Uber's move into bikes and food delivery deepens losses

Getty Images

Getty ImagesLosses at Uber are mounting even as it reported a 51% annual increase in income from its taxi app business.

Income from its global taxi businesses, once it had paid its drivers, rose to $2.7bn (£2.1bn) in the last quarter.

But the cost of expansion plans into areas like bike sharing and Uber Eats, its food delivery business has meant losses have grown rapidly.

The company said adjusted losses in the last three months rose 32% on the previous quarter to $404m.

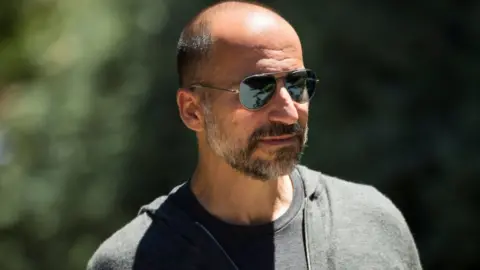

Dara Khosrowshahi, Uber chief executive said the company was "continuing to grow at an impressive rate for a business of our scale.

"We're deliberately investing in the future of our platform: big bets like Uber Eats; congestion and environmentally friendly modes of transport like Express Pool, e-bikes and scooters; emerging businesses like Freight; and high-potential markets in the Middle East and India where we are cementing our leadership position."

In May at a conference in California Mr Khosrowshahi said the food delivery business Uber Eats was taking $6bn bookings a year and growing 200% annually.

Under pressure

Uber is under pressure to become more profitable for a planned offering of its shares to the public next year.

David Brophy, professor of finance at the University of Michigan, told Reuters the firm could expect to see its valuation slashed in a public listing if it did not show more progress towards becoming profitable.

The taxi giant was most recently valued at $72bn, making it one of the most valuable privately held firms in the world.

Uber, which is a private company, released figures to investors showing that the firm made $12bn in quarterly gross bookings, which includes both rides and its food-delivery service, Uber Eats, up 41% from a year before.

Getty Images

Getty ImagesUber has retreated from major markets China, Southeast Asia and Russia over the last year after failing to fend off local competitors.

But it said it was still committed to India and the Middle East, despite pressure from some investors to quit those markets too.

Mr Khosrowshahi was brought in last year to revive Uber's image after a damaging sexual harassment scandal engulfed the firm.

But the company still has a number of costly legal battles, including over its classification of drivers as independent contractors, and federal inquiries to resolve.

Regulatory pressure also threatens to hinder growth in major markets.

Last week New York voted to impose a temporary cap on new licences for ride-hailing vehicles to tackle congestion. And Mayor of London Sadiq Khan on Wednesday said he would seek similar restrictions in the UK's capital.