Falling food sales hit Marks & Spencer

Marks & Spencer has reported falling clothing and food sales and warned that it sees little improvement in sales this year.

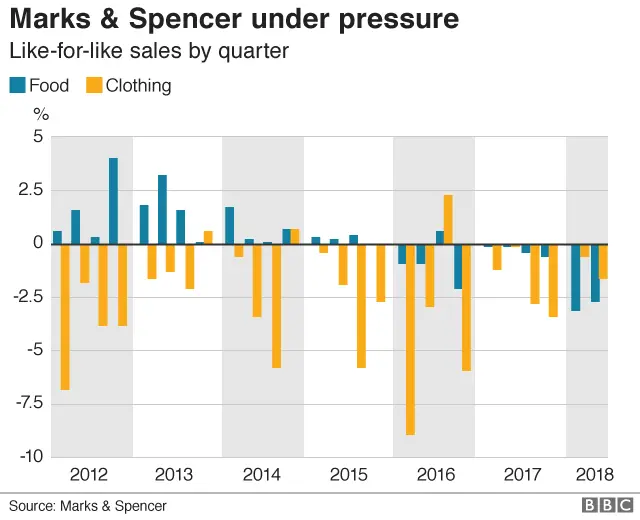

Like-for-like sales, which strip out the impact of new stores, were down 2.2% for the six months to the end of September.

Food sales were down 2.9% and clothing and home sales slid 1.1%.

M&S warned trading conditions for the remainder of the financial year will remain "challenging".

"We are expecting little improvement in sales trajectory," the firm said.

M&S chief executive Steve Rowe told the BBC that food was "trading behind our expectations", but the retailer was "reshaping" its business with prices lowered on hundreds of food items.

"What we are doing is making sure we protect the magic of M&S," he said.

Revenue fell 3.1% to £4.96bn, but underlying pre-tax profits ticked up 2% to £223.5m.

Shares ended the day 0.5% lower at 300.9p, valuing the company at £5bn.

Analysis

By Dominic O'Connell, Today programme business presenter

Marks & Spencer has an organisation that is "silo-ed, slow and hierarchical". Not the words of a hedge fund looking to short the shares of one of the nation's favourite retailers, but the verdict of the company's own chief executive, Steve Rowe.

The damning judgement is delivered in the company's half-year results. They show the same pattern of trade of recent years - clothing in a slow slide, food a bit worse than expected, with like-for-like sales down nearly 3% - but are remarkable for their clear-eyed view of what needs to be done to break that pattern.

Fewer stores - 100 will close - a better online offering, and in general a tightening-up of management and structures that should save £350m a year.

Some critics will say that Mr Rowe is not going far enough, or fast enough, with some advocating a break-up of the company or other radical surgery.

There is a clue, though, in the half-year figures as to why stronger medicine has not been adopted. The average leasehold commitment that M&S has on its stores is 20 years. Going faster in closing stores or shrinking them would be extremely expensive.

Retail analyst Steve Dresser, director of Grocery Insight, tweeted: "You can't run a business on meal deals and 25% off wines forever but these things take time to back out of.

"Closures of established stores will also impact food as it's not always the case they didn't perform - onerous leases also impacted."

M&S plans to close 100 shops by 2022, as announced in May - a move it says is "vital" for its future.

Mr Rowe said the retailer was "continuing to review" its store closure programme and did not rule out further closures, especially as a third of its business would be online in future.

He said 32 million people visited M&S stores every year, so the retailer had "a broad range of customers".

"What we have to do is have a broad range of merchandise available that suits all their tastes," he added.

Under its plan, M&S intends to have fewer, larger clothing and homeware stores in better locations.

The retailer points out that its clothing and homeware business has "an ageing customer base, a very wide range, a weak supply chain and and ageing store portfolio".

It is facing heightened competition from online retailers, as well as discounters such as Aldi, Lidl and Primark.

Its directors were not awarded bonuses this year because of the disappointing results.