Flats out of fashion with first-time buyers

BBC

BBCFirst-time buyers are bypassing flats and moving straight into houses - leading to a fall in the cost of apartments, official figures suggest.

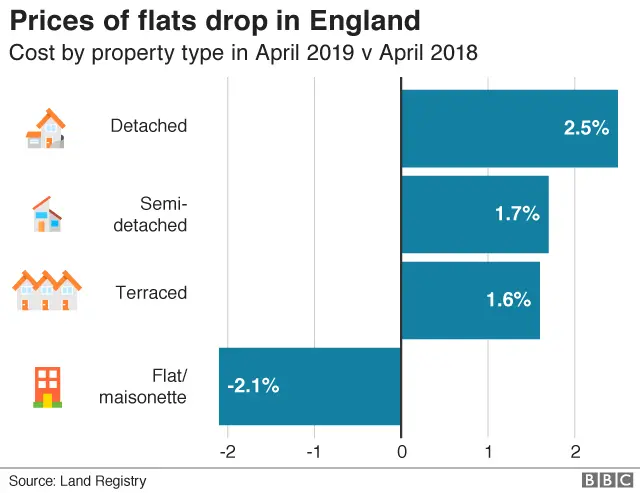

The cost of a typical apartment or maisonette in England has fallen by 2.1% in a year, while other types of property have become more expensive.

Experts suggest people are buying their first home later and are happy to rent a flat, but not necessarily buy one.

Many apartments being built in cities are designed specifically for rental.

The cost of detached homes has been rising fastest, with semi-detached and terraced homes also going up in England, figures from the Land Registry show. In Wales, prices of all types of property are going up, but rises are slowest among flats and maisonettes.

First-time buyers want to buy a home to live in for longer than their predecessors, according to Richard Donnell, insight director at Zoopla. This meant they were more likely to push themselves to buy something bigger and wanted to "leapfrog" flats, he said.

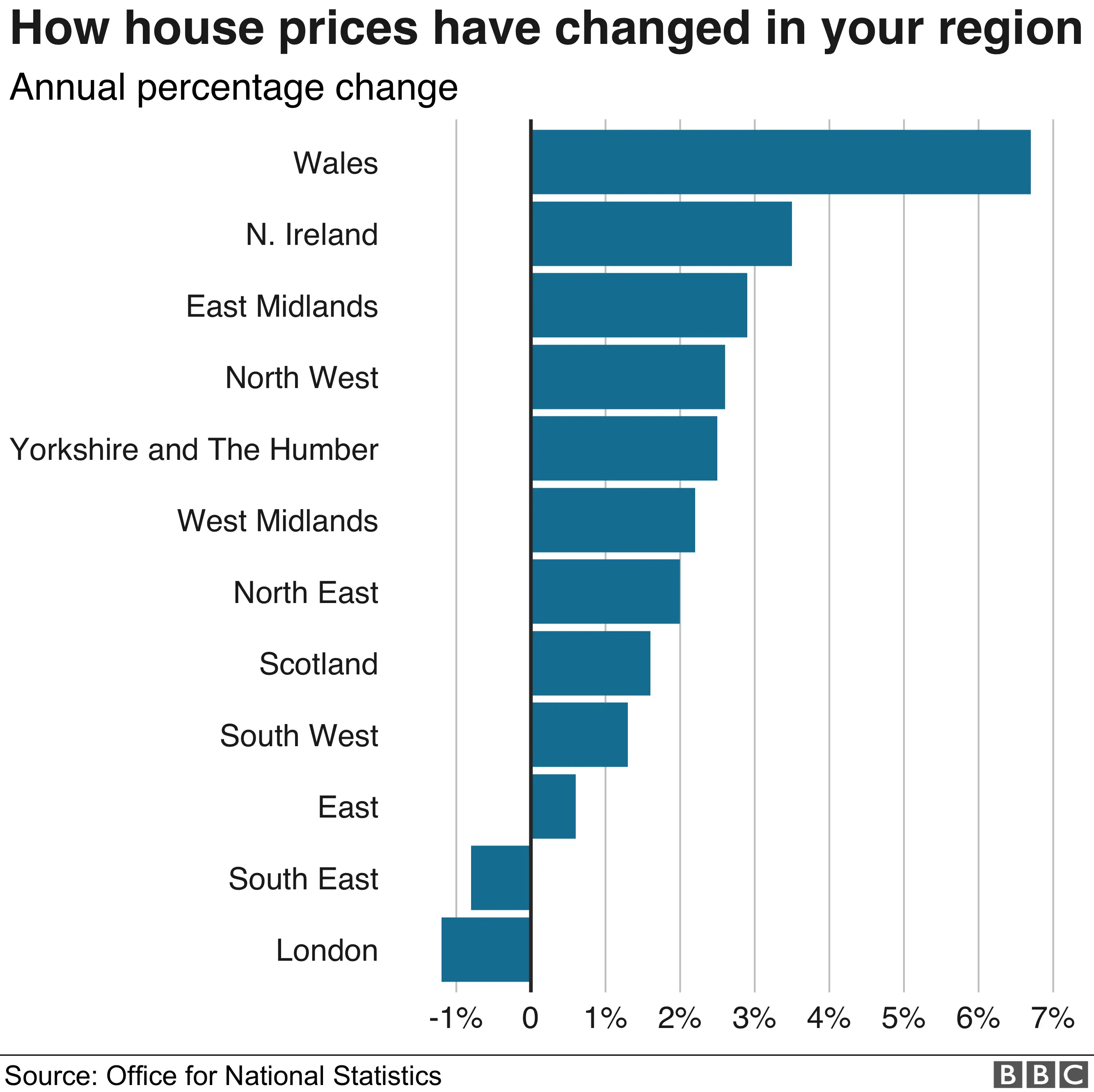

He said that the fall in demand from investors, many of whom have pulled out of the market, had affected demand for flats. Primarily the slowdown in the market in London and the South East of England had meant lower demand for flats, as there was a heavy concentration of apartments in the capital.

