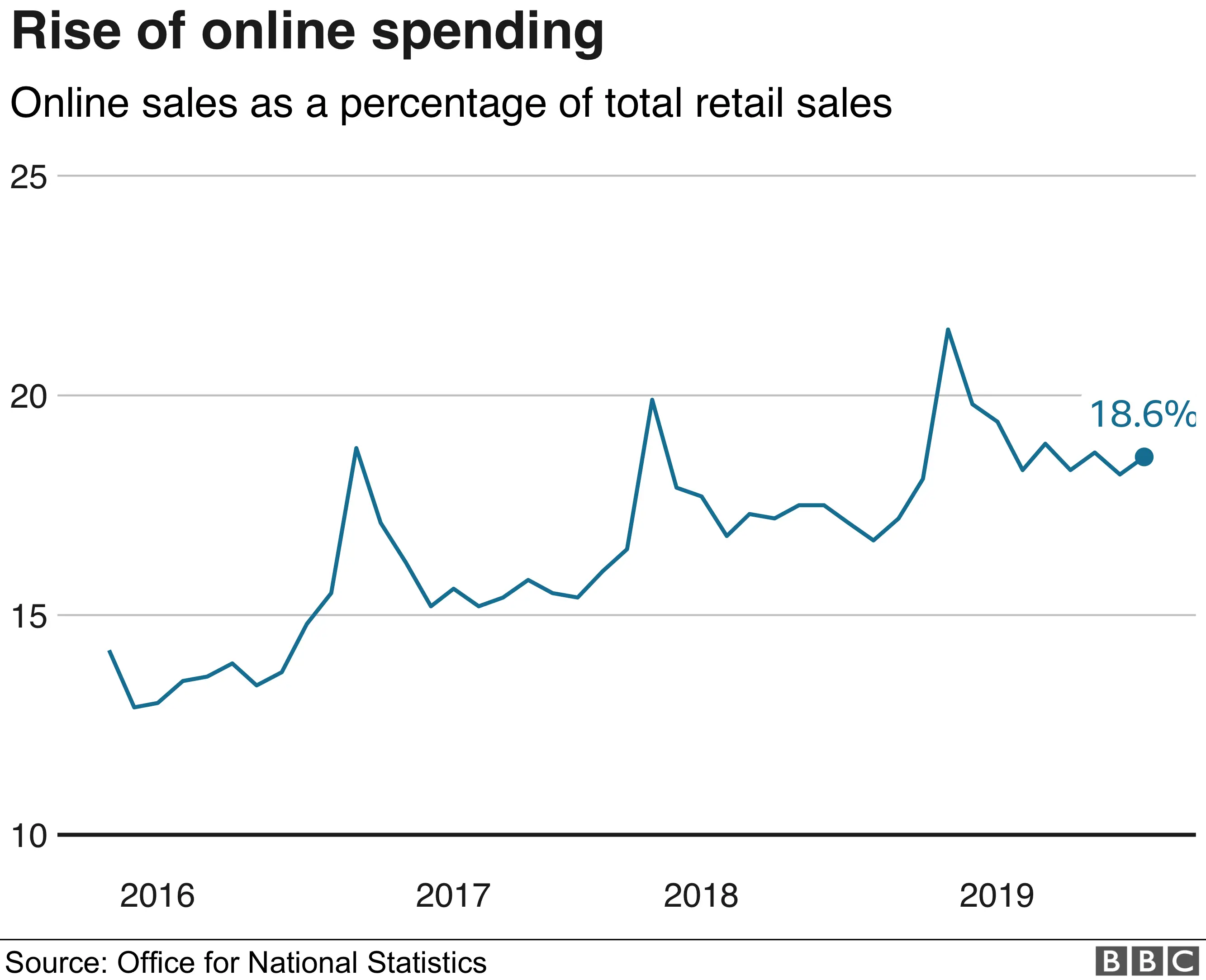

Consumers now spend one in every five pounds online - and if businesses are seeing 20% fewer sales on the shop floor as well as their fixed costs rising, then profit margins will be squeezed.

This huge shift in spending is making businesses think again about how they make money. Too many retailers either fail or are unable to adapt.

Those with underlying problems have suffered.

Take Debenhams, it's been struggling for years. Its previous owners had saddled it with a huge amount of debt and it was tied into long leases.

Another department store, House of Fraser, was rescued last year by Mike Ashley's Sports Direct. He outlined a plan to create the "Harrods of the High Street" and said about 80% of the stores would remain open. But he's now admitted the business was losing more than £1m a week.

