Tenants' tales - in five charts

Getty Images

Getty ImagesThe UK is a nation of homeowners but the decade since the financial crisis has seen a shift towards residents living in accommodation rented from a private landlord.

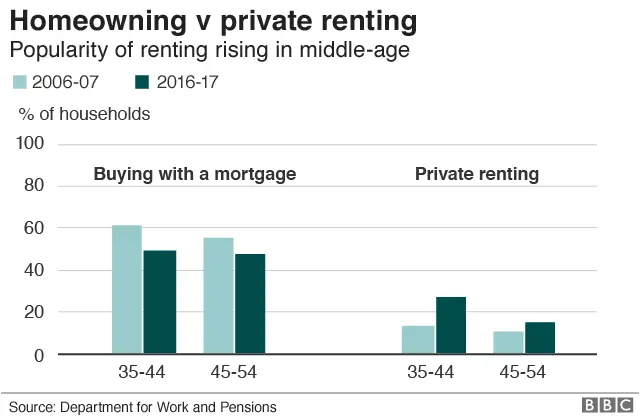

This is most clearly illustrated among 35 to 54-year-olds. As the numbers of those getting a mortgage to buy has dropped, so private renting has risen.

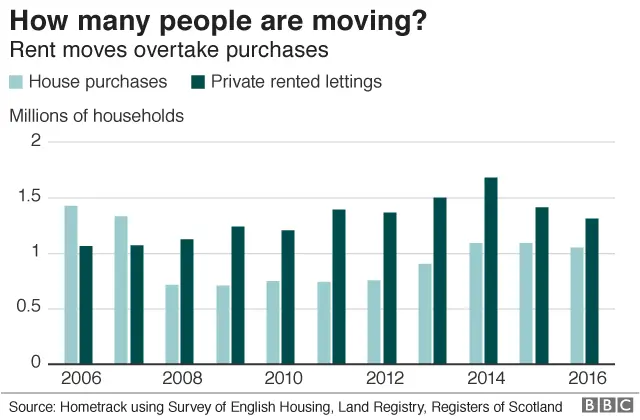

The credit crunch has also led to homeowners becoming more likely to stay put owing to factors including affordability and availability of mortgages.

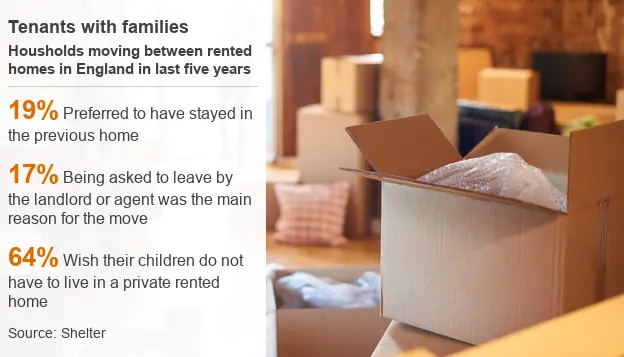

In contrast, moves within the rental sector have grown and many tenants, especially those with children, have complained that renting can mean a lack of security. Landlords may ask them to move at short notice, leading to disruption with schooling and family life.

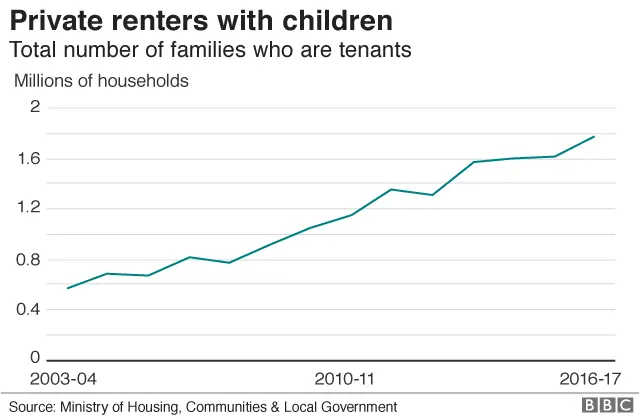

The number of families with children who rent their home from a private landlord has tripled in the course of 10 years.

This is a lifestyle choice for some but many of these parents want to bring up their children in a home they own, says the housing charity Shelter.

Since December last year, tenants in Scotland have had indefinite security of tenure.

But some tenants in England and Wales feel the security of their domestic life is determined by their landlord.

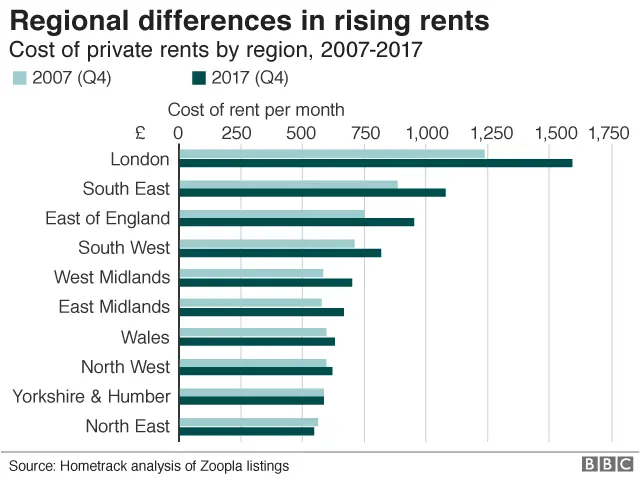

Then there is the cost - and how rent levels have changed in the last 10 years depends on where you live, north or south.

For those in London, the South East or the East of England, there has been a significant increase but the picture is much more stable in other parts of England and Wales.