Major housing projects from the old Battersea Power Station in London to plans for the Metalworks in Liverpool suggest that developers still see plenty of demand for city flats.

The overall trend suggests that apartments are becoming more affordable.

Research for online estate agents Housesimple suggests buyers can purchase a flat for less than £80,000 in 17 towns and cities in the UK.

Based on Land Registry figures, it said the average flat in Burnley was the cheapest at £54,161, followed by Hartlepool (£57,659), Middlesbrough (£63,100), Durham (£63,638), Blackpool (£67,670), and Preston (£74,084).

In contrast, the average price of a flat in Kensington and Chelsea in London was more than £1m, and - despite house price falls - the cheapest London boroughs of Havering, Barking and Dagenham, and Bexley still saw the average cost of a flat totalling more than £230,000.

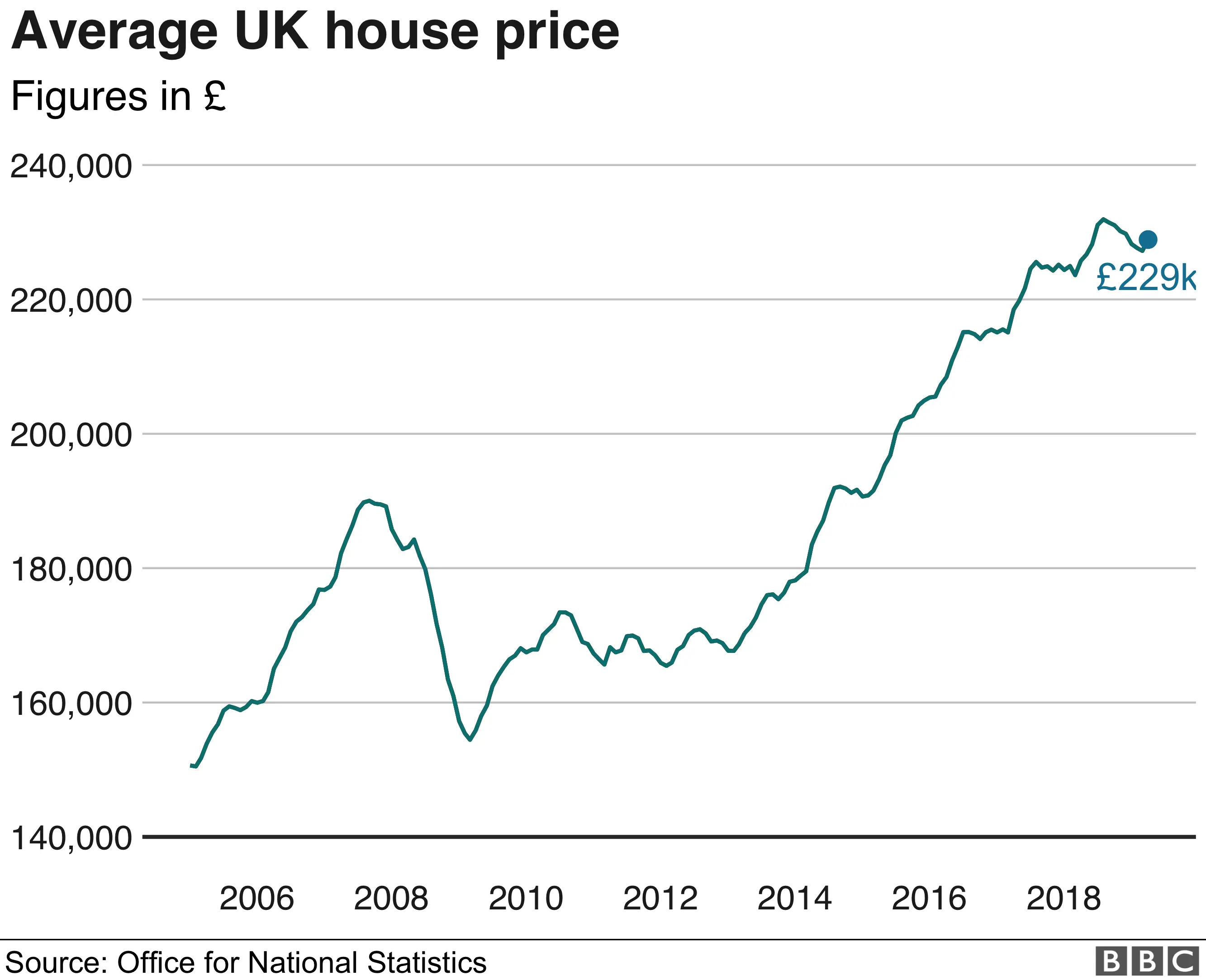

In general, Office for Statistics (ONS) figures showed UK property prices were continuing to rise but at a slower rate than a year ago.

The average UK house price was £229,000 in April, the data shows, which is £3,000 higher than the same period a year earlier.

The cost of renting a home has accelerated slightly, according to separate ONS figures.

Rental prices paid by tenants to private landlords went up by 1.3% in the UK in the 12 months to May.