Poundworld enters administration after rescue talks fail

PA

PADiscount retailer Poundworld has appointed administrators, putting 5,100 jobs at risk.

The move came after talks with a potential buyer, R Capital, collapsed leaving Poundworld with no option other than administration.

Poundworld, which serves two million customers a week from 335 stores, also trades under the Bargain Buys name.

Administrators Deloitte stress the stores will continue to trade as normal with no redundancies at this time.

It said in a statement: "Like many high street retailers, Poundworld has suffered from high product cost inflation, decreasing footfall, weaker consumer confidence and an increasingly competitive discount retail market.

Clare Boardman, joint administrator at Deloitte, said: "The retail trading environment in the UK remains extremely challenging and Poundworld has been seeking to address this through a restructure of its business.

"Unfortunately, this has not been possible."

She said Deloitte believed a buyer could be found for the business, or at least part of it.

A spokesperson for Poundworld''s owner, TPG said filing for administration had been "a difficult decision".

"Despite investing resources to strengthen the business, the decline in UK retail and changing consumer behaviour affected Poundworld significantly," they added.

Poundworld has been losing money for the past two years. Losses for the financial year 2016-17 were £17.1m, up from £5.4m the year before.

Tough

It's the latest High Street retailer to run into trouble.

Just last week, department store chain House of Fraser said it would close 31 of its 59 shops, citing the need to adapt to "fundamental change" in the retail industry.

A combination of falling consumer confidence, rising overheads, the weaker pound and the growth of online shopping have made it tough for traditional retailers.

Electronics chain Maplin and toy chain Toys 'R' Us both collapsed into administration earlier this year.

Other High Street chains such as Mothercare and Carpetright have been forced to close stores in order to survive.

Restaurant chains such as Italian chain Carluccio's, pizza restaurant Prezzo and burger chain Byron have also had to close stores as they battle a triple-whammy of falling trade, higher costs and increased competition.

Analysis by BBC business correspondent Jonty Bloom

Only a few years ago Poundworld was expanding aggressively, now it is set to become yet another High Street casualty.

It has, of course, been hit by the usual suspects, lower consumer confidence, falling footfall and more online shopping.

But for pound shops these problems can be multiplied; for a start they depend on high turnover because the margin of profit when everything is sold for a pound is minute.

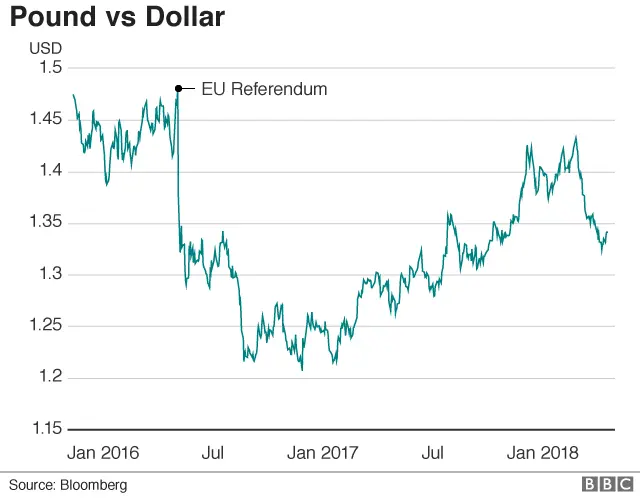

Then they import a lot of what they sell, including large amounts from specialised suppliers in China. The weakness of the pound has pushed up the cost of imports and when by definition it is impossible to increase their prices, the squeeze on pound shop profits can be dramatic and very sudden.

'Too many mouths'

Independent retail analyst Richard Hyman said Poundworld was simply not managing its business well enough. "The clue's in the name: These days having a fixed price in the title is a disadvantage but it is not a killer disadvantage.

"Importing products is not peculiar to Poundworld but others have been getting round this by getting manufacturers to put fewer biscuits in the pack, for example.

"The bigger picture is there are too many retailers with too many stores for the market to feed."

But despite the collapse of so many stores, David Gill, the national officer for the Union of Shop, Distributive and Allied Workers, was not wholly pessimistic: "When Toys R Us went into administration we had a number of retailers we work closely with saying 'there are job vacancies can you point them in this direction?', but whether you can absorb all 5,000 jobs that's another discussion."

Poundworld, which has its headquarters in West Yorkshire, was formed in 2004, but it says it can trace its origins "back to 1974 and a market stall in Wakefield, West Yorkshire".

In 2014 Poundworld's founder Chris Edwards took a central part in a BBC documentary about the intense competition between the company and its rivals Poundstretcher and Poundland.

Investment company TPG, which bought a majority stake in Poundworld in 2015, also controls the restaurant chain Prezzo whose landlords and creditors agreed a restructuring last month.