Is this the end of Macri's vision for Argentina?

Getty Images

Getty ImagesEven by the standards of Argentina's very volatile financial markets, it was a brutal meltdown.

In a matter of hours, the country's main stock index Merval - which represents the most heavily traded shares - shed 37% of its value.

The national currency lost almost 30% of its value against the dollar before gaining some ground again and ending the day 18% lower.

The government used heavy artillery to contain the damage caused by the primary election results held on Sunday. It raised interest rates on its seven-day notes from 63% to 74%. And it used $50m (£41m) to buy back its currency in the markets.

But there was still little it could do to appease investors. Ultimately markets used prices to show they do not trust President Mauricio Macri will reverse the massive blow he has been dealt by the electorate in the primary election defeat.

Some Argentine stocks traded in Wall Street saw drops of 60%.

AFP/Getty

AFP/GettyOver the past four years, the international financial community and the International Monetary Fund have invested a lot of energy and capital in Mr Macri's plan to rescue the economy. Many now seem to be jumping ship.

So is this the end of the concerted effort to revive one of the world's top 20 economies and the second largest in South America?

Underdog

Mr Macri still has two months to convince voters his project is not over. Argentina's election will be held on 27 October and his goal now is to force a run-off vote on 24 November.

To say he is the underdog in this race is now an understatement. Political consultancy group Eurasia - which had been predicting Mr Macri's re-election until recently - now says he has a less than 10% chance of winning.

Mr Macri came to power in 2015 putting an end to more than a decade of Kirchnerismo - a host of left-wing policies that favoured capital controls and government spending.

The two successive governments of Néstor Kirchner(2003-2007) and his wife Cristina Fernández de Kirchner (2007-2015) did much to revive Argentina's economy after the profound crash of 2001 and a default on a debt with the IMF.

Getty Images

Getty ImagesThe husband-and-wife team renegotiated with the IMF and used a global boom in commodities to re-establish growth and prosperity in the economy, favouring social programmes for the poor.

But by the end of Cristina Fernández's government in 2015, a deeper crisis seemed imminent. Inflation and poverty were on the rise.

The international financial community disbelieved official inflation and growth numbers published by the government. Poverty statistics stopped being released altogether.

Capital controls

Most market analysts pointed to capital controls as the main culprit. Christina Fernández's economic policy kept the national currency artificially high against the dollar, creating a black market. And the government provided subsidies in many areas of the economy to keep prices down, such as electricity and water bills.

The appearance of Argentine prosperity, Mr Macri claimed, was fake. The government was financially overstretched and the bubble would soon burst.

Getty Images

Getty ImagesIn his first few hours after taking power in 2015, Mr Macri put an end to capital controls. He then began his policy of "gradualism", which was meant to re-establish international trust in the economy with a consistent plan of budget cuts and the elimination of subsidies.

Gradualism meant Argentines would no longer be subject to major economic shocks like in the past.

But shocked they were in May 2018, when Mr Macri announced the country would be asking for a "preventive credit line" of $50bn from the IMF.

Despite all the effort and money invested by the IMF and the international community, Mr Macri has failed to deliver on many of his promises.

Patience worn thin

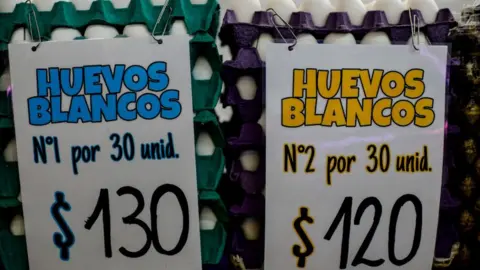

The country is deep in recession. Argentina's economy contracted 5.8% in the first quarter of 2019, after having fallen 2.5% in 2018. Meanwhile, inflation is expected to end the year at around 40%. Three million people have fallen into poverty over the past year.

Getty Images

Getty ImagesMany of the policies implemented by Mr Macri - such as the cut in government subsidies and austerity measures in the public sector - have failed to produce results yet. Argentina still relies on issuing debt as much as it did during the Kirchner era . The lack of trust in the country's track record means the government has to offer interest rates of above 60%.

The IMF has continually reiterated its trust in Mr Macri, but on Sunday Argentine voters suggested in the primaries that their patience has worn thin.

The new favourite to win October's election, Peronist candidate Alberto Fernández, has not clearly outlined what his economic policies will be, but he is a staunch critic of Mr Macri's deal with the IMF. Analysts say he is likely to be more pragmatic than Cristina Fernández, who is the vice-presidential candidate on his ticket.

A political U-turn in Argentina is also likely to have repercussions in the entire region. For years, the region has been tilting towards the right - after decades of rule by left-wing politicians. A win by the Peronists would put an end to that trend.

October's election is still some way off. Until then, Argentines and their neighbours will be holding their breath.