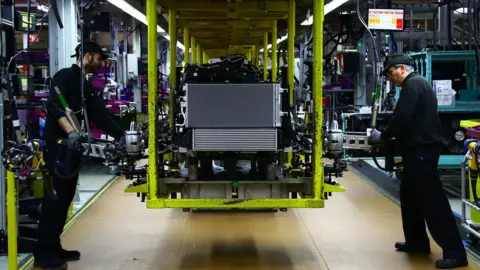

Brexit: Manufacturers stockpiling at record pace

Getty Images

Getty ImagesUK manufacturers prepared for Brexit by stockpiling raw materials at a record pace last month, a closely-watched survey has suggested.

The research, by IHS Markit/CIPS, found companies were stockpiling goods in January at the fastest pace in the survey's 27-year history.

Employment in the sector fell, and the survey warned that export orders were "near-stagnant".

It added that there was a risk of the sector slipping into recession.

Overall, the survey's Purchasing Managers' Index fell to 52.8 last month from 54.2 in December, which was a three-month low and the second weakest reading since July 2016.

While the figure above 50 still implies activity in the sector is expanding, IHS Markit/CIPS said manufacturing had made a "lacklustre" start to the year.

With two months to go until the UK is due to leave the EU, the lack of clarity over the terms of the UK's departure means firms are having to make contingency plans.

"The start of 2019 saw UK manufacturers continue their preparations for Brexit," said Rob Dobson, director at IHS Markit.

"Stocks of inputs increased at the sharpest pace in the 27-year history, as buying activity was stepped up to mitigate against potential supply-chain disruptions in coming months.

"There were also signs that inventories of finished goods were being bolstered to ensure warehouses are well stocked to meet ongoing contractual obligations."

An equivalent survey of eurozone manufacturers also found the sector struggling in the 19-nation bloc. The PMI reading of 50.5 for January indicated minimal growth and was the lowest reading since November 2014.

The eurozone survey also found new orders were falling at the fastest rate in nearly six years,

Analysis:

By Dharshini David, BBC economics correspondent

PA

PAWith clarity as yet elusive, manufacturers are intensifying efforts to prepare for a possible a no-deal Brexit. Both raw materials and finished goods are being stockpiled at an unprecedented rate, to avoid disruption to supply chains and gaps on warehouse and shop shelves.

So on the face of it, the overall PMI activity balance for this survey suggests greater manufacturing momentum last month in the UK than in France or Germany.

But away from the buzz of stockbuilding, orders, particularly for export, are struggling. Overseas customers may be more reluctant to order goods, in case they face delays or tariffs on delivery in the event of a no-deal.

This survey tends to be more volatile than official manufacturing figures. But there is increasing evidence of dwindling export demand in many sectors. Orders for British malting barley, for example, from the rest of the EU has dried up, as that crop could attract particularly steep charges.

Jobs cut

The report referred to some UK supply chains as being "closer to breaking point"

It noted there had been "a marked slowdown" in the growth of new orders, and those companies that did report an increase in output "mainly linked this to stock-building activity".

"January also saw manufacturing jobs being cut for only the second time since mid-2016 as confidence about the outlook slipped to a 30-month low, often reflecting ongoing concerns about Brexit and signs of a European economic slowdown," said Mr Dobson.

"With neither of these headwinds likely to abate in the near-term, there is a clear risk of manufacturing sliding into recession."