Debenhams warns on profits for third time this year

Getty Images

Getty ImagesDebenhams said full-year profits will be lower than expected - the third time it has issued a profit warning this year.

The department store blamed "increased competitor discounting and weakness in key markets" for the profit shortfall.

It said annual pre-tax profits would come in between £35m and £40m, below previous estimates of £50.3m.

Debenhams' latest profit warning comes despite a turnaround plan designed to cut costs and boost sales.

Chief executive Sergio Bucher pointed to "exceptionally difficult times in UK retail".

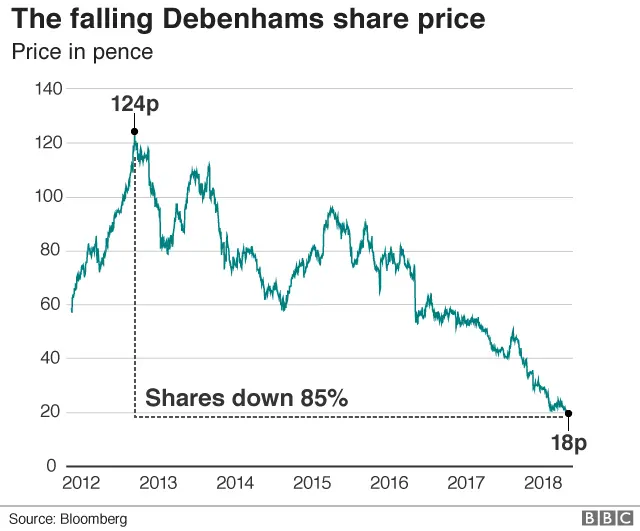

Shares in Debenhams fell as much as 16% in early trading before recovering slightly.

Debenhams runs 182 stores in the UK, Republic of Ireland and in Denmark, where it operates under the Magasin du Nord name.

Analysis

By Emma Simpson, BBC business correspondent

Debenhams is under pressure. The big question is whether it can deliver its turnaround plan quickly enough to adapt to the big structural changes in retail as well as a host of cost pressures.

The retailer is caught between the need to bolster its finances but at the same time invest and revamp its stores.

It's now cutting back on capital spending next year. Big department stores are expensive to run and require constant investment.

Some will be wondering whether it will be able to spend what's really needed on its large number of stores to revive sales.

The boss is promising real evidence of progress in the autumn. The race is on to show that the strategy is working and can deliver some much needed growth in the key Christmas season.

Retail rout

Debenhams' latest warning adds to a chorus of recent woes on the UK High Street.

House of Fraser, Marks & Spencer, New Look and Mothercare have all announced store closures this year.

Competition from online retailers, higher import costs due to the weaker pound, a rise in business rates and squeezed household incomes have all combined to make times tough for High Street stores.

Debenhams said sales had fallen in May and June thanks to rivals' discounting and weak consumer spending.

Like-for-like sales, which reflect sales at stores open for more than a year, fell by 1.7% in the 15 weeks to 16 June. Digital sales grew 16% over the same period.

Mr Bucher who joined Debenhams in 2016, has launched a turnaround plan, putting more emphasis on food and beauty and improving the firm's online platform.

However, in January the chain warned profits would be lower this year after a disappointing Christmas trading period.

In April, the retailer warned that the cold weather in late February would eat further into profits.

Nicholas Hyett, analyst at Hargreaves Lansdown, said: "Half a decade of falling sales and heavy discounting has trashed margins and left the group struggling to make ends meet. Unfortunately it all feels like Debenhams is playing catch-up with an industry that's left it behind."

Footasylum

FootasylumThere was more bad news for the retail sector as shares in sportswear retailer Footasylum nearly halved after it reported a slowdown in sales growth and said profits would be lower in the coming year.

In its first results since floating on the stock market in November, revenues rose 33% to £194.8m in the year to 24 February with underlying profits up 4% at £8.4m.

However, chief executive Clare Nesbitt said trading since the start of the new financial year had been affected by weak consumer confidence, meaning profits would show "more modest growth".

Footasylum aims to more than double its 65 stores in the UK.

Stockbroker Peel Hunt said there were also longer-term concerns over Footasylum, as major brands such as Nike and Adidas focus on selling directly to consumers and limiting the number of retailers they use: "Footasylum may find that its access to the cool product files is restricted over time."