Turkish lira rallies after emergency rate hike

AFP

AFPThe Turkish lira has pared its heavy losses against the dollar following an emergency interest rate hike by the central bank.

The currency climbed 2% higher having fallen 5% earlier to hit a record low.

The lira has lost more than a fifth of its value this year as fears grow that the government might undermine the powers of Turkey's central bank.

Many investors have been calling for higher interest rates to bring down inflation, which is in double figures.

Following an emergency meeting, the Turkish central bank steeply raised a benchmark lending rate from 13.5% to 16.5% on Wednesday.

"Current elevated levels of inflation and inflation expectations continue to pose risks on the pricing behaviour," the central bank said.

"Accordingly, the committee decided to implement a strong monetary tightening to support price stability."

Getty Images

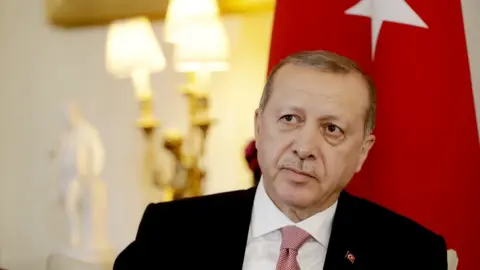

Getty ImagesThe crisis emerged after the Turkish President said he planned to take more control of the country's finances after a general election on 24 June.

Recep Tayyip Erdogan has previously described himself as an "enemy of interest rates".

His deputy Bekir Bozdag this week implied that foreign powers were to blame for the lira's collapse.

However, on Wednesday he tweeted his full support for the country's central bank. "The central bank governor and members of the monetary policy committee have my full backing in doing what's necessary to stem the slide in lira and achieve price stability," he wrote.

"None of Turkey's macroeconomic problems [are] insurmountable. We've fixed problems in the past, we can do it again."The lira fell as low as 4.8450 against the dollar early on Wednesday before recovering slightly, moving up to 4.628.

It is still down by around 17% since the end of 2017.

Peter Dixon, an economist at Commerzbank, said investors were concerned about the amount of financial power that could end up in Mr Erdogan's hands.

"I think markets are beginning to take fright at the extent of government interference over certainly central bank policy," he said.

"That's certainly been one of the factors which has caused the lira to lose ground. It's been a trend which has been ongoing for some time, but I think the rhetoric is being cranked up now."