Inflation rises on increases in the cost of food and wine

Getty Images

Getty ImagesFood and alcohol price rises helped push inflation higher in February, the first rise since August 2018.

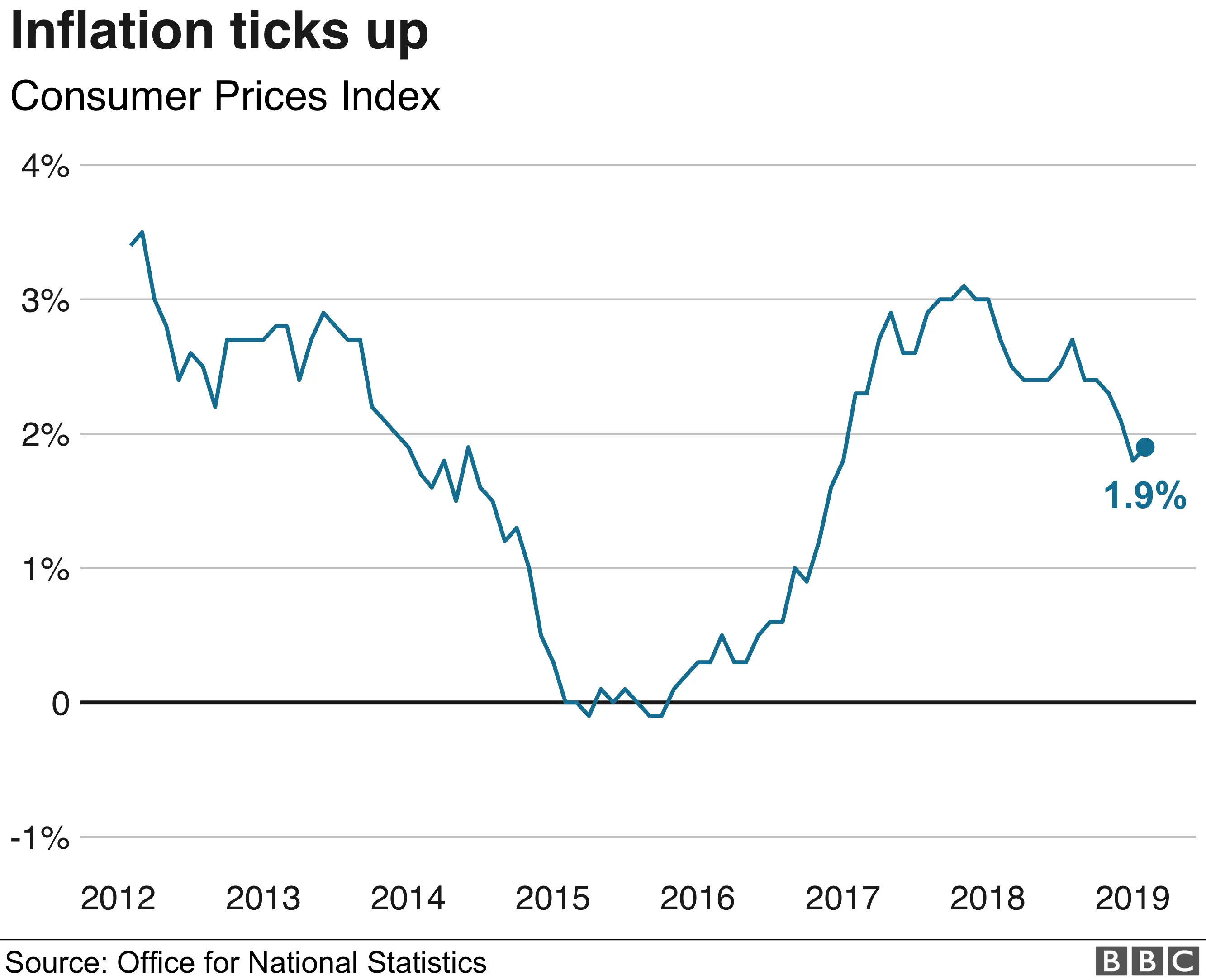

The rate of price changes, measured using the Consumer Prices Index (CPI), rose to 1.9%, from 1.8% in January.

