Spring Statement: Hammond promises 'deal dividend'

Getty Images

Getty ImagesThe chancellor has pledged to spend a £26.6bn Brexit war chest to boost the economy, if MPs vote to leave the European Union with a deal.

Philip Hammond vowed to free up more money to help end austerity in a "deal dividend".

However, he said tax cuts and spending rises depended on a smooth Brexit.

Mr Hammond used his Spring Statement to warn that a disorderly Brexit would deal a "significant" blow to economic activity in the short term.

He said the decision by MPs to reject Theresa May's Brexit deal for a second time had left a "cloud of uncertainty hanging over our economy".

Growth slowdown temporary

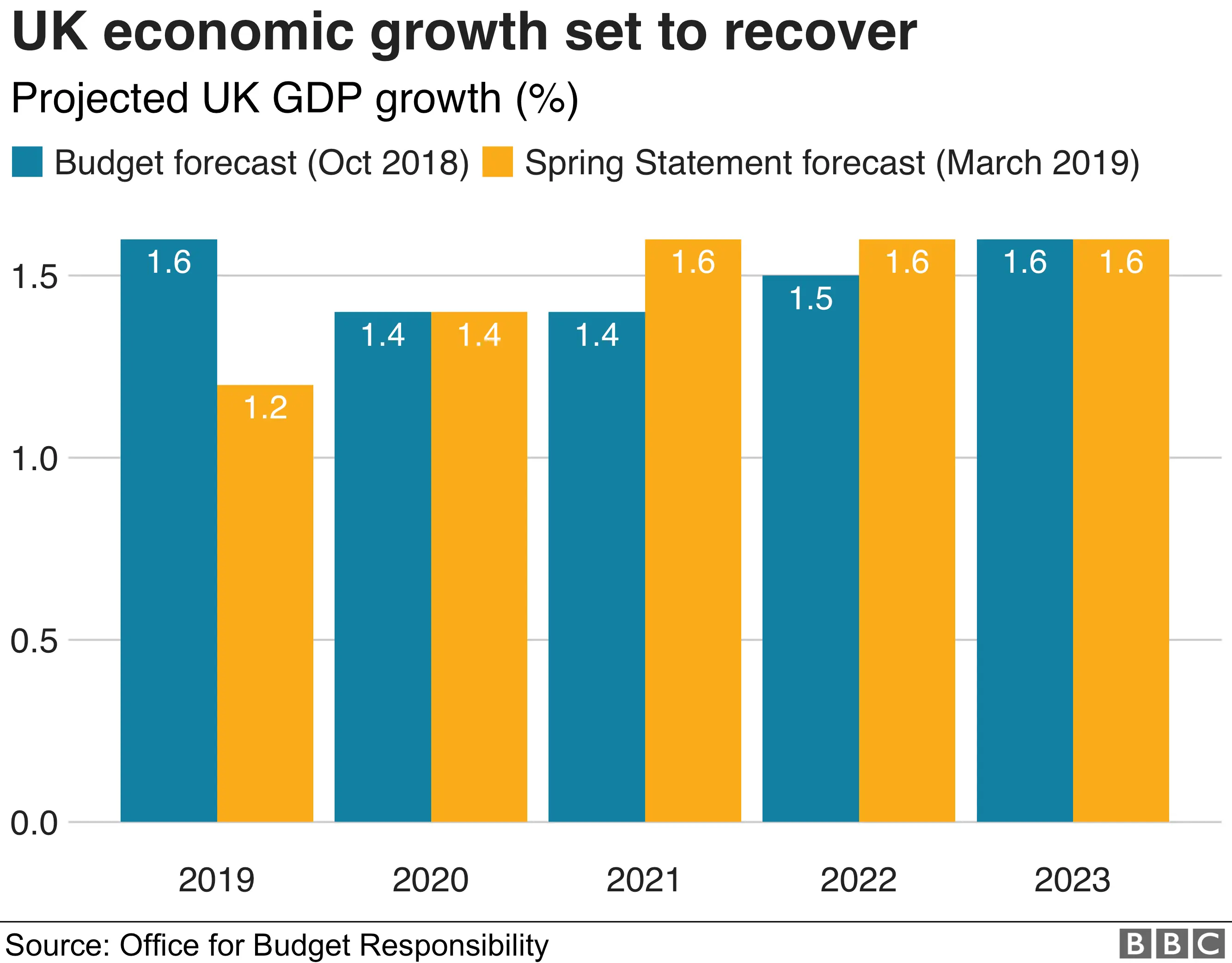

The latest figures from the Office for Budget Responsibility (OBR) forecast that the UK economy will grow at the slowest pace since the financial crisis this year.

The OBR cut its 2019 growth forecast to 1.2%, the weakest growth rate since 2009.

That is a significant cut from the 1.6% expansion predicted by the government's economic watchdog last October.

After that growth is expected to rebound.

Mr Hammond said the economy had "defied expectations" as wages were expected to keep growing at rates of above 3% over the next five years.

He hinted that the government would have up to an extra £26.6 billion to spend if MPs voted to leave the EU with a deal, while still meeting self-imposed limits on government borrowing.

This is almost double the £15.4bn estimated by the OBR in October.

The statement left the forecast for GDP growth in 2020 at 1.4% and now expects the UK economy to expand by 1.6% a year in the following three years.

