Sainsbury's-Asda merger: Competition probe begins

Getty Images

Getty ImagesThe UK's competition watchdog has launched an investigation into the proposed Sainsbury's-Asda merger.

The Competition and Markets Authority (CMA) will look into whether the deal will mean less consumer choice, higher prices or worse service.

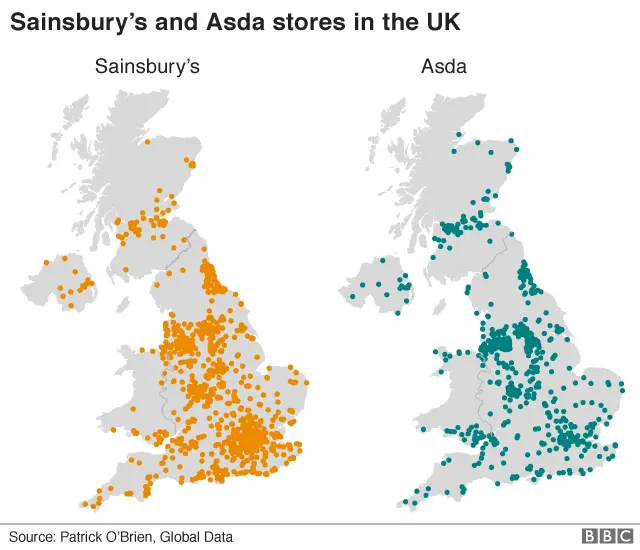

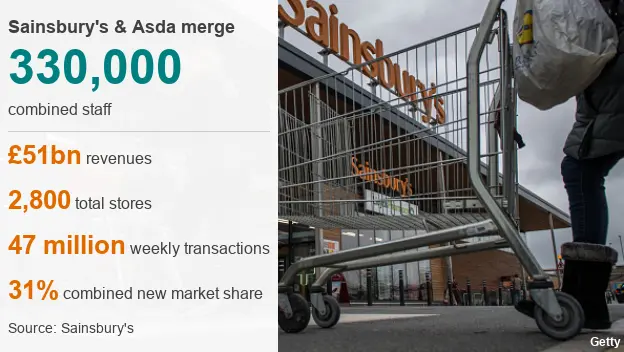

The combined group would be the UK's biggest retail chain with 2,800 stores and 31.4% of the grocery market.

The CMA will also look at whether the merged company could use its size to squeeze the prices it pays suppliers.

Sainsbury's and Asda - which has been owned by US retail giant Walmart since 1999 - are the second and third largest supermarkets in the UK.

Under the terms of the deal, Walmart would retain 42% of the combined business.

As well as being major retailers of groceries, both in-store and online, Sainsbury's and Asda also compete to sell goods such as fuel, electrical products, toys and clothing.

Analysis by retail property experts Maximise UK estimated that the CMA will recommend that 6%, or 73, of the combined group's supermarkets should be sold off. Others have speculated that up to 300 sites could have to be divested.

The chief executive of the CMA, Andrea Coscelli, said: "About £190bn is spent each year on food and groceries in the UK so it's vital to find out if the millions of people who shop in supermarkets could lose out as a result of this deal.

"We will carry out a thorough investigation to find out if this merger could lead to higher prices or a worse quality of service for shoppers and will not allow it to go ahead unless any concerns we find are fully dealt with."

In the past few months the CMA has been gathering the information needed to start what is known as Phase 1 of the inquiry. This is where it works out whether the deal can be cleared relatively quickly or whether it needs to be looked at in more detail in a Phase 2 investigation.

Both Sainsbury's and Asda have asked the CMA to fast-track Phase 1 so it can move rapidly on to the in-depth Phase 2 inquiry.