Sainsbury's-Asda deal faces investigation

Getty Images

Getty ImagesThe £15bn merger between supermarkets Sainsbury's and Asda is to be subjected to an in-depth competition investigation, it has been announced.

The Competition and Markets Authority said the deal "raises sufficient concerns to be referred for a more in-depth review".

The CMA undertook an initial review of the deal, which would create a business taking £1 in every £3 spent on groceries.

The chains say prices will fall.

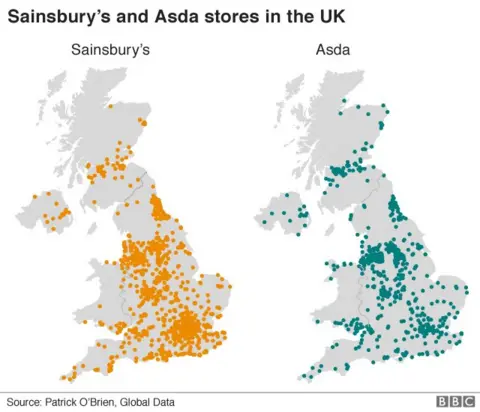

But the CMA said: "The companies are two of the largest grocery retailers in the UK and their stores overlap in hundreds of local areas, where shoppers could face higher prices or worse quality of service."

The competition body said it would also look at issues relating to fuel, general merchandise such as clothing and what it describes as "increased buyer power over suppliers".

It has been calculated that the deal, announced in April, between the UK's second and third-largest supermarkets would create the UK's biggest retail chain with a 31.4% market share and with 2,800 stores.

Analysis by retail property experts Maximise UK has estimated that the CMA will recommend that 6%, or 73, of the combined group's supermarkets should be sold off. Others have speculated that up to 300 sites could have to be divested.

Suppliers have also said they could suffer as a result of the merger, which comes at time when supermarkets are facing pressure from discounters.

The CMA investigation was announced as rival Tesco, the biggest supermarket, prepared to unveil its new Jack's discount chain.

Asda and Sainsbury's had asked the CMA to "fast track" the first stage of its inquiry, which began in August.

The CMA said it had now moved to the second stage and would publish a detailed issues statement in the coming weeks.

This will set out the key topics it will scrutinise by taking evidence from consumer surveys and information from retailers, suppliers and industry bodies.

It has set a deadline of 5 March 2019 to complete this stage of its investigation.

When Asda chief executive Roger Burnley and Sainsbury's chief executive Mike Coupe gave evidence to MPs about the deal, they insisted they would have a 25% market share, rather than the 30% predicted by analysts.

They said that small suppliers would not be hurt by their attempt to cut the price of every day items such as milk, bread and tinned tomatoes by 10%.

US retail giant Walmart, which has owned Asda since 1999, will retain 42% of the combined business.