April tax changes: Will I be better or worse off?

Getty Images

Getty ImagesThe start of April - according to the poet Geoffrey Chaucer - brings showers of sweetness and the melody of the first birdsong.

Rather more prosaically, it also marks the beginning of the tax year.

If you are relatively well-off, the chances are that April will make you richer.

If you are in a low-paid job, you may also be better off, thanks to generous increases in the National Minimum Wage.

Pensioners and recent students will also have reason to celebrate.

However if you are responsible for paying council tax, your bill is likely to rise sharply.

Nine million workers will see their pension contributions triple.

And families on benefits could be more than £300 a year worse off.

Income tax

Almost all taxpayers will be better off as a result of changes to income tax. The point at which workers start paying tax will rise from £11,500 to £11,850, saving basic-rate taxpayers some £70 a year. The level at which workers start paying higher rate tax (40%) will rise from £45,000 to £46,350, saving them £336 a year, according to the government calculator.

However, the rise in income tax thresholds is only going up by inflation. The Institute for Fiscal Studies (IFS) points out that all other rises since 2010 have been more generous.

Scottish tax

For the first time this April, Scottish taxpayers will have different rates from those in England and Wales. Those earning more than £33,000 - about 45% of the population - will pay more income tax if they live north of the border. However, that leaves about 55% who will be paying less.

Minimum wage

Rates for the National Minimum Wage - for those under 25 - and the National Living Wage - for those over 25 - are rising by more than inflation. The most generous increase is for 18 to 20-year-olds, whose salaries will rise by 5.3%. Those over 25 who currently earn the bare minimum will see an increase of 4.4%, or 33p an hour. Rates increase on 1 April.

The Office for National Statistics has produced a calculator which shows how you might have to cut back on spending if you earn the National Living Wage.

Student loans

From 6 April, former students will be able to earn more before they have to start paying back their loans. English and Welsh students who took out loans before September 2012, along with students from Scotland and Northern Ireland, will be able to earn £18,330 (up from £17,775) before having to make repayments.

However, English and Welsh students with post-2012 loans will see more significant benefits. Instead of having to start paying back at £21,000, they will now be able to earn up to £25,000. Someone earning £23,500 will save £18 a month, or £206 a year. Someone earning £27,000 will save £45 a month, or £530 a year.

Inheritance tax

Getty Images

Getty ImagesFrom this April, those who own a home will face less inheritance tax (IHT) when passing on their estate. There is no increase in the main exemption - the first £325,000 of any estate - but the additional exemption for property will rise from £100,000 to £125,000. That represents a potential saving of up to £10,000 on IHT bills.

Council tax

In England, council tax is going up by an average of 5.1% from 1 April. For the average band D property, it will cost £1,671 - a rise of £81 on last year.

Londoners will see an average increase of £55. Those in county council areas will have to pay £86 more.

English councils were allowed to raise council tax by a maximum of 5.99%, including 3% for those with social care responsibilities.

All Scottish councils are increasing council tax by 3%, the maximum allowed.

Getty Images

Getty ImagesResidents of Wales will be hit by some of the largest rises, as no restrictions were applied by the Welsh Assembly. The biggest hike will be in Pembrokeshire, where council tax is going up by 12.5%.

Pensions

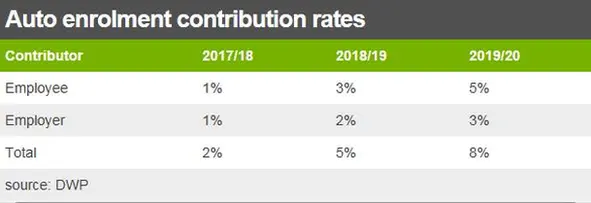

From 6 April, nine million workers who have auto-enrolment pensions will have to pay more in. Their monthly contributions will triple, from a minimum of 1% to a minimum of 3%.

Most people will therefore have to pay several hundred pounds a year more. But by doing so, they will also get a 2% contribution from their employer, and more tax relief from the government.

According to figures compiled for the BBC, staying in an auto-enrolment scheme could eventually earn you up to £17,000 a year more in retirement.

From April, the Pensions Lifetime Allowance - the most you can have in a pension pot - is going up from £1m to £1,030,000. Having more than that means paying 55% tax on lump sum withdrawals or 25% on income withdrawals.

Those with a state pension will see their income rise by 3% from 9 April, thanks to the government's triple lock mechanism. The Consumer Prices Index (CPI) rose by 3% in the year to September 2017.

Savers

Not much to celebrate here.

The Help to Save programme - which promises those on benefits a 50% top-up from the government - was to have launched in April, but has now been postponed until October.

The most you can invest in an Isa remains at £20,000, although the maximum for Junior Isas will rise by £132 to £4,260 on 6 April.

The maximum amount you can get from share dividends without being taxed goes down from £5,000 a year to £2,000. Basic rate taxpayers will be charged 7.5% on any dividends over £2,000, while higher rate taxpayers will be charged 32.5%.

Benefits: The freeze continues

About 10 million households will see no increase this year in Child Tax Credit, Child Benefit, Jobseeker's Allowance, some Employment Support Allowance payments and Universal Credit.

Furthermore, this year - the third year of a four-year freeze - will be "the most painful so far", according to the IFS.

Had the freeze not existed, claimants could have expected a 3% increase, in line with last year's September inflation figure. Last year, they missed out on a 1% rise, while in the previous year it was 0%.

The Resolution Foundation has calculated that a typical family with two children will get £315 less this year than they might otherwise have expected had the freeze not been in place.

Support for mortgage interest

From 6 April, about 124,000 benefit claimants - most of them pensioners - will no longer be able to get cash help with their mortgage payments. From then on, the benefit will be converted to a loan, repayable when they sell the house. Citizens Advice has more information.

Sugar tax

Getty Images

Getty ImagesFrom 6 April, manufacturers of sugary drinks will have to pay the Sugar Levy. Drinks that contain more than 5% sugar will incur a lower rate; those with more than 8% will be liable to a higher rate. It's thought the levy will put up the price of a typical fizzy drink by about 8p a can.

Water bills

The average combined water and sewerage bill across England and Wales will rise by £9, to £405 a year, from 1 April.

Other taxes

Air Passenger Duty is frozen for short-haul flights, ie those under 2,000 miles. Above that distance, economy seat passengers will pay an extra £3, with first or business class costing £6 extra.

Vehicle Excise Duty will rise for new diesel cars that do not meet the European pollution standard RDE2. The increase will be up to £310 a year.

Tobacco tax is increasing by 2% above RPI inflation each year of this Parliament.

Prescription charges will rise from £8.60 to £8.80 in England. The cost of a three-month subscription remains the same. Wales, Scotland and Northern Ireland have abolished such charges.

Fuel duty is frozen for another year.