China economy: Beijing unveils $298bn tax cuts to boost growth

Getty Images

Getty ImagesChina's number two leader Li Keqiang has warned the country faces "a tough struggle," as he laid out plans to prop up the world's second-largest economy.

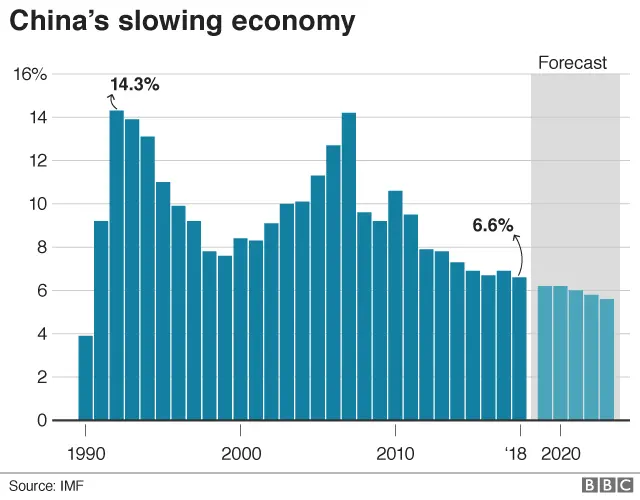

Opening the annual session of China's parliament, he forecast slower growth of 6% - 6.5% this year, down from a target of around 6.5% in 2018.

China has struggled with a slowing economy and a US-led trade war.

It plans to boost spending, increase foreign firms' access to its markets, and cut billions of dollars in taxes.

"In pursuing development this year, we will face a graver and more complicated environment as well as risks and challenges... that are greater in number and size," Mr Li said in a lengthy speech.

"We must be fully prepared for a tough struggle."

Mr Li told 3,000 delegates at the National People's Congress that China would aim to deliver nearly 2 trillion yuan ($298bn; £227bn) of cuts in taxes and other company fees.

A value-added tax (VAT) for transportation and construction sectors will be sliced from 10% to 9%, and VAT for manufacturers will fall from 16% to 13%, he said.

China will increase its military budget by 7.5% to 1.2 trillion yuan, down from last year's 8.1% rise.

The country's defence spending is closely watched for any signals as to its military intentions.

Mr Li also said China would continue to carry out a prudent monetary policy and use reserve requirements as policy tools. China cut reserve requirements - the amount commercial banks are required to hold on reserve - several times last year to boost lending.

The economy expanded 6.6% in 2018, growing at is slowest rate since 1990.

'Easing US tensions'

Mr Li also announced that Beijing would further relax controls over access to Chinese markets for foreign companies.

BBC China Correspondent Stephen McDonell says this appears to be an attempt to ease trade tensions with the US.

Even though officials have sounded more upbeat about negotiations with the US recently, failure to achieve a deal would see tariffs on $200bn of Chinese goods rise almost immediately and could see the US impose fresh tariffs.