Tesla: Shares fall after regulators launch Musk lawsuit

Tesla shares have sunk after US regulators took legal action against co-founder Elon Musk for alleged securities fraud.

On Thursday the Securities and Exchange Commission filed a lawsuit over claims made last month by Mr Musk that he had funding to take the company private.

The billionaire boss of the electric carmaker called the action unjustified.

But the filing was a potentially serious blow for the company, which was already under financial strain.

Mr Musk has led the electric carmaker as chief executive since 2008, presiding over its rise into a company with a market value that rivals Ford and General Motors.

His celebrity status and reputation for entrepreneurial vision attracted investors and legions of fans - even though the firm has consistently lost money and struggled to hit manufacturing targets.

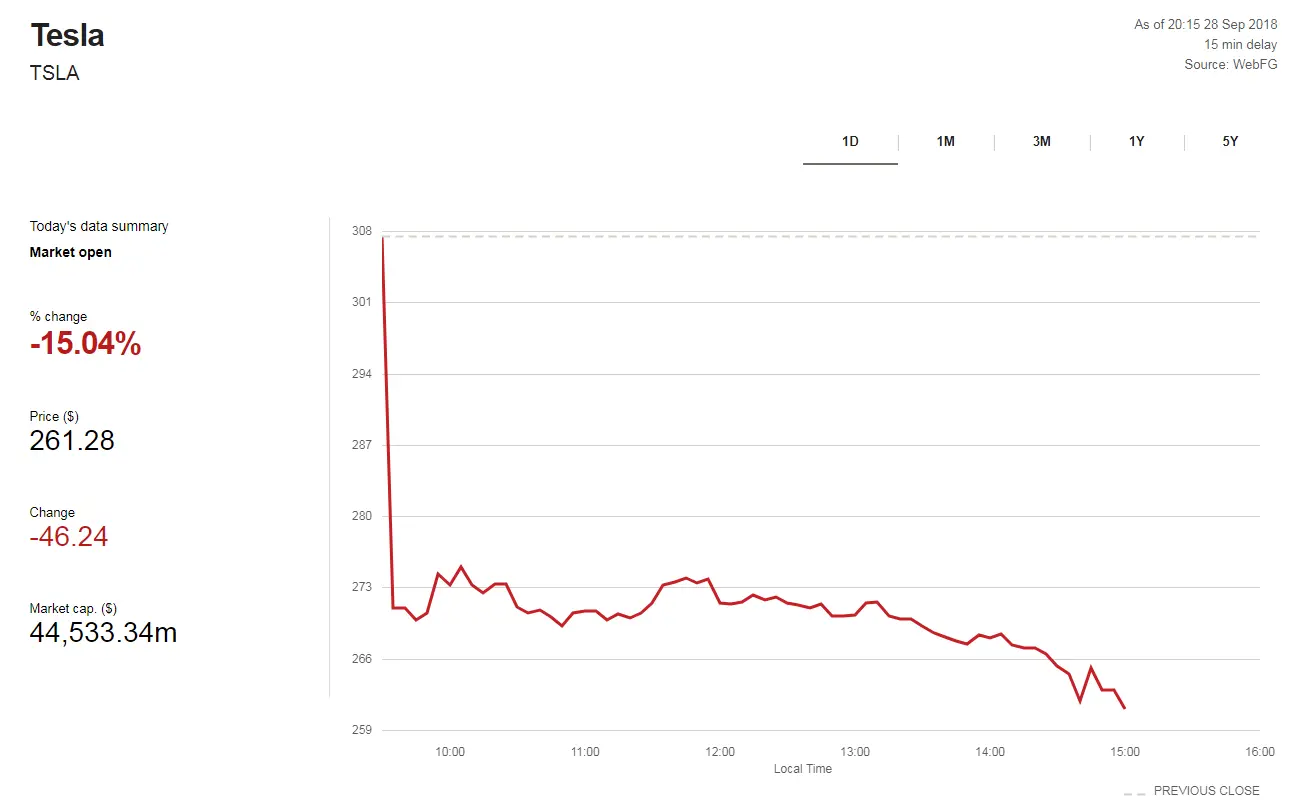

Tesla's shares closed 13.9% lower. During the trading session on Friday, shares fell by 15%.

Now the SEC is seeking to bar Mr Musk from acting as an officer or director of a publicly traded company.

The move would strip him of his role at Tesla and could make it difficult for the firm to raise money at a critical moment for the company, which has been spending heavily to increase production of its latest car.

On Friday, the shares opened 10% lower as Wall Street investors reacted to the news.

"The mere possibility that Musk could be removed as chief executive (or entirely from Telsa) is likely to cast an overhang on the stock," analysts for AllianceBernstein wrote.

What are the charges?

Mr Musk stunned the business world in August when he announced on Twitter that he was considering taking Tesla off the stock market and into private ownership.

He wrote he had "funding secured" for the proposal, which would value Tesla at $420 per share.

In a complaint filed in New York, the SEC said those claims were "false and misleading".

"In truth and in fact, Musk had not even discussed, much less confirmed, key deal terms, including price, with any potential funding source," the regulator said.

Mr Musk has opted to fight the claims, reportedly rejecting opportunities for settlement.

On Thursday, the Tesla chief said that he acted in the "best interests of truth, transparency and investors".

"Integrity is the most important value in my life and the facts will show I never compromised this in any way," he said in a statement.

Tesla's board of directors said in a statement that they were "fully confident in Elon, his integrity and his leadership of the company".

What are his chances?

The SEC has a strong case when it comes to proving that Mr Musk's tweets - which triggered a temporary spike in the firm's share price - were reckless, said Adam C Pritchard, a professor of securities law at the University of Michigan Law School.

But he says it may be more difficult to convince a court that the claims merit a lifetime bar from acting as director or officer of a public company, given how critical Mr Musk has been to Tesla's success and ability to raise money.

"If I'm the judge, I'm thinking - do I want to blow up this company just because he's a jackass?" Mr Pritchard added.

He says he expects the two sides to eventually negotiate a settlement.

Will Elon Musk leave the company?

Rebecca Lindland, executive analyst for Kelley Blue Book, said Mr Musk is behind much of Tesla's appeal for car buyers and investors.

But, she added, his behaviour in recent months has not done the firm "any favours".

Getty Images

Getty ImagesThis spring, Mr Musk alarmed investors with jokes about Tesla's bankruptcy and abrupt dismissal of questions from financial analysts during earnings calls.

Then in July, Mr Musk drew widespread criticism after accusing a British cave diver involved in the rescue of Thai teenagers from a flooded cave of being a child abuser.

The diver later filed a defamation suit.

He also drew attention after an emotional interview with the New York Times, in which he said he worked "120-hour weeks" and took sedatives.

And earlier this month, he smoked marijuana live on the web during a podcast with comedian Joe Rogan.

"The disappointing part of all this is it's self-inflicted," Ms Lindland said. "I could see investors potentially being reassured if a strong, experienced stable management team were to come in and replace him."

Still, she said she would want Mr Musk to remain in an advisory role, lending his vision to the firm.

"It's obviously a very big deal...but it doesn't mean it's the death of Tesla," she said.