UK economy's fate is held in the hands of the shopper

AFP

AFPLike it or loathe it, the consumer is king - or even, queen - and no more so than over Christmas.

The spike in festive spending between November and January typically makes up 40% of a retailer's takings.

For many, the season's tidings weren't particularly cheerful (if not perhaps as bleak as some feared). The amount ringing through tills is crucial to their survival - and that of the High Street.

Yet it has a far wider significance.

Add in spending on services - from haircuts to day trips - and households' outlays make up two-thirds of GDP, the driver of growth in recent years.

But strip out the seasonal noise - the turkey and present-buying frenzy, the browsing of the Boxing Day sales, be it online or in stores - and one thing is clear: the underlying trend is spending is slowing down, as the official number-crunchers at the Office for National Statistics (ONS) have confirmed.

Anxiety

Back as the heady days of summer, when retailers were still designing their Christmas ranges, the Bank of England's governor, Mark Carney, warned that a slowing of consumer activity may be on the cards.

Just before heading off to hang up their stockings for Christmas, the members of the Bank's interest-rate setting panel confirmed it was seeing signs of a slowdown in retail sales, and claimed that "Brexit-related uncertainty" was weighing on the economy.

Certainly, the prolonged anxiety appears to have dented sentiment, with the respected GFK survey reporting that consumer confidence is at its lowest level for five years.

Why so glum? The prolonged uncertainty about post-Brexit arrangements, coupled with the mounting warnings about the impact of a no-deal on everything from prices to jobs, may justify caution.

And these come against the backdrop of that lost decade for incomes. Strip out changes in the cost of living and wages are lower than prior to the financial crisis, on average. In other words, we're worse off than a decade ago.

Then there's slowing house price growth and a weaker housing market, both of which affect how well-off we feel.

Brexit rebound?

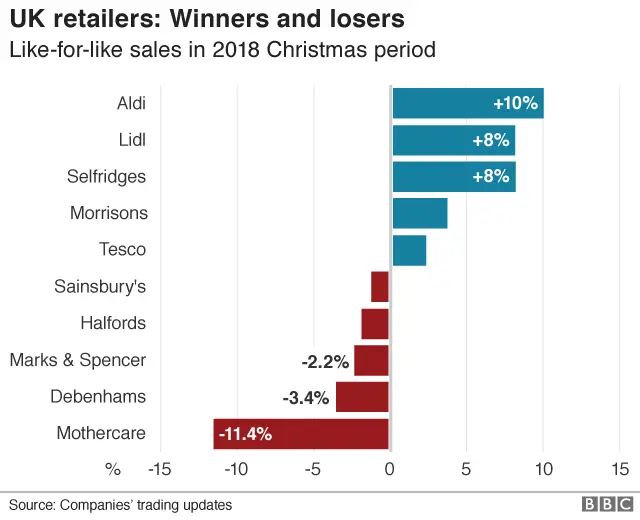

But are sentiment surveys overdoing the gloom? While the sales reports from our biggest retailers didn't make for cheerful reading, they could have been worse.

There does appear to be some disconnect between sentiment and reality. Indeed, the squeeze on real incomes is now being eased - albeit gradually.

Earnings on average grew at their fastest rate in November for a decade, helping to recoup a bit of the lost ground.

Bear in mind that employment is at record levels, and that bodes well for a rebound in both sentiment and spending if and when there is greater certainty about the post-Brexit landscape: a household-funded deal dividend.

It's not just about what the arrangements are, but how consumers respond to those.

Jeff J Mitchell/Getty Images

Jeff J Mitchell/Getty ImagesDismal investment

That would ease the pressure on a beleaguered sector. Retailers are facing not only intense cost pressures, from wages to business rates, but also changing shopping habits.

For the first time, more than a fifth of shopping in November was carried out online, according to the ONS.

It's sink or swim for retailers as they try to keep up. As the list of casualties grows, more than 60,000 jobs disappeared from the sector encompassing retail between June 2017 and September 2018.

In a month's time, we'll discover how the economy fared in 2018.

Add dismal investment and lower public spending to a more hesitant consumer and GDP is likely to have suffered its weakest year for growth since the crisis.

The same factors are likely to mean a sluggish start to 2019. What happens next depends as much on consumers as politicians: it's literally in our hands.