Danske Bank boss quits over €200bn money-laundering scandal

Reuters

ReutersThe chief executive of Danske Bank has resigned in the wake of a money-laundering scandal involving its Estonian operation.

Thomas Borgen stepped down following an investigation into payments of about €200bn (£177bn) through its Estonian branch.

The Danish bank said many of those payments were suspicious.

Mr Borgen said it was clear Danske had failed to live up to its responsibilities, which he regretted.

"Even though the investigation conducted by the external law firm concludes that I have lived up to my legal obligations, I believe that it is best for all parties that I resign," he said.

The bank said it was unable to determine how much money was believed to have been laundered through its Estonian branch between 2007 and 2015.

Shares in Danske fell 7% in Copenhagen following Mr Borgen's resignation and a lowering of its outlook for the full year.

Estonia's Financial Supervision Authority (FSA) said it was now examining the findings of Danske's internal investigation.

"The report describes serious shortcomings in the organisation of Danske Bank, where risk-appetite and risk control were not in balance," said the Estonian FSA's chairman, Kilvar Kessler.

The watchdog and Denmark's financial supervision authority will now consider taking action.

The FSA said that it had carried out thorough inspections of Danske Bank's Estonian branch in 2014.

The following year the FSA said it ordered the bank to rectify flaws in its risk control organisation. That resulted in Danske's Estonian branch no longer serving customers who did not live in the country.

'Massive tax scam'

The branch's handling of Russian and former Soviet money has also been the focus of an inquiry in Estonia itself.

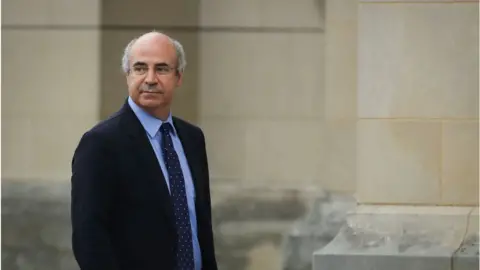

International financier Bill Browder is one of Russian President Vladimir Putin's most public critics.

He has long alleged that Danske's Estonian branch was "one of the main conduits related to the fraud".

Getty Images

Getty ImagesIn July 2017, he gave evidence to the US Senate Judiciary Committee pertaining to allegations that Russia interfered with the 2016 US presidential elections.

Mr Browder set up and ran Russia's most successful hedge fund, Hermitage Capital Management, from 1995 to 2005.

In 2005, he claims that the Russian government took over his firm and used it to claim a $230m tax refund.

Mr Browder was refused entry into the country for "national security" reasons, so he moved to London and asked his staff to move with him.

Magnitsky Act

Mr Browder said his lawyer, Sergei Magnitsky, refused to leave as he wanted to investigate evidence of what he said was a massive tax scam by Russian government officials. Mr Magnitsky died in 2009 while in Russian custody.

After Mr Magnitsky's death, Mr Browder embarked on a worldwide campaign asking governments to pass legislation to freeze the assets involved and deny visas to human rights abusers.

In the US, this law was passed in 2012 and is known as the Magnitsky Act. The UK passed a similar bill in February 2017, updating its existing Proceeds of Crime Act.

In 2013, Mr Browder was tried in absentia in Russia and sentenced to nine years in prison for tax fraud.

Russia asked Interpol to arrest Mr Browder, but the international policing agency rejected the claim.

In May, Mr Browder was arrested and detained for two hours in Spain. He was released after Interpol announced that the arrest warrant was politically motivated.