M&S to close 100 stores by 2022

Getty Images

Getty ImagesMarks and Spencer plans to close 100 stores by 2022, accelerating a reorganisation that it says is "vital" for the retailer's future.

Of the 100 stores, 21 have already been shut and M&S has now revealed the location of 14 further sites to close.

Under its plan, M&S wants to move a third of its sales online and plans to have fewer, larger clothing and homeware stores in better locations.

The latest closures will affect a total of 872 employees.

"Closing stores isn't easy but it is vital for the future of M&S," said Sacha Berendji, its retail operations director.

He said that where stores have already closed, "encouraging" numbers of consumers were now shopping at nearby stores. The company has just over 1,000 UK stores.

The 14 M&S stores affected are:

- Bayswater, Fleetwood (outlet store) and Newton Abbot (outlet store), which are all due to close by the end of July 2018

- Clacton and Holloway Road, which will both shut by early 2019

- Darlington, East Kilbride, Falkirk, Kettering, Newmarket, New Mersey Speke, Northampton, Stockton and Walsall, which are proposed for closure

Since M&S first announced its closure programme in November 2016, 18 stores have shut and three have been relocated.

The 18 closures were in Andover, Basildon, Birkenhead, Bournemouth, Bridlington, London Covent Garden, Dover, Durham, Fareham, Fforestfach, Keighley, Portsmouth, London Putney, Redditch, Slough, Stockport, Warrington and Wokingham.

The three relocations were in Greenock, Newry and Crewe.

Analysis: Emma Simpson, BBC business correspondent

M&S store closures are always big news, especially for the towns where the shops have been reassuring fixtures on the high street for decades.

This latest wave of closures will feel like a body blow to locations that are already under pressure. But the hard truth is that M&S has more stores than it needs, given our changing shopping habits.

Many experts believe that closing a large swathe of stores is a tough but necessary step.

One key question is: will those lost fashion and home sales be recaptured online or in the fewer but better physical locations in the future?

M&S says there are encouraging signs from towns such as Warrington where it closed a town centre store, but shoppers have since flocked to its new outlet in a retail park.

But this business still has a massive task in reviving its fortunes and tomorrow's annual results will be further proof of that.

Retail veteran Archie Norman, who took over as M&S chairman last year, said the retailer has been "drifting" and promised to speed up changes.

Those changes included scaling back ambitions for its Simply Food chain. It had intended to open 40 stores this financial year, but has cut that number to 25.

"M&S is repositioning itself for the new retail world," said Laith Khalaf, senior analyst at stockbrokers Hargreaves Lansdown. "Having a huge store estate is no longer the powerful retail force that it once was."

The retailer is trying to spur growth after disappointing trading over the Christmas period.

In the three months to 30 December, M&S said like-for-like sales fell at its food business, where sales had been rising, as well as at its clothing and homeware division.

Investors will be looking for evidence of improvement in the company's annual results on Wednesday.

M&S shares were down 2.6% at 292p in afternoon trading on Tuesday. They had been worth almost 400p a year ago.

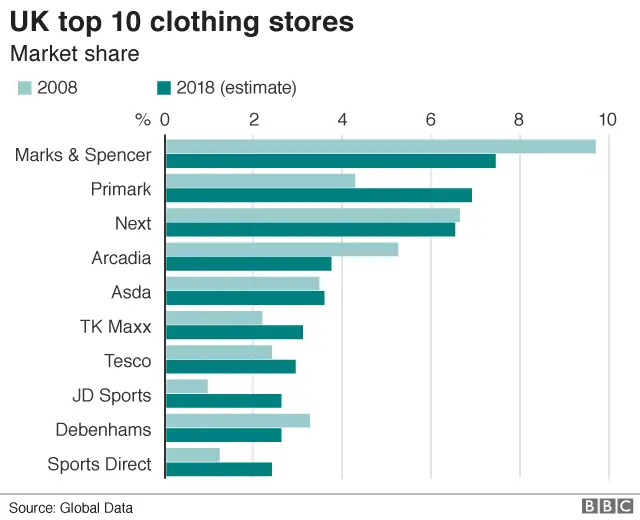

Maureen Hinton, from analytics firm GlobalData, said M&S was "perilously close" to losing its top spot in the UK clothing market to Primark.

GlobalData has forecast that its clothing market share will be 7.6% this year - almost halving in two decades - despite opening more stores selling clothing, homewares and food under the one roof.

''To make its space more productive M&S has to produce a compelling offer showcased in an inspiring environment," Ms Hinton said.

"Closing stores will make its space more productive and help to improve profitability, but it still has not solved its fundamental problem: top-line growth."