Why smartphones are no longer driving the search for 'blue gold'

Getty Images

Getty ImagesCobalt is one of those metals that define the modern world.

Historically it was used to colour glass or ceramics. The Egyptians were using cobalt compounds 2,600 years ago in their sculptures.

But in the 20th Century, cobalt was found to have qualities central to our most advanced technologies.

Combining it with other metals produces alloys that are immensely tough, stable under extreme temperatures and anti-corrosive.

So you will find it in aircraft engines, rockets, nuclear power stations, turbines, cutting tools, even artificial hip joints.

That alone made it valuable, but what has made it especially precious to investors and speculators is its role in the cathodes of rechargeable batteries.

It is no surprise that investors have called the metal "blue gold".

Google

GoogleFrom 2008, the rising popularity of the smartphone ramped up demand for batteries that could recharge at an ever faster rate.

Then four years ago, the electric car (EV) seized the imagination of the cobalt traders.

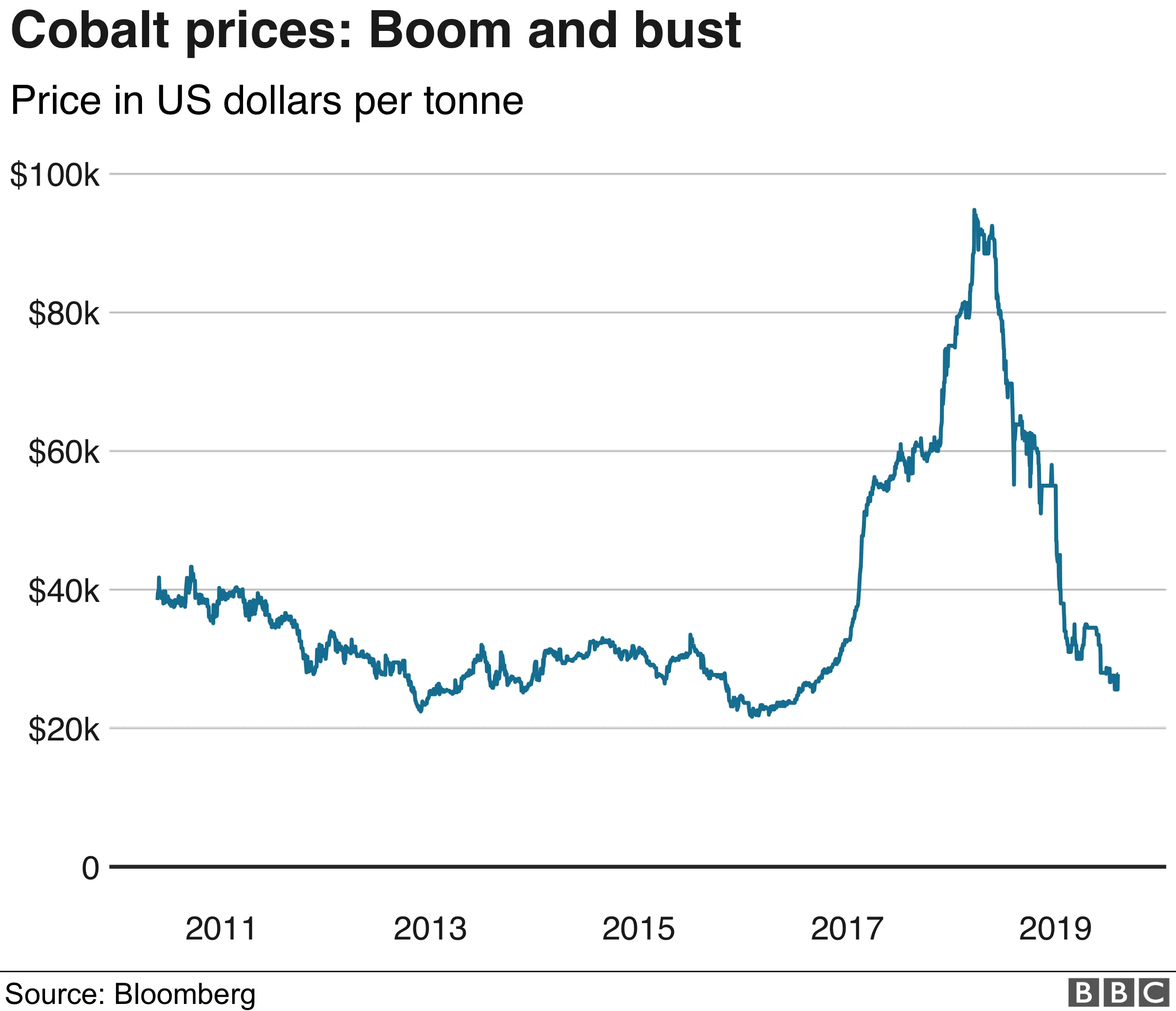

From 2016 until 2018, the price of cobalt soared, from about $26,000 (£21,500) a tonne to more than $90,000.

