Could smartphones replace bank branches?

Getty Images

Getty ImagesBanks now send more than 16 text alerts every second in an indication of how much we now rely on smartphones rather than computers to manage our money.

Some 512 million alerts were sent last year telling people their salary had been paid in or that they were heading into an overdraft, a report shows.

The report, by banking trade body UK Finance, reveals our increasing reliance on technology to budget.

It comes as TSB continues to face difficulties with digital services.

The migration of data on TSB's five million customers from former owner Lloyds' IT system to a new one managed by current Spanish owner Sabadell a month ago caused major problems for customers.

Adrian Buckle, head of research at UK Finance, said that the level of upset created by the TSB saga had shown how much consumers now relied on digital services.

"It is up to the industry to ensure that these problems do not happen again," he said. "It is not just TSB looking at that but all banks across the whole industry."

Apps on the rise

The Way We Bank Now report by UK Finance revealed that there were about 5.5 billion log-ins to banking apps last year, a 13% rise on the previous year.

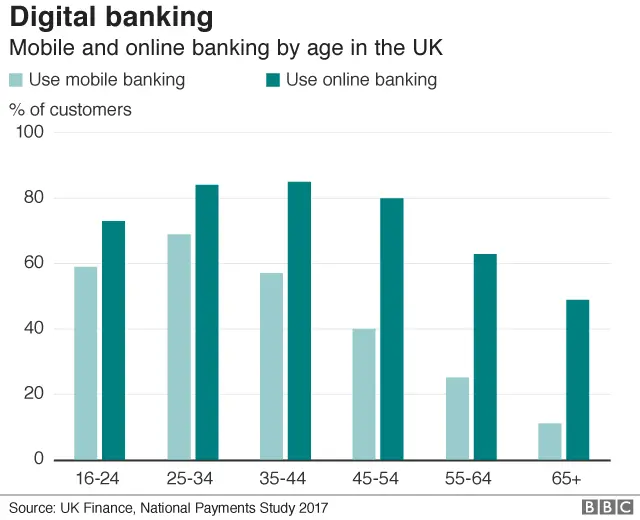

Mobile banking is most popular among millennials, with almost 59% of 16 to 24-year-olds and 69% of 25 to 34-year-olds using their smartphones. In contrast, almost half (49%) of 65-year-olds bank online.

The figures come a day after industry analyst CACI predicted that more consumers would use apps on their smartphones rather than a computer to do their banking by as early as next year.

Initially, apps only allowed people to check their balance and see recent transactions, but now they are used regularly for more complex tasks such as setting up standing orders, transferring money to friends, or other money management functions.

Technology is also changing the way bank statements are being produced. Some already provide forward-looking statements that give a clear indication of when regular or pending payments will come out of an account and affect the customer's balance.

Regulators have aimed for more competition in the sector through the system of Open Banking, which allows customers access to specific new services through their old account.

Getty Images

Getty ImagesOne huge change on the horizon is the planned introduction of a streamlined payments system - currently called New Payments Architecture.

It is designed to be operational by 2021, although it will run in parallel to the current system for a few years. In time, it should offer real-time balances and 24/7 payments, meaning - in theory - salaries could be paid on the same day each month even if this falls on a weekend. It could also mean no "pending transactions" on a bank balance.

Customers would be able to confirm the identity of a payee - rather than simply rely on getting the correct account number and sort-code, and invoices and other information could be attached to payments, helping business with their reconciliation of payments.

It could also offer the opportunity for those struggling to pay bills to do so in instalments, without the need for long agreements and paperwork.

Security remained "paramount", Mr Buckle said, but the TSB debacle has clearly proved that what bank customers want above all else with new technology is for it to work properly.