Consumers are spending increasing amounts of their disposable income on experiences and lifestyle. Being mediocre isn't good enough anymore.

3. Footfall is declining

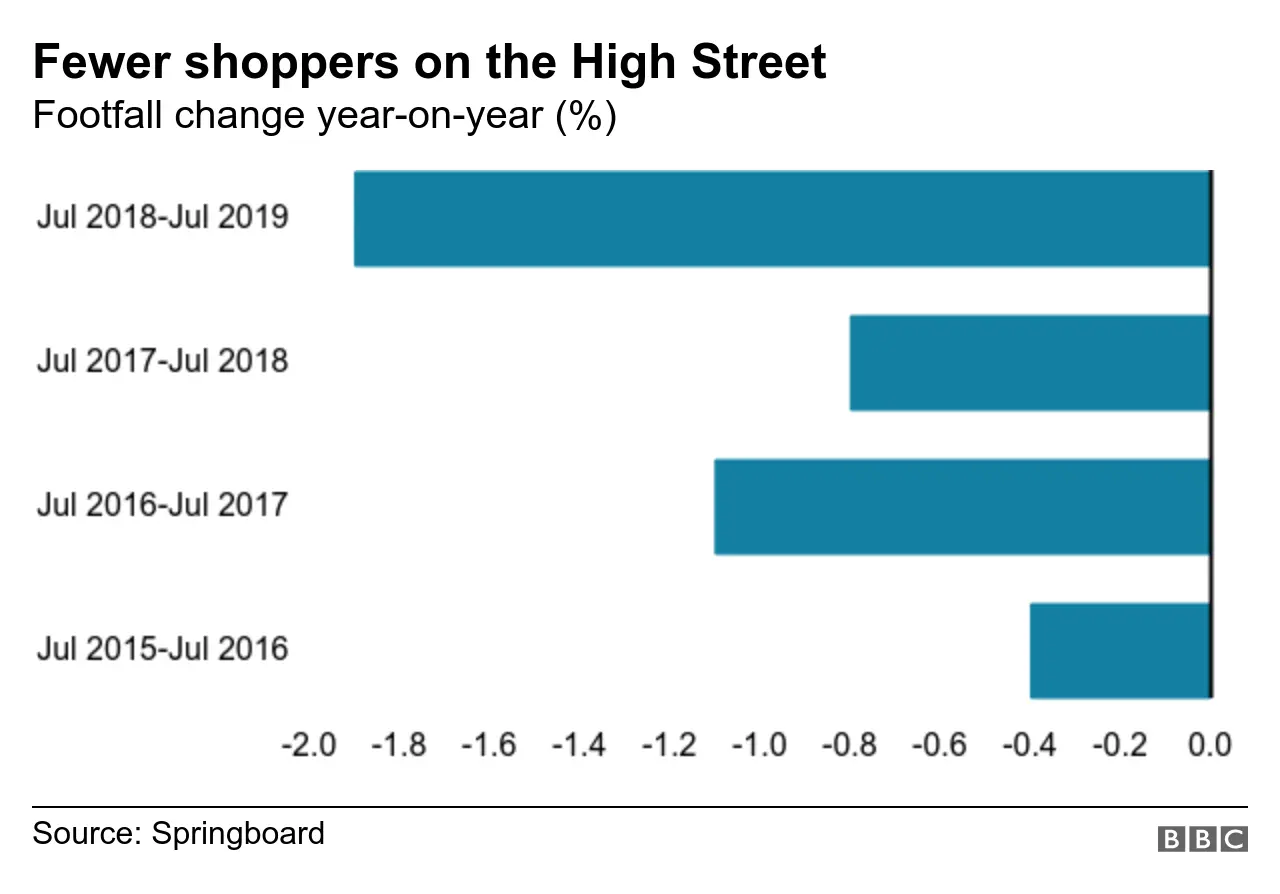

Shoppers are making fewer visits to High Streets.

The retail analytics company Springboard tracks footfall in main towns and cities. It's seen a decline in numbers for the past few years.

Bad weather and a reduced appetite for spending by consumers have played a role along the way.

Consumers are still shopping, of course. But even with the rise of online, shops need people to walk through the door.

4. Jobs are being cut

From March 2016 to 2019, UK retail lost 106,000 jobs according to the British Retail Consortium (BRC). Those figures are based on data from the Office for National Statistics.

Poundworld saw the biggest job losses, with more than 5,000 redundancies. Toys R Us and Maplin also lost 5,500 jobs between them.

PA

PAThis year, the fallout from various restructurings includes 1,000 job losses and plunging profits at Sir Philip Green's Arcadia group and 100 redundancies at the fashion retailer LK Bennett.