More than 50% of all cobalt demand is now for battery use, while the EU and the US both class cobalt as a critical raw material.

Then last year, the price crashed.

This week, Swiss-based miner Glencore shut the Mutanda cobalt mine, the world's biggest, in the Democratic Republic of Congo (DRC), saying it was "no longer economically viable".

So what went wrong with the cobalt boom?

Haste and hoarding

In short, the market overreached itself.

The age of the electric vehicle is about to dawn - but not quite yet.

As one industry source said: "Everyone is talking about it but who exactly is manufacturing electric vehicles at scale? Tesla? Who else? And how many charging points do you see in London?"

Another factor was that several processors - largely in China and Africa - were hoarding cobalt in the hope of making a killing as the price rose.

They started to release those stocks just as investors realised that EV demand was not yet as massive as people had hoped.

But most analysts who follow the cobalt market say the fundamentals have not gone away.

At the heart of this argument is the precarious nature of cobalt's supply. It is an element that occurs nowhere on earth in a "free" form, but which has to be chemically prised from copper or nickel using acids and heat.

More than 60% of global supply comes from the DRC, which is commonly described as being to cobalt what Saudi Arabia is to oil.

And as George Heppel, head of cobalt and lithium analysis at CRU International, explains, the DRC is not an easy place to do business in.

'Massive hike'

Despite last December's democratic election - the first since independence in 1960 - the politics are unpredictable, to say the least.

Mr Heppel said: "The country's mining code had promised another 10-year freeze on the amount of royalties mining companies had to pay the government. Then suddenly it increased that royalty from 2.5% up to 10%. That is a massive hike."

Getty Images

Getty ImagesEarlier this year, Verisk Maplecroft, the influential global risk consultant, named the DRC as top of its list of countries most likely to nationalise their resource industries, equal with Venezuela. "That," said Mr Heppel, "gives you an idea of how risky it is to invest in the country."

And then there is corruption.

Glencore itself is facing investigations by the US Commodity Futures Trading Commission and the US Department of Justice relating to its operations in countries that include the DRC.

However, now that Glencore is closing down Mutanda, some 25,000 tonnes of cobalt will be taken out of global supply. That should start to stabilise prices.

Mr Heppel believes it will take until the end of the year before the effect is felt on the market.

And as prices start to creep up, another factor will return to the market - the artisanal miners.

Cost of production - in lives

These are freelance miners working in horrendous conditions, injured and sometimes dying in landslips as they work with hand-held tools under appalling conditions. Amnesty International's report in 2013 described frequent injuries and asphyxiation, due to a lack of adequate ventilation in mining pits, some more than 100m deep.

Two months ago, more than 40 miners were killed working illegally on a Glencore site in Lualaba province in south-east DRC when a mine collapsed.

Reuters

ReutersUnicef estimates that there are approximately 40,000 children working in mines across southern DRC.

Amnesty has accused Apple, Samsung and Sony, among others, of failing to do basic checks to ensure the miners did not include children.

Despite international condemnation of the abuses, artisanal mining continues.

Artisanal miners often have few or no other sources of income and in sub-Saharan Africa millions depend on it for their livelihoods. Globally there has been some success in regulation and control by governments and the mining companies themselves - it can provide a viable way of life.

