Four reasons that Apple shares have been falling

Getty Images

Getty ImagesApple was once the, well, apple of Wall Street's eye.

The first US company to achieve a trillion dollar market value, the tech giant boasted trend-setting products, a cash pile larger than the economy of some countries and consumers so loyal they would camp out overnight.

But in recent weeks, the California firm has fallen sharply out of favour.

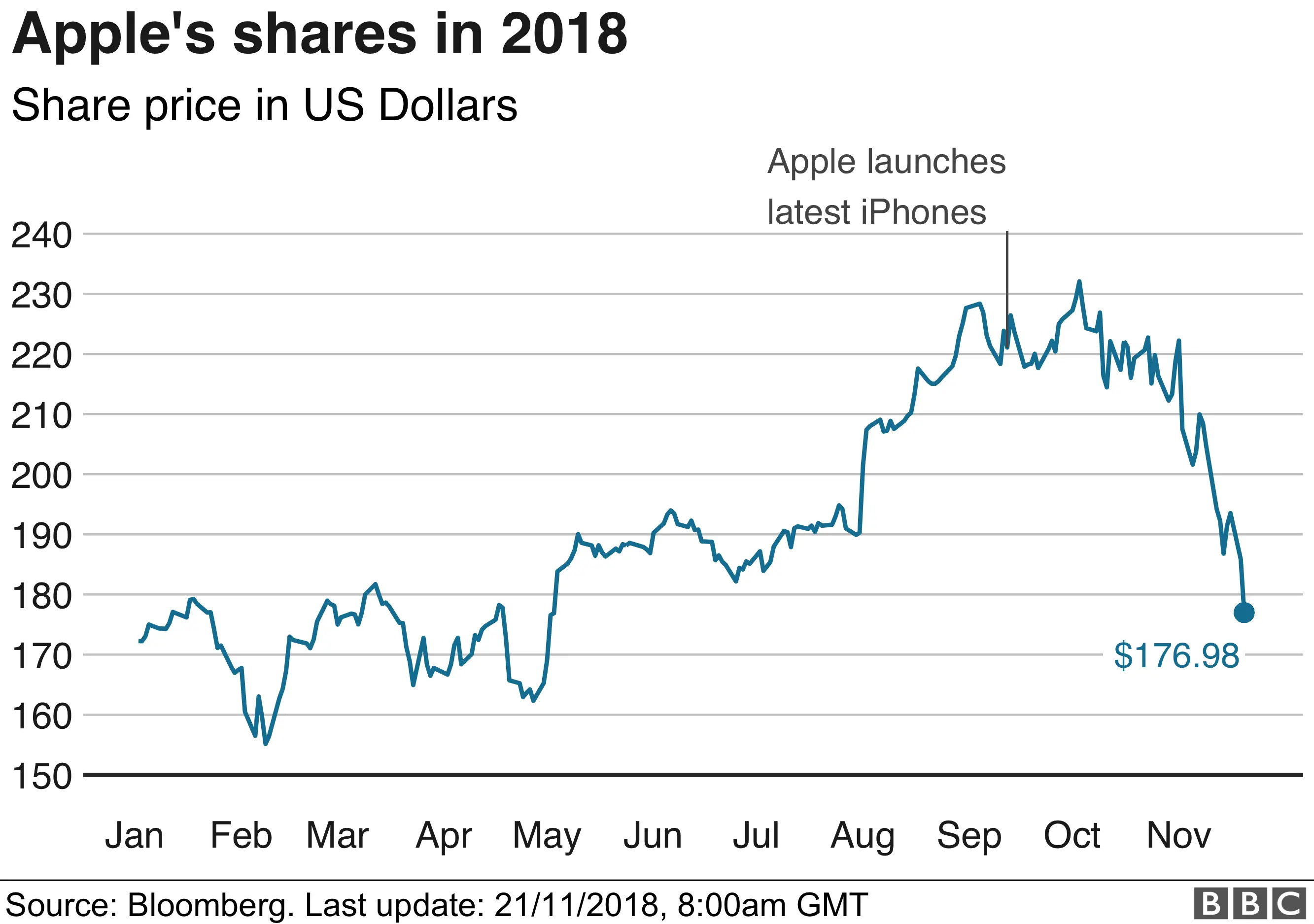

Its share price has tumbled more than 20% since October, hurting other stocks and infecting the wider market.

