Engineering giant GKN sold to Melrose for £8bn

Getty Images

Getty ImagesOne of Britain's oldest engineering firms has been sold for £8.1bn to a controversial investment firm.

GKN, which has had a hand in making everything from Minis to Spitfires, lost its battle to stay independent.

Melrose Industries, which specialises in turning round troubled manufacturing businesses and selling them on, won the backing of 52% of GKN shareholders.

Business Secretary Greg Clark said Melrose now had to honour its commitments to stay UK based.

Labour called Melrose a "short-termist asset-stripper" and condemned the deal.

Admitting defeat, GKN's management said it would now work with Melrose to ensure the success of the new company.

The battle for GKN, which employs 58,000 staff worldwide, 6,000 of them in the UK, drew protests from government, unions and GKN customers.

GKN's board had promised it would overhaul itself and sell off its car parts division, but it was not enough to stop investors agreeing to sell their shares to Melrose.

Christopher Miller, chairman of Melrose, said: "We are delighted and grateful to have received support from GKN shareholders for our plan to create a UK industrial powerhouse with a market capitalisation of over £10bn and a tremendous future."

News of the successful bid sent GKN's share price up over 6% to 450p. Melrose's offer is equivalent to 462p a share.

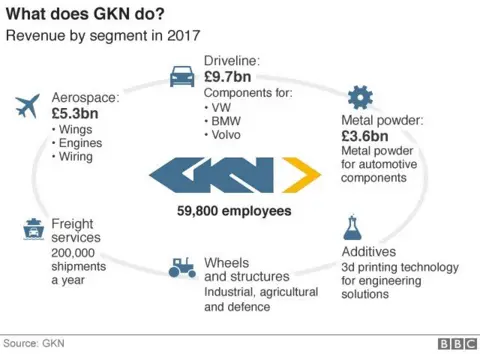

GKN's businesses cover aerospace and automotive engineering. Its Driveline division makes systems for roughly half the world's passenger cars and light trucks.

Its aerospace division is a major supplier to the US military and a key partner on defence programmes such as the F-35 joint strike aircraft in which the UK government has a stake.

Melrose's strategy it says, is to keep the company together "to improve all of the businesses in GKN, only realising their value once they have reached full potential."

Getty Images

Getty ImagesAlarm

However, what happens afterwards has alarmed politicians and unions and some of GKN's customers.

Mr Clark said: "During the bid, Melrose made commitments which they are bound to honour including investment in research and development and maintaining itself as a UK business.

"Now that shareholders have made their decision the government has a statutory responsibility to consider whether the merger in its proposed final form gives rise to public interest concerns in the areas of media plurality, financial stability and national security.

"This assessment will be made by the appropriate authorities and the conclusion set out in due course."

Getty Images

Getty ImagesBefore Melrose won the bid Airbus, which is supplied by GKN, said it would be "practically impossible" to give new business to GKN if Melrose's offer was accepted because it damaged long-term investment prospects in the company, which could reduce R&D budgets and limit innovation.

Paul Everitt, the chief executive of the ADS trade organisation, which represents the aerospace and defence sectors, said: "GKN is an important part of the UK industrial landscape and it is important that its owners continue to invest for the long-term and support high value jobs both directly and throughout its UK supply chain."

The Unite union said it would be holding Melrose's "feet to the fire" over concessions it had made in recent days and seeking "concrete guarantees" on job security, investment and future work in the UK.

Bid launched

Melrose launched its bid in January, initially at £7bn. It increased that this month to £8.1bn, with up to another £1bn to support the pension fund.

It argued that it could increase GKN's profitability which has been falling steadily over the last five years.

Reuters

ReutersIn the run up to the bid, GKN had also suffered a crisis of leadership, with its chief executive-in-waiting, Kevin Cummings, forced to step down after problems in the company's US aerospace division.

The new chief executive, Anne Stevens, a former Ford executive, devised a plan to merge GKN's Driveline with the US car components group Dana to create a new company. GKN would have got a 47% stake in it and $1.8bn (£1.28bn) in cash from Dana.

But Melrose called the plans "panicked and fraught with contradictions".