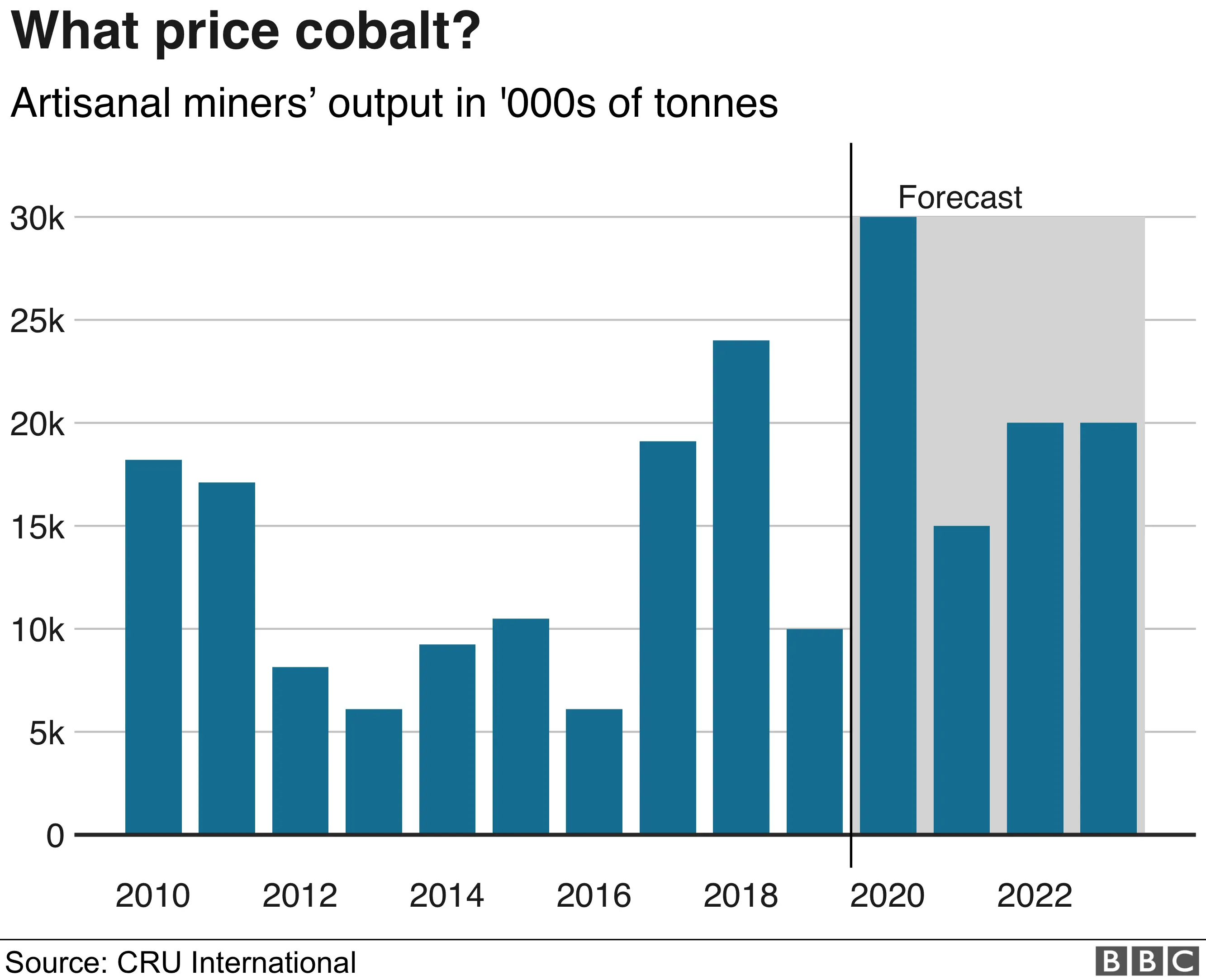

Mr Heppel says the ebb and flow of this kind of mining is tightly linked to the market price.

As the price rose in 2017, CRU International estimated that the miners' output rose from 6,500 tonnes to more than 24,000. Then, as it fell, so did their output - down to 10,000 tonnes.

By 2020, he expects the miners' output to hit record levels as they take up the slack from the closing of the Glencore site, risking their health and lives in the unregulated market to feed our green demand for electric cars.

The supply chains of cobalt are chaotic and muddied, stretching from shacks in the southern DRC to warehouses in China. It is almost impossible to trace how and by whom any cobalt stock was mined.

But while the mobile phone companies have been been told to check up on their suppliers, the car companies have so far escaped criticism.

Future boom?

But the time is coming, says CRU International, when they will be buying cobalt on a massive scale.

Mr Heppel says: "When we look at the EV market over the next 10 years, we see the big increase coming in 2020 to 2021. That will be the crunch time for global demand for cobalt as the big car companies, the BMWs, the VWs, Ford and Daimler are set to increase production."

Getty Images

Getty ImagesHe estimates demand for cobalt for car batteries will grow by between 24% and 35% every year from 2020 to 2023.

Even if Glencore brings Mutanda back on stream (the shutdown is for "care and maintenance"), and with the artisanal miners producing anything up to 40,000 tonnes a year, Mr Heppel believes it won't be sufficient to meet demand.

"There needs to be new supply of cobalt," he said. "There has been a lot of talk about the next-generation battery technology, but there is still nothing that competes with the nickel cobalt battery.

"There are some that in theory, in laboratory conditions, are cheaper and more efficient, but so far none have been proven to be commercially viable."