House prices are rising at their slowest rate for almost six years, the Office for National Statistics said.

Inflation overall was "stable", with rising food and alcohol prices offset by slower price rises in clothing and footwear, the ONS said.

Why has inflation risen?

Prices for food and non-alcoholic beverages went up by more from January to February this year than in the same period a year ago. The main upward contributions came from bread, cereals and vegetables, the ONS said. Tobacco prices also rose more than last year.

Duty on a bottle of wine rose on 1 February, pushing the cost of a bottle up by 8p, a tax rise that was announced in the Autumn Budget, alongside a rise in duty on some some high-strength sparkling cider.

"Rising prices for food, alcohol and tobacco, and across a range of recreational and cultural goods produced the largest upward contributions," the ONS said.

"The largest, offsetting, downward contribution came from clothing and footwear, with prices rising between January and February... but by less than between the same two months a year ago."

The inflation rate measures price changes over the last 12 months and is updated every month.

Prices are rising slightly more quickly, but the inflation rate remains close to the two year low it hit in January.

Moreover wages are rising at a much faster pace, of 3.4%. So any consumers benefitting from salary increases will feel better off.

Will inflation keep rising?

Inflation fell slightly in January after the introduction of a cap on domestic energy prices. But the government has already planned to raise the level of that cap in April.

Getty Images

Getty ImagesSuren Thiru, head of economics at the British Chambers of Commerce (BCC), said that would mean further upward pressure on prices over the next few months.

"Businesses also continue to report that the cost of imported raw materials are rising," he said.

However, he said that over the longer term, inflation would remain near the Bank of England's 2% target level because of "the UK's weakening economic outlook".

Ruth Gregory, senior UK economist at Capital Economics, said inflation was unlikely to stay below 2% for long and said February's rise marked "the start of an upward trend which could see inflation reach 2.5% by April".

The UK's inflation rates peaked at a five-year high of 3.1% in November 2017.

What will that mean for interest rates?

It's not just households, but the Bank of England too, which worries about the cost of living.

It's tasked with setting interest rates to keep inflation close to a target of 2%. The latest rate of 1.9%, won't trouble those policy makers.

But the Bank estimates it takes two years for interest rates to influence prices (largely via the spending and borrowing habits of households and businesses).

So it's looking at the prospects for prices then, rather than now. And it's concerned faster wage growth - which official figures confirm, on average, are comfortably outstripping the cost of living - could have an impact by then.

The view from the City is that those pressures won't persuade the Bank to raise rates yet - especially as the outcome of Brexit remains so unclear.

But if the trend of faster real wage growth continues and a Brexit deal is swiftly agreed, with little disruption to the economy, some economists think there could be a small rate rise later this year.

That's quite a few ifs.

With prolonged uncertainty, or even a no-deal, some argue that the next move in interest rates, when it comes, may be down rather than up.

What is happening to house prices?

