Why Californian wine will soon cost more in Beijing

Getty Images

Getty ImagesChina is set to hike tariffs on a range of US goods on Saturday, marking the latest strike in the trade war between the world's two largest economies.

Beijing will raise tariffs on $60bn (£47.6bn) worth of US products, which will hit more than 5,000 items.

The rates on products, including wine and meat, will rise from between 5 and 10% to as much as 25%.

China is targeting goods to hurt US producers and the Trump administration.

At the same time, heightened trade tensions have weighed on Chinese investment to America, stoking fresh uncertainty for the US economy.

What products will be hit with tariff hikes?

Tariffs will be raised on a total of 5,140 products. They include:

• Meat: Fresh or cold boned sheep meat, smoked or salted beef, chopped meat

• Alcohol: Sparkling wine, regular wine, other fermented beverages, gin, tequila

• Oil seeds and fruits: Sunflower seeds, other oily seeds and fruits, plants mainly used as medicine

• Frozen foods: peas, corn, legumes, spinach, fruits and nuts

Who do these tariffs hurt?

American farmers: The trade dispute has seen Beijing target US farmers, including those supplying agricultural products like meat, grains and soybeans.

Higher tariffs mean these goods will become more expensive for Chinese consumers, who have other options.

"Farmers need some relief from this ongoing trade war and we're getting hit from all sides between the economy, the weather and these retaliatory tariffs," said Dale Moore, executive vice president at The American Farm Bureau Federation.

"We've been holding on for a long time. For some of our farmers that time is about to run out," he said.

Mr Trump has promised $16bn in assistance to help farmers. These are politically sensitive states for the US president - the folks who got him elected - which is why Beijing has put so many agricultural products on the tariff list.

American vineyards: The US wine industry is also at risk and the cost of American wine in China is set to rise. Tariffs here are set to increase by an additional 15%.

It will mark the third time China has imposed tariffs on American wine in 14 months: The first was in April of last year, then September in retaliation to US tariffs on $200bn worth of Chinese goods - and now this final round.

Getty Images

Getty Images"With each additional round [of tariffs] it becomes more and more difficult to compete in the fastest growing wine market in the world," says Robert Koch, president of the Wine Institute.

According to the industry group, China will soon be second only to the US in the total value of wine sales.

Tariffs have already knocked the industry. The first set of duties imposed last year saw American wine exports to China fall 25%.

But it is not Chinese drinkers, but American producers that will pay the price.

The Chinese are still drinking good wine from places like Australia, New Zealand and Europe - countries that have seen their orders grow since tariffs on American wine were put in place.

Will China still invest in the US?

Beijing's tariffs on American goods - while politically targeted to cause the most pain - aren't going to have much of an impact on US economic growth.

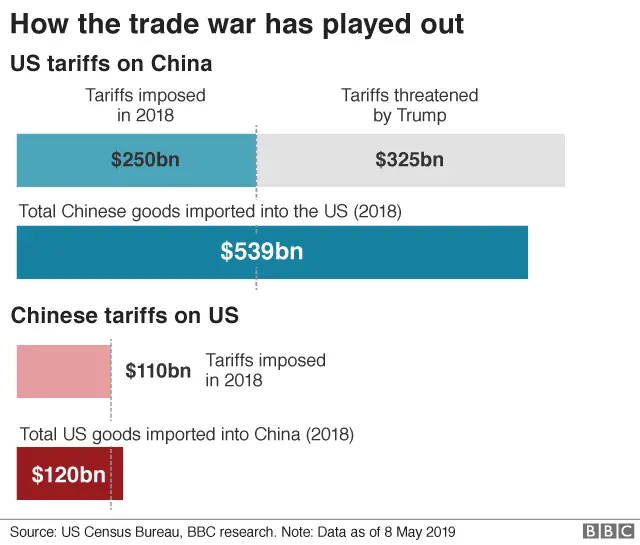

After all, China is only able to tax around $120bn worth of America's goods - that's how much it imported from the US last year.

Economists say at most, the US might see about one tenth of its gross domestic product shaved off by Beijing's tariffs.

But what could hurt the US is reduced Chinese investment.

The US China Business Council has warned that exports to China from the US were down about 7% last year because of the trade war.

Separately, a report by the US-China Investment Project found Chinese investment into the US plummeted by 60% in 2018, partly because of the souring political climate.

And it is having an impact on future Chinese investment too, according to an April survey conducted by the US China Business Council.

"While most executives reported plans to maintain or accelerate investment in each other's markets in the next year, most who indicated they would be curtailing such investments were Chinese," said Anna Ashton, director of business advisory at the US China Business Council.

Of course, the trade war isn't the only factor at play. The Chinese had been cutting back on investment in the US for other reasons even before their trade fight began.

But it is likely to accelerate the pace of the pullout. Analysts say this could potentially be another drag on US economic growth, as foreign direct investment typically creates jobs and opportunities.

What could happen next?

China is directly targeting the US where it hurts most.

Beijing could go even further, as I've said before, and in recent days it has even warned about curbing its rare earth exports to the US.

China is by far the largest producer of these raw materials, used in a range of products from electronics to renewable energy - and vital for many American industries.

Getty Images

Getty ImagesIf it does curb rare earth exports to the US, it would be challenging for American companies to find alternative sources quickly.

Of course Beijing isn't immune to this pain, it has problems of its own.

You've heard this often enough by now to know that it's true - no one wins in a trade war - and China's gearing up for a long battle ahead.

But it doesn't have to worry about winning over voters in the next election.