Heathrow v Gatwick: Could the winner be... Stansted?

Stansted

StanstedStansted Airport has always been a bit of underdog. Nestled in the Essex countryside, 40 miles from central London, its fortunes have been tied to the low-cost airline revolution of the 90s and especially its biggest customer - Ryanair.

It is synonymous with bleary-eyed early starts, cheap flights and pre-6am pints.

Its more global and glamorous sisters, Heathrow and Gatwick, have long tussled over who should take the ultimate next step and gain the right to build another runway.

Stansted, on the other hand, has been busy with its own, more immediate practical business of mopping up cheap flights across Europe to destinations such as Timisoara, in western Romania.

But is Stansted now becoming its own Cinderella success story?

Runaway growth

The airport's bosses claim Stansted is set to be London's fastest-growing airport with more than 10.8 million airline seats available this summer, 1.2 million more than in summer 2017.

Stansted

StanstedAccording to them, Stansted's growth will surpass all other London airports, with a 12.1% year-on-year increase in demand for runway slots, compared with 1.4% at Heathrow, and 2.1% at Gatwick.

Stansted will welcome five new airlines this year - Primera Air, Emirates, WOW air, Air Corsica and Wideroe - serving destinations ranging from New York, Washington DC, Boston and Toronto to Dubai, Corsica, Reykjavik and Kristiansand (Norway).

The airport will also be transformed with a new £130m arrivals terminal.

The 34,000 sq m (365,972 sq ft), three-level building will be built next to the current terminal and is expected to be completed by 2021.

Stansted

Stansted"Stansted now sits in a geographic sweet spot serving both London, which is rapidly expanding north and eastwards towards the airport, and the vibrant East Anglian region," says Ken O'Toole, chief executive of Stansted Airport.

"This, coupled with constraints on runway capacity elsewhere in the South East, means we are expecting our passenger numbers to reach 35 million per annum in the early 2020s."

Upgraded retail

So what is behind Stansted's surge?

The airport's ownership changed hands in 2013 when BAA was forced to sell Stansted as a result of a ruling by the Competition Commission.

Since then, its new owner Manchester Airports Group (MAG) has spent £150m upgrading the Norman Foster-designed terminal with a focus on improving its retail space.

The airport now earns £6.20 per passenger from non-aviation revenue - primarily, retail and car parking - more than the £5.40 it does from the flights themselves.

Primera

PrimeraBut it isn't just the better shops that are attracting new airlines such as low-cost Latvia-based airline, Primera, which started a new long haul service to New York on Thursday.

"Stansted allows us to grow," says Anastasija Visnakova, Primera's chief commercial officer.

"London to New York is one of the biggest routes in the world," she says. The demand from people wanting to travel is just endless, and to profit, "you just have to be there at the right time, in the right moment, with the right tools".

More routes?

But Stansted has flirted and failed with long-haul flights before.

Another low cost carrier, Air Asia X, began a service from Essex to Kuala Lumpur in 2009 but it closed two years later. Two transatlantic business-class only airlines, Eos and MaxJet, have also failed from Stansted.

"Perhaps it wasn't the right time for those airlines. But I wouldn't bet against new routes coming back to Stansted," says Ms Visnakova - who hints her airline is looking at launching new flights to different continents from Stansted.

"Passenger flow has increased around the world. It is tremendous. There are people travelling today who we'd never think would be travelling even a year ago. Times are changing, the equipment is changing, the technology is changing.

"Aviation is becoming more affordable and the selection of the right routes with the right intelligence behind them will succeed."

Getty Images

Getty ImagesAnalysis, John Strickland, aviation expert

I worked at Stansted between 1990-2003, for KLM's UK subsidiary, Air UK, which launched a network of domestic and European services. Later we established Buzz, a low-cost airline which added more European destinations.

The 90s saw some false starts with several major European airlines testing out services to their continental hubs but none enduring. There was even a short-lived Chicago service operated by American Airlines.

The airport wasn't as well known as it is today and it took the massive growth by low-cost carriers to put it firmly on the map. As access has improved from further afield and other airports have become more congested, Stansted can now support more varied services.

The arrival of Emirates, in particular, is a real vote of confidence. The airline's powerful Dubai hub will provide worldwide access to the airport's growing catchment. Emirates understands the advantages which Stansted offers.

The growing tech and pharma industry around Cambridge and easy access to North London, Essex, East Anglia and the Midlands will all support selective growth at the airport. While Stansted won't become another Heathrow, it has a growing role to play.

Stansted's biggest opportunity lies in its spare capacity.

"Heathrow is full, Gatwick is pretty much full, if anyone wants to grow in London we've got the capacity to make that happen," says Ken O'Toole.

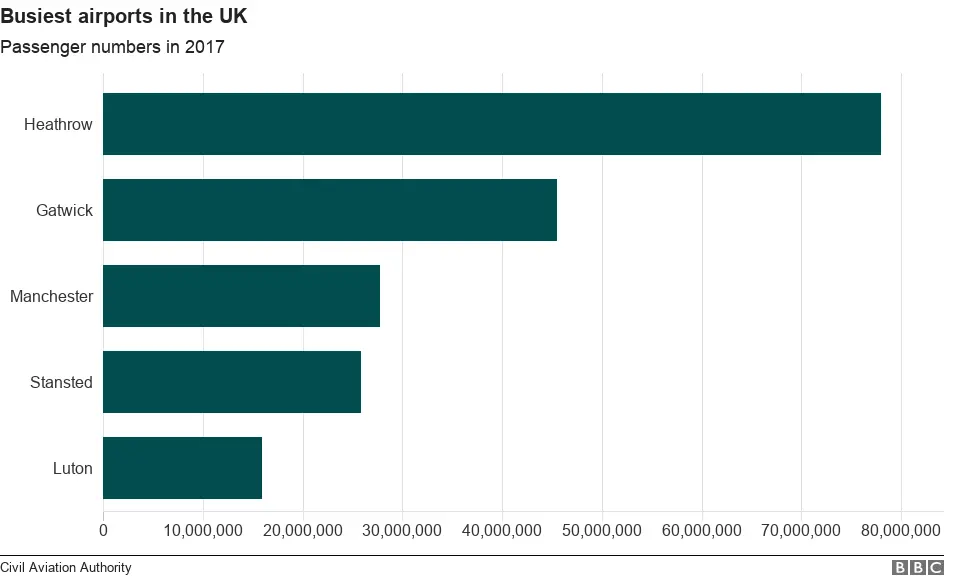

Gatwick is the world's second-busiest single runway airport in the world after Mumbai and handles 45.7 million passengers per year.

Stansted, in contrast, currently handles 26.1 million, but a "planning cap" limits its passenger numbers to 35 million per year. It has recently applied to extend this to 43 million.

"When MAG acquired Stansted from BAA in 2013, it would be fair to say that the airport had lots of untapped potential. Almost exactly five years later, and having brought a new ambition to the airport, we have a real momentum and we are predicting continued strong growth in passenger numbers."