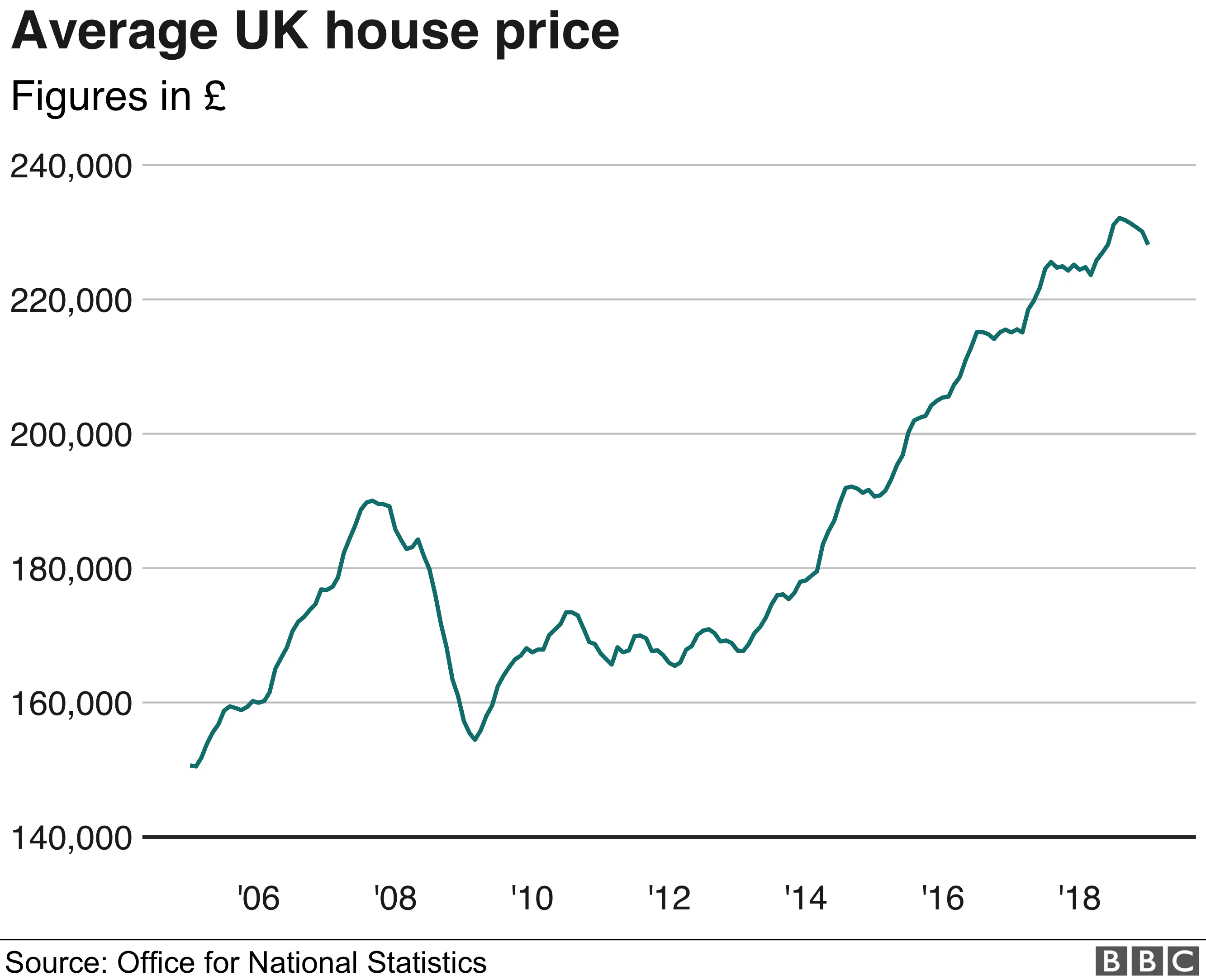

The ONS said UK house prices in January rose by an annual 1.7%, the smallest increase since June 2013.

The lower rate of house price rises was in large part down to a 1.6% fall in London house prices.

Prices in the capital are 3.3% below their peak in June 2017, the ONS said.

Jamie Durham, economist at PwC, said: "This decline is driven by ongoing uncertainty around Brexit - London has been particularly affected due to its integration with the rest of Europe."

"London is not the only area with falling prices. House prices in the East of England also fell on an annual basis for the first time since October 2011, and declined by -0.2%.

"Elsewhere in the UK, strong positive house price inflation continued in the Midlands, and particularly the East Midlands. The North West and Yorkshire and the Humber also showed strong annual house price growth, of 3.4% and 2.9% respectively."