Compensation possible for London Capital & Finance investors

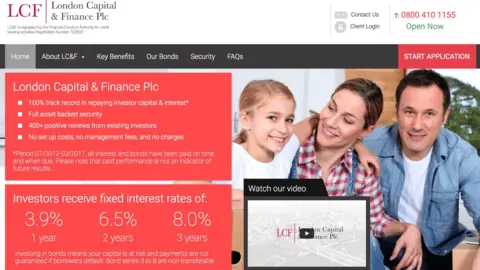

LCF promotional material

LCF promotional materialThousands of small-scale investors who lost their savings by investing with London Capital & Finance (LCF) have been given fresh hope they may qualify for compensation.

Nearly 12,000 people put £236m into the firm which collapsed in January.

The Financial Services Compensation Scheme said it would "explore whether there are grounds for compensation"

The compensation body had earlier said investors wouldn't be able to lodge claims as the scheme was unregulated.

The FSCS was set up by the government to protect consumers if UK regulated firms went bust.

But its chief executive told the BBC in March that it was unlikely LCF customers would get compensation, explaining that the company was not regulated for the purposes of selling its products, which it marketed as low risk investments.

However the FSCS has now said it is looking at whether any of the conversations LCF had with investors counted as providing financial advice or whether it conducted other activities which could trigger compensation.

The FSCS said LCF investors should register with the FSCS via its website for updates of its investigation.

"By registering with us they will get regular updates on our investigation and this will be the best way for them to hear whether we believe there are grounds for compensation.

"This is a highly intricate case though, so we expect our investigation may take some time," it said.

LCF advertised itself as a low-risk ISA, and promised to spread funds from the sale of mini-bonds between hundreds of companies.

In reality, the fund did not qualify as an ISA, and the money was only invested in 12 companies - 10 of which were described as "not independent" from LCF, in a report by the fund's administrators.

The Serious Fraud Office is conducting a probe into individuals associated with LCF.

The company's administrators Smith & Williamson released a report which found that:

- There were a number of "highly suspicious transactions" involving a "small group of connected people" which led to large sums of investors' money ending up in their "personal possession or control"

- A large number of borrowers don't appear to have sufficient assets to pay back LCF investors

- Some transactions were "highly suspicious" or had "no commercial benefit" to investors

- Investors' money was loaned to a complex web of companies, many of which were controlled by people involved in LCF

- A quarter of all the money invested was paid straight to LCF's marketing company Surge