British Gas owner says trading 'challenging'

Getty Images

Getty ImagesBritish Gas owner Centrica has warned of "challenging" trading conditions amid controversy over executive pay.

The company said that warmer-than-usual weather, the falling price of gas and a cap on standard variable tariffs would affect its financial performance in the first-half of the year.

The alert on Monday coincided with Centrica's annual general meeting.

The gathered shareholders comfortably approved a 44% pay rise for boss Iain Conn, despite fears of a rebellion.

Mr Conn is now due to receive a total payout of £2.4m for 2018, up from £1.7m a year earlier, after securing the approval of 85% of shareholder votes.

The GMB union had urged major shareholders to vote against the pay package.

It pointed out that his rise comes after thousands of job cuts at the company and a cut in pension benefits for workers.

"The ghost of Cedric the Pig will haunt the Centrica AGM on Monday," said GMB national officer Justin Bowden.

He was referring to a stunt in 1996 when GMB activists bought a live pig, called Cedric, to the British Gas AGM to protest over the pay award to former chief executive Cedric Brown.

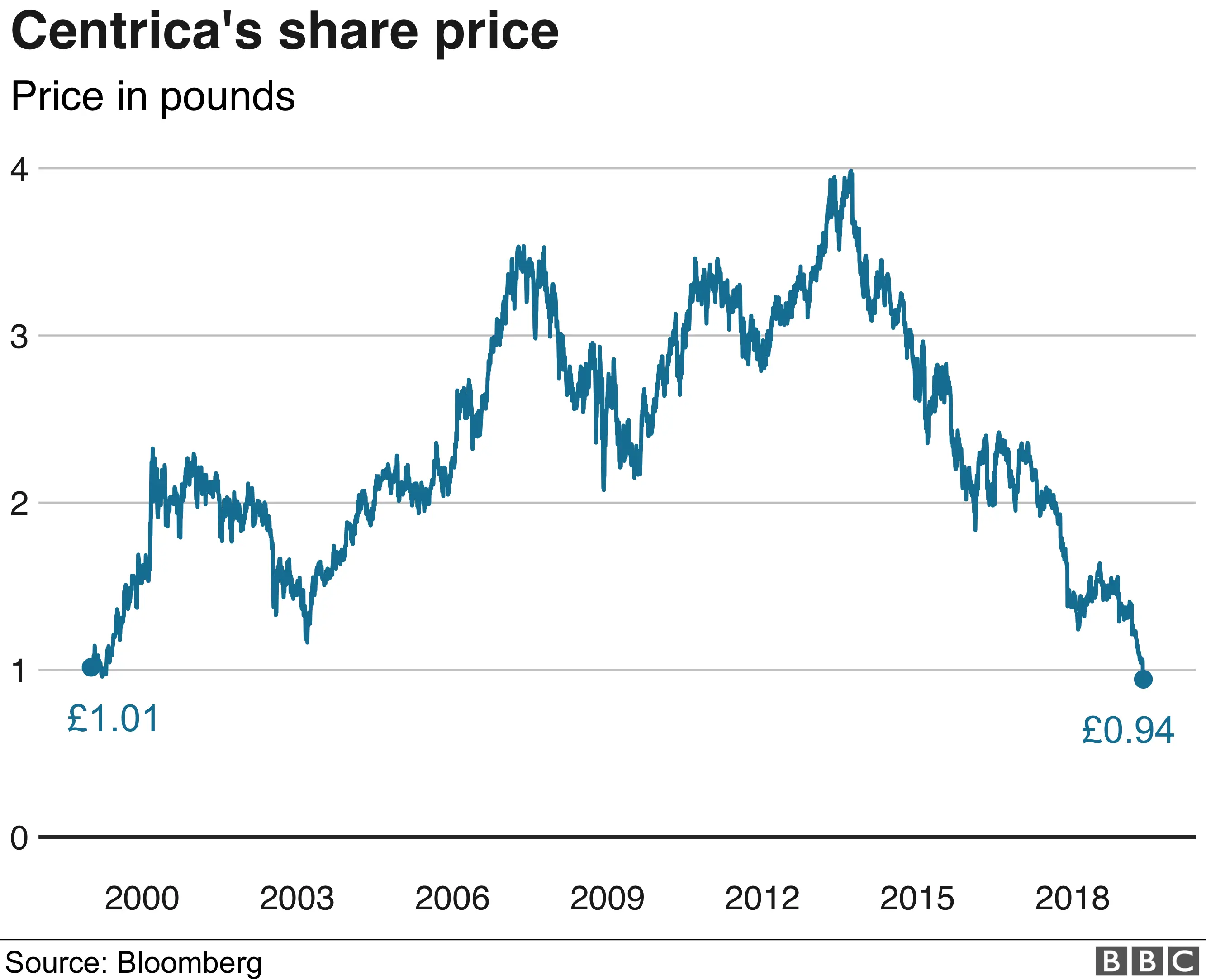

Some investors have questioned why the chief executive is receiving a pay rise when shares have fallen by more than a third over the past year, taking the price to the lowest level in 20 years.

"The share price reflects despair in the strategy," said Neil Wilson, chief market analyst at Markets.com.

"Quite how the 44% pay jump can be justified, I'll never know - absurd. Unless the July update comes with a convincing strategic update I wouldn't think he'll be sticking around for much longer," he added.

Shares closed 3% higher on Monday at 95.40p. In July last year, the shares stood at about 160p each.

PA

PAThe latest trading update from Centrica revealed that British Gas lost another 234,000 accounts in the first four months of the year, adding to the more than 740,000 that went in 2018.

The company also said it was sticking to its previous forecast for 2019 of an operating cash flow of between £1.8bn and £2.0bn.

Centrica does not give guidance on profits.

The company said it would not know the full impact of warm weather and other negative factors until later in the year, but they should be reflected in the firm's interim results, due to be published on 30 July.

Centrica also promised a strategic update on that date which will "include reflections on the current business portfolio, updated future expectations for the customer-facing divisions and an update to the group's financial framework".

What is the energy price cap?

Energy price capping is a flagship government policy designed to protect the vulnerable and those who have stayed loyal to their energy supplier.

The first cap came into force at the start of January, a later review revised that cap and allowed suppliers to charge more from April.

Ofgem sets the cap for households in England, Wales and Scotland. Northern Ireland has a separate energy regulator and its own price cap.

Ofgem sets a cap on the unit price of energy for electricity and gas, and a maximum standing charge.

Energy companies are not allowed to charge default tariffs that are higher than these thresholds.

The cap for those on prepayment meters came into force earlier but has also been reviewed and revised up.