Netflix shows Bird Box and Elite drive subscriber growth

Saeed Adyani/Netflix

Saeed Adyani/NetflixShows including Bird Box helped Netflix end 2018 with more than 139 million subscribers, adding 8.8 million members in the last three months of the year.

The streaming giant said the growth reflected the success of its original programmes.

Netflix-original material now represents the "vast majority" of its most popular shows, executives said.

Television viewers in the US also spend an estimated 10% of their time on Netflix, they claimed.

The figures accompanied the release of the firm's quarterly earnings report on Thursday.

They offered investors a rare glimpse of audience viewing patterns, as the firm seeks to explain how its massive spending on content - much of it funded with debt - is paying off.

The company released details of some of its most popular shows:

- Bird Box was watched by 80 million households in its first four weeks after release

- Spanish drama Elite was watched 20 million households in its first four weeks after release

- Netflix estimates that You and Sex Education will both be watched by 40 million households within their first four weeks of release

Analysts estimate that Netflix spent more than $13bn on movies and shows this year.

Netflix said its spending is likely to increase.

"Our multi-year plan is to keep significantly growing our content while increasing our revenue faster to expand our operating margins," Netflix said in a shareholder letter tied to the earnings report.

"Our growth is based on how good our experience is," it said.

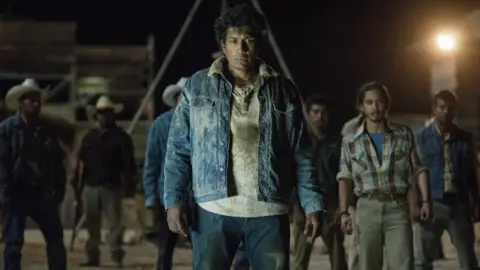

Carlos Somonte/Netflix

Carlos Somonte/NetflixShares, which had risen sharply in recent weeks, dipped more than 3% in after-hours trade, after revenue for the fourth quarter fell shy of analyst expectations.

The firm reported quarterly revenue of $4.2bn (£3.2bn), up 27% from the same period in 2017.

However, a price increase in the US and some countries in Latin America and the Caribbean announced this week has the potential to add some $1bn in revenue.

The firm said it will also look to adjust prices elsewhere as currencies fluctuate, but warned the increases could lag behind the exchange rate shifts, causing revenue hiccoughs.

George Salmon, analyst at Hargreaves Lansdown, said he expected Netflix subscribers to swallow the higher fees.

The 8.8 million rise in paid subscribers - most of them from overseas - marked 6% growth from the prior quarter.

He added: "The worry, of course, is that international bruisers like Disney and Amazon aren't going to go down without a fight, and both have the financial clout to counterpunch pretty hard. The battle for viewers' eyeballs is only just getting started."

Analysis

Dave Lee, BBC North America technology reporter, San Francisco

In its letter to shareholders, there's a candid passage about where Netflix's real competition lies.

It said it faces greater competition from people watching clips of video game Fortnite over those watching rival entertainment provider HBO.

"When YouTube went down global for a few minutes in October, our viewing and signups spiked for that time," it added.

It's what makes predicting Netflix's future so interesting - they're not so much in the entertainment business, but the eyeballs business.

You, the consumer, have more things than ever to look at, or interact with, and competition for Netflix will only get fiercer in 2019.

In the letter, Netflix took time to big up its successes - Bird Box, which it estimates will be watched by 80 million households within four weeks of its release, and a Spanish-language exclusive, Elite, that has attracted more than 20 million.

That's all positive news, but we'll learn more about the health of the company in three month's time, when we find out if consumers have a problem with Netflix's recent price hike in the US and some other countries.

As for today's earnings, they are rather unremarkable: with the firm disappointing Wall Street on some measures (revenue) but outperforming expectation on others (subscriber growth). As I write this, shares are down - but I'd expect the price to recover quickly.