Healthy public finances

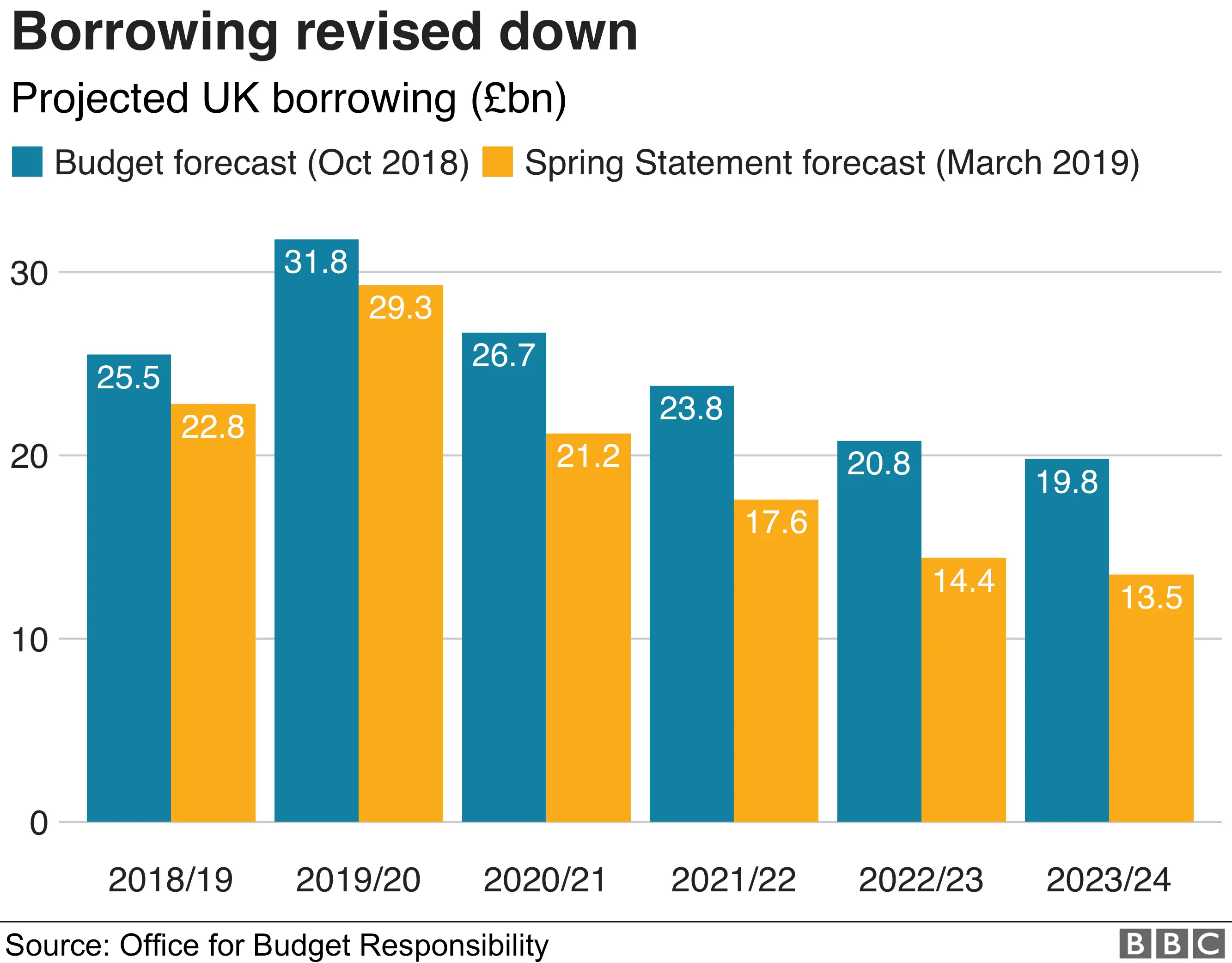

The government is expected to borrow £22.8bn this financial year to plug the gap between the money it spends on public services and the tax revenues it collects.

This is almost £3 billion lower than the £25.5bn predicted by the OBR in the October Budget.

The watchdog expects the improvement in the public finances to continue in future years, helped by stronger tax receipts and lower spending on debt interest.

While borrowing is expected to rise to £29.3bn next year, it is then predicted to fall over the next four years.

Boost for public services

Mr Hammond announced a £800m increase in non-NHS spending by the middle of the next decade to keep pace with inflation

In January the government announced it would pump a similar amount into the NHS to maintain real-terms spending.

The chancellor also said he was making an additional £100m available over the course of the next year to help deal with the surge in knife crime.

The cash is to be used for police overtime and to fund new 'Violent Crime Reduction Units' to help respond to the increase.

Getty Images

Getty ImagesStudent loans headache

Mr Hammond is expected to set out detailed plans about how money will be allocated to different government departments beyond 2020 in a spending review starting this summer.

However, changes to the way student loans are treated on the government's books will eat away at the Brexit war chest that Mr Hammond has set aside.

The changes, which reflect the fact that many students will never fully repay their loans, are expected to reduce the pot of available cash by around £12bn this autumn.

The watchdog said this would also make an ongoing aspiration of eliminating the deficit "harder to achieve".

Robert Chote, the chairman of the OBR, said the Chancellor could respond to the statistical shake up by changing his borrowing targets, or by tweaking other tax and spending measures.

NurPhoto

NurPhotoThe government's fiscal rules state that it must keep borrowing, adjusted for the ups and downs of the economy, below 2% of GDP in 2020-21.

The OBR said there was a 40% chance that the government would eliminate borrowing entirely by 2023/24.

Brexit costs

Mr Chote also highlighted that the OBR's forecasts were based on a smooth Brexit, with employment expected to remain steady and business investment predicted to rise.

He said the economic outlook remained uncertain, with the Spring Statement sandwiched between crucial votes that will determine the UK's exit from the EU.

Mr Chote said no deal would probably lead to a "short-term shock to the economy" which would have implications for taxes and spending.

However, he said the hit to the country's longer term growth prospects and UK living standards would be a bigger concern.

While Mr Chote said the government was likely to spend more money to support the economy, he said the direct effects of this on the economy were "presently unknowable".