FCA suggests 'basic savings rate' to boost returns

PA

PABanks could be forced to set a minimum interest rate on their savings accounts, the Financial Conduct Authority (FCA) has suggested.

The FCA said it was concerned that savers who stay with the same bank or building society for a long time get poor returns on their money.

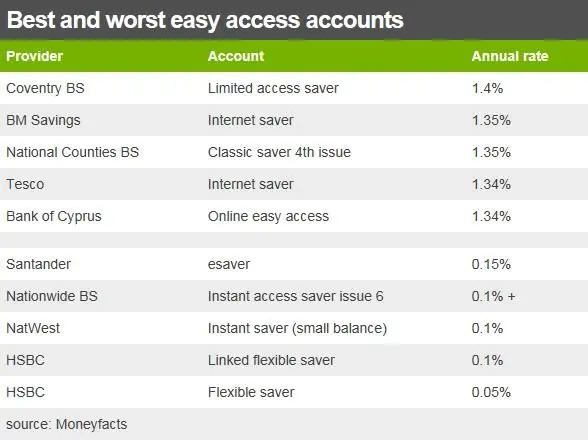

Some banks currently pay just 0.05% a year on instant access accounts.

The Basic Savings Rate (BSR) would apply to all easy access cash ISA products, as well as savings accounts.

It would be applied after the account had been opened for a set period, for example one year.

"Providers can take advantage of high levels of customer inaction to pay lower interest rates to longstanding customers," said Christopher Woolard, executive director of strategy and competition at the FCA.

He said customers who do not shop around for higher rates should be treated fairly by their banks or building societies.

Citizens Advice said the average amount that savers were losing by not switching accounts was £48 a year.

The FCA suggested it would be up to each bank to set their own BSR, which would apply across all their instant access accounts. The rates would then be published on the FCA's website, so consumers could compare them easily.

'Concern'

Banks said they had already taken measures to improve competition in the savings market.

"These include communicating more clearly with customers about the rates they receive, faster cash ISA transfers and enhanced customer prompts before a rate is reduced," said Peter Tyler, director of conduct and savings policy at UK Finance, which represents the High Street banks.

The FCA has tried previously to encourage savers to shop around for better rates, but with limited success.

"Efforts to encourage customers to switch have had limited impact and we remain concerned about the way firms are treating customers," Mr Woolard said.

"This is why we are considering the introduction of a basic savings rate for older accounts, which would promote competition and help get customers a better rate of interest."

The highest returns are generally offered by current accounts, where savers can get up to 5% a year in some cases - although such accounts have strict limits on the amount of money that can be put in.

Analysis, Simon Gompertz, BBC personal finance correspondent

The FCA has tried forcing banks to tell customers how to switch accounts. It's tried naming and shaming the ones paying the worst rates.

But none of these measures has made much difference.

So now it is looking at a more powerful weapon to use against savings providers who exploit their customers.

This isn't the FCA reaching for the nuclear button of setting minimum rates itself, because each institution would set its own Basic Savings Rate.

But the measure would prevent the least savvy savers being left behind and make it easier to compare what's on offer.

The danger - if this ever happens - is that the new weapon explodes in the FCA's face, if banks react by setting the lowest Basic Savings Rates they can get away with.

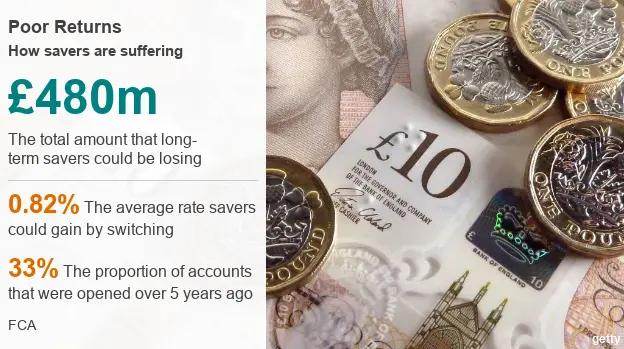

The FCA said a Basic Savings Rate (BSR) could enable customers jointly to earn up to £480m a year more than they do at the moment.

It said around a third of accounts were opened more than five years ago.

And on average, customers with such accounts earned 0.82% less than people whose accounts were opened more recently.

Interested parties can respond to the FCA's discussion paper between now and 25 October.

The savings ratio is the proportion of our disposable income (what is left over after taxes) that we save.

According to the ONS... that figure is now at 4.1%, the third lowest since records began in 1963. In the 1990s, it was as high as 14.7%.

Put simply, we are losing the savings habit.

If there is a rainy day ahead, we are not preparing for it because for many people the rainy day is now