Savers 'missing out on better rates'

PA

PAMillions of people could get a better return on savings by switching deals rather than waiting for banks to increase rates, experts say.

A huge number of savers leave money languishing in old accounts with poor rates of interest, often with the same provider as their current account.

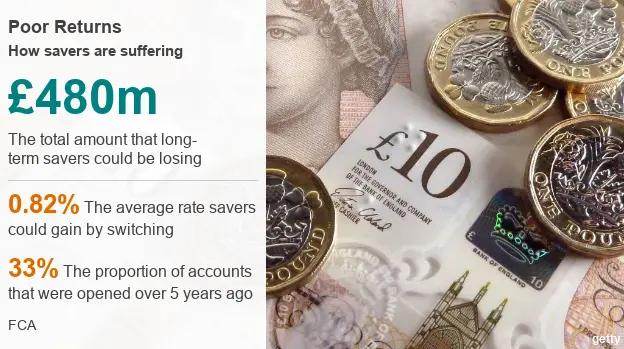

The City regulator says they are missing out on up to £480m in interest.

Bank of England governor Mark Carney suggests new entrants are increasing competition, creating better deals.

But others argue that competition rarely works in banking.

Pass it on

The Bank of England raised its key base rate on Thursday from 0.5% to 0.75%. This is a benchmark for banks and buildings societies to use as a guide to set the interest rates they pay savers and charge borrowers.

After a rise in the Bank rate, providers are watched closely to see if they pass on the increased rate in full to savers, especially given savers have had such poor returns for so long.

Following the previous Bank rate rise in March, interest paid on half of all savings accounts failed to rise at all. Of those that did, the average rise did not match the Bank of England's increase.

Since Thursday's rise there has been very little movement in rates, although generally it takes at least a week for any rises to be announced and a month for any of those better returns to take effect.

Tom Adams, of comparison site Savings Champion, said that rather than waiting, many people could get a much better deal by moving off an old deal that might pay about 0.5% in interest, or as little as 0.05%, to one of the better buys.

The leading rates for instant access savings accounts are well over 1% so, for many, simply switching to a new savings account would be more lucrative than hoping the base rate increase is passed on to their existing account.

"This year we have seen competition between the newer challenger banks rather than the big High Street names," he said.

The reason for this, in part, is that the largest banks, particularly, did not need to attract savers. They had money sloshing around from schemes that allowed them access to cheap funds to lend out.

Challenge for customers

The competition view was echoed by Bank governor Mr Carney, who told BBC's Today programme on Friday that while competition was not the Bank's direct responsibility, it had created a better-prepared wicket for this to be played out.

"In order to have competition, you need all of the banks to be healthy," he said.

"That required a lot of repair post-crisis, and... you need a lot of new banks in the system, so we've authorised 40 more banks."

The City regulator has suggested that a minimum savings rate should be considered for longstanding customers, but a widely held view is that savers need to ditch their loyalty and move their funds around.

However Mick McAteer, director of the Financial Inclusion Centre, said that switching would not benefit many households with squeezed finances.

He said many millions of savers did not have sufficient amounts tucked away for a small rise in interest to make much of an impact.

Even a 1% rise in the savings interest rate would only add 20p a week or so to many people's savings, he said, which was an "immaterial rise" and one that would do little to encourage people to save more.