Donald Trump raises stakes as US-China trade war begins

Getty Images

Getty ImagesDonald Trump has threatened to impose tariffs worth hundreds of billions of dollars on Chinese imports to the US as a trade war between the world's two largest economies began on Friday.

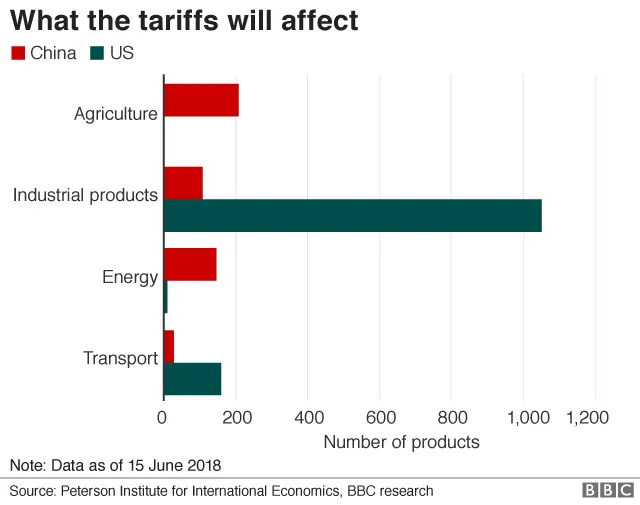

US tariffs on $34bn (£25.7bn) of Chinese goods have come into effect.

China retaliated by imposing a similar 25% tariff on 545 US products, also worth a total of $34bn.

Mr Trump said the US might target Chinese goods worth $500bn - the total value of Chinese imports in 2017.

Beijing accused the US of starting the "largest trade war in economic history" and has lodged a case with the World Trade Organization (WTO).

"Trade war is never a solution," said Chinese Premier Li Keqiang. "China would never start a trade war but if any party resorts to an increase of tariffs then China will take measures in response to protect development interests."

The government-run English language China Daily newspaper said: "The Trump administration is behaving like a gang of hoodlums with its shakedown of other countries, particularly China."

Conflict within the administration

By Tara McKelvey, BBC News White House reporter

Behind the trade war, there's conflict within the administration. Hardliners such as Peter Navarro, a trade policy adviser, says the US is defending itself against an "aggressive" China. Meanwhile some of the officials who had previously worked for the Obama administration - known as "holdovers" - are hoping to tamp down the US-China conflict.

The tension between these factions is occasionally on display in the West Wing. I've seen two hardliners struggle over a podium, vying for a chance to broadcast Mr Trump's harsh message on economic issues, while the holdovers sit quietly at the side of the room.

This reflects a larger division in the White House: Mr Trump and his closest aides are trying to bring about radical change, while those who support a more cautious approach find themselves sitting in silence.

Analysts at Bank of America Merrill Lynch forecast only a modest escalation in the US-China battle, adding: "However, we can't rule out a full-blown, recession-inducing 'trade war'."

Rob Carnell, chief Asia economist at ING, said: "This is not economic Armageddon. We will not have to hunt our food with pointy sticks.

"But it is applying the brakes to a global economy that has less durable momentum than appears to be the case."

China's decision to impose its own tariffs means US goods including cars, soya beans and lobsters are now subject to additional taxes.

BMW said it could not absorb all of the 25% tariff on the cars it exports to China from a plant in Spartanburg, South Carolina and would have to raise prices.

The US tariffs are the result of Mr Trump's attempt to protect US jobs and stop "unfair transfers of American technology and intellectual property to China".

The White House said it would consult on tariffs on another $16bn of products, which Mr Trump has suggested could come into effect later this month.

Mr Trump said: "You have another 16 [billion dollars] in two weeks, and then, as you know, we have $200bn in abeyance and then after the $200bn, we have $300bn in abeyance. OK? So we have 50 plus 200 plus almost 300."

The imposition of the tariffs had little impact on Asian stock markets. The Shanghai Composite closed 0.5% higher, but ended the week 3.5% lower - its seventh consecutive week of losses.

Tokyo closed 1.1% higher and European markets were up more than 1% in morning trading before turning negative on Friday afternoon.

Mr Trump has already imposed tariffs on imported washing machines and solar panels, and started charging levies on the imports of steel and aluminium from the European Union, Mexico and Canada.

The US tariffs imposed so far would affect the equivalent of 0.6% of global trade and account for 0.1% of global GDP, according to Morgan Stanley.

Analysts are also concerned about the impact on others in the supply chain and about an escalation of tensions between the US and China in general.