Trade war: Firms look to new factories as tariffs bite

Getty Images

Getty ImagesThe world's largest maker of industrial computers, Taiwan's Advantech, plans to boost US production to combat the hit from the trade war.

Executive director Chaney Ho told the BBC the firm would avoid tariffs - imposed on 40% of its goods - if it assembled more products in the US.

The company is one of many rethinking their supply chains in response to the US-China trade battle.

The two sides will meet this week for talks crucial to resolving the dispute.

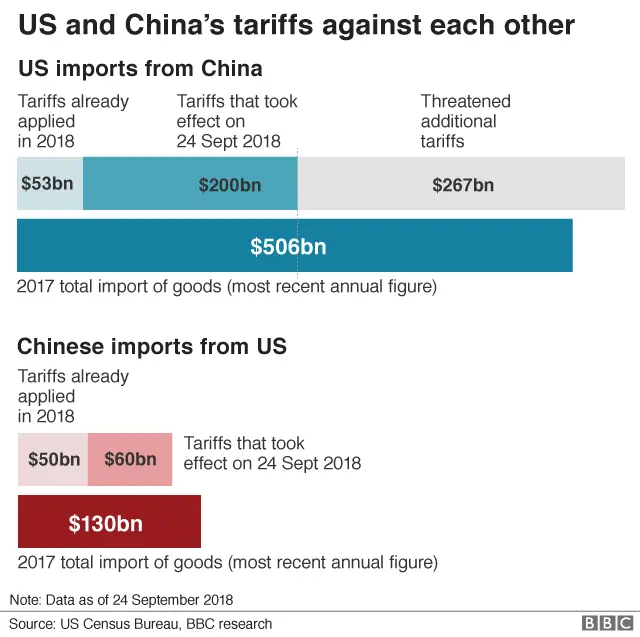

The world's two biggest economies are trying to solve entrenched differences over trade policy that have seen both sides impose tariffs on billions of dollars worth of each other's goods.

A high-level Chinese delegation will visit Washington for two days of negotiations, beginning on Wednesday.

The countries have a deadline of 1 March to strike a deal, or the US has said it will increase tariff rates on $200bn (£152bn) worth of Chinese goods from 10% to 25%.

'Made in America' push

Advantech is one Asian company caught in the crossfire.

The firm is the biggest maker of industrial PCs, according to data from IHS Markit, making computers that are used to power machines in hospitals, infrastructure and transport amongst others.

It splits manufacturing equally between two sites in mainland China and Taiwan. Many products are sent to plants in the US and Europe for assembly.

Co-founder and executive director Chaney Ho said 40% of goods sold in America were hit by tariffs imposed by the US in 2018.

To soften that blow, the company plans to boost its US capacity.

It says it will take a proportion of production currently assembled in China and move it to the US. If the tariffs are removed, it will shift it back.

"We are going to increase the capability because of the tariffs," Mr Ho said.

Advantech has an assembly plant in California and plans to open another facility in Illinois in the next few years.

Mr Ho said while labour would be cheaper in China, the tariffs imposed by the US on Chinese imports justified "more local assembly".

He believes the trade spat could continue for years.

"We are trying to avoid the 10% or 25% tariff and also we try to be close to the market and our customer."

Advantech

AdvantechShifting production

Advantech is not alone.

The Taiwanese company is one of many firms that may adjust their sourcing or manufacturing locations to steer around the US-China dispute.

A recent survey of 200 manufacturing firms by investment bank UBS found 33% planned to move production out of China within the next year, in part because of the trade war.

It found 37% of firms surveyed had already moved production out of China over the past year.

Separately, two Apple suppliers plan to boost capacity outside of China.

Getty Images

Getty ImagesFoxconn will invest more than $200m in India and Vietnam while Pegatron reportedly plans to build production capacity in Indonesia, Vietnam and India.

Deborah Elms, executive director of the Asian Trade Centre in Singapore, said that trend would accelerate if the US hikes tariffs again.

"At that point the US company or sourcing company will say this is serious and doesn't appear to be going away, and at 25%, that's a lot of money."

She says if the US and China reach 1 March without a deal "you'll find a lot of firms changing their decisions".

"Then you will definitely see supply chains shifting way faster than anyone imagined."