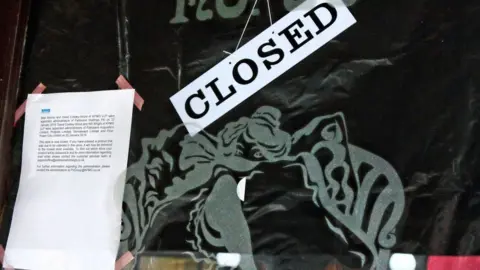

Patisserie Valerie black hole grows to £94m

PA

PAThe accounting black hole at Patisserie Valerie has swelled to £94m, more than double a previous estimate, according to a new report by its administrators.

After it fell into administration in January, the cafe chain was found to have overstated its cash position by £30m and failed to disclose overdrafts of nearly £10m.

KPMG's latest report says the company falsely claimed to have £54m in cash.

The majority of Patisserie Valerie has been sold to a private equity firm.

In the report, KPMG notes that when the company's accountancy problems were first reported last October its chairman Luke Johnson pumped £20m into the business.

But it says: "Further analysis by the directors and forensic accountants in the following months led the board to understand that the consolidated accounts were overstated by approximately £94m."

The former finance director of the chain, Chris Marsh, is under investigation by the Serious Fraud Office.

He was arrested and released on bail in October.

Getty Images

Getty ImagesKPMG said that as well as overstating its cash position, Patisserie Valerie also claimed its assets were worth £23m more than they were in reality.

The accountancy firm also said because of the scale of the problems,

"It will be necessary for the Company to consider whether there may be sufficient grounds to establish potential legal claims against a number of parties.

"These parties may include Grant Thornton, who were the auditors to the Patisserie Valerie Group," it said.

However, KPMG said it would not be appropriate for it to consider whether Patisserie Valerie has a potential legal claim against Grant Thornton because "Grant Thornton are also auditors to KPMG".