More job losses will come. More than two years ago, the BRC warned there would be up to 900,000 fewer jobs in retail over the next decade.

5. Tastes are changing

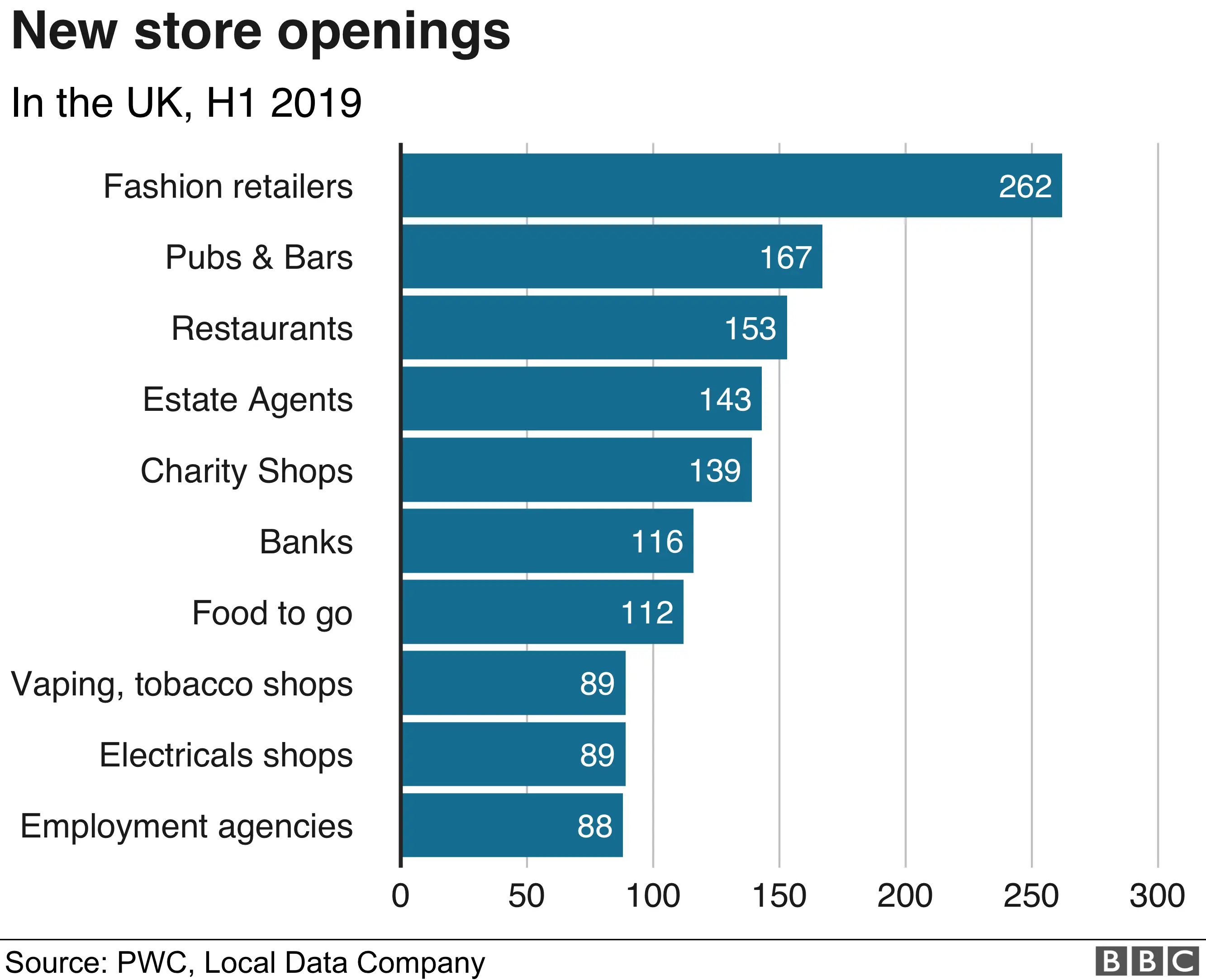

Although the first half of this year saw a net decline of 1,234 chain stores on British High Streets, there were some bright spots.

Takeaways, gyms and specialist vaping shops were some categories that saw the largest increases in store openings.

Analysts have said this demonstrates the High Street's move away from traditional retailing.

Supermarkets Aldi and Lidl are two of the big names also continuing to open lots of stores.

But the overall picture is the UK has too many shops, they're too big and in the wrong locations. The winners will be the companies that know what their consumers want and give it to them, with great service and products they want to buy.