The firm's share price is now trading below $180, and remains up only about 2.3% for 2018.

So what's taken the shine off Apple?

1. Investors are worried about iPhone sales.

In September, Apple unveiled a new line-up of products but it isn't clear if that the excitement they generated is translating into sales.

The number of products Apple shifted was relatively flat in its most recent quarter and the firm's forecast of 0-5% year-on-year revenue growth for the holiday season - typically a time when families stock up on the latest gadgets - disappointed investors, triggering a steep market sell-off.

Recent announcements of production cuts at some of the firm's suppliers - such as Lumentum - heightened the anxiety, even though such moves are notoriously difficult to interpret.

Apple exacerbated matters with its decision to stop saying how many iPhones, iPads and other products it has sold each quarter, raising suspicions that it had something to hide.

"The iPhone unit metrics being pulled ... was the straw that broke the camel's back on Apple's stock," said Daniel Ives, managing director of equity research for Wedbush Securities.

2. Apple's high prices could leave it exposed if the economy sours.

In recent years, Apple has responded to a slowdown in smart phone sales by raising prices - a move that has helped the company enjoy record revenues, even while the industry generally contracts.

But global and US growth is expected to slow, and recent data on consumer spending has been mixed.

Getty Images

Getty ImagesWith Apple demanding $750 for the cheapest of its new iPhones, it is at risk in the event of a slowdown. And its own sales forecasts have exacerbated those worries.

"Clearly the average selling price trend can't continue forever," said Angelo Zino, equity analyst at CFRA. "I think the real concern out there for investors is how long can they keep this going."

3. Investors aren't confident - yet - about Apple's services business.

Apple has identified its services business - which includes items such as ApplePay, Apple Music and the App store - as the next big growth driver. It aims to book $50bn in services revenue by 2020, drawing on its large user base.

But investors generally still have a lot of questions. For example, Apple hasn't formally shared its plans for television and movies and its goals for breaking into the health industry also remain relatively obscure.

Getty Images

Getty ImagesAnalysts will have to adjust to a business driven by smaller, regular payments, instead of big hardware hits, said Carolina Milanesi analyst at market research firm Creative Strategies.

But Ms Milanesi thinks worries are premature, for now.

"If we know that sales for the iPhones are going to be either flat or down and then there's nothing else to compensate that, then of course there are reasons for concern but I think it's too early," she said.

"In a year's time, if we don't see the services business pick up in the way we expect, then I think the concerns could be legitimate."

4. Apple reflects broader market concerns - like US-China trade tensions.

The technology sector overall has been hit hard in recent weeks, as investors flee an industry that had driven market gains earlier in the year.

However, until Apple's update to investors on 1 November, the turmoil left its shares relatively unscathed by comparison.

STR/AFP

STR/AFPNow the iPhone maker has also been infected by the market fears, of which there are plenty, including overly optimistic valuations, rising interest rates, currency fluctuation and US-China trade tensions.

China, in particular, is a risk some are watching for Apple, since the Greater China region - which includes Hong Kong and Taiwan - is the source of about 20% of the firm's revenue.

It also relies on manufacturers there, though its products have been spared from tariffs so far.

"It's definitely a white knuckle period," said Mr Ives. But, he added, that he remains optimistic about Apple's fortunes over the longer term.

"This product cycle does not appear to be hitting the levels the bulls were hoping for," he said. "But I don't believe that there is a broader change in the Apple story if we look out over the next two, three, four years."