Technology giants face European 'digital tax' blow

Big technology firms face paying more tax under plans announced by the European Commission.

It said companies with significant online revenues should pay a 3% tax on turnover for various online services, bringing in an estimated €5bn (£4.4bn).

The proposal would affect firms such as Facebook and Google with global annual revenues above €750m and taxable EU revenue above €50m.

The move follows criticism that tech giants pay too little tax in Europe.

EU economics affairs commissioner Pierre Moscovici said the "current legal vacuum is creating a serious shortfall in the public revenue of our member states".

He stressed it was not a move against the US or "GAFA" - the acronym for Google, Apple, Facebook and Amazon.

According to the Commission, top digital firms pay an average tax rate of just 9.5% in the EU - far less than the 23.3% paid by traditional companies.

Its figures are disputed by the big tech firms, which have called the tax proposal "populist and flawed".

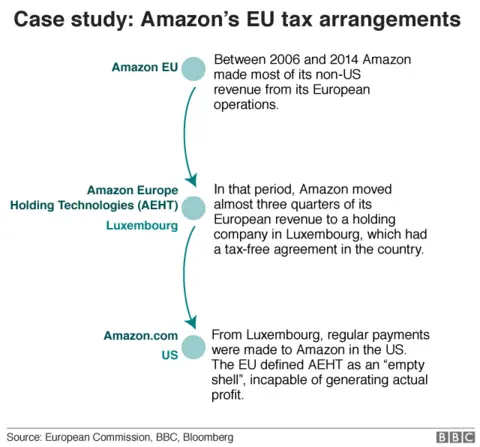

Countries including the UK and France have accused firms of routing some profits through low-tax EU member states such as Ireland and Luxembourg.

Big US tech companies have argued they are complying with national and international tax laws.

However, the Commission said it wanted to tax companies according to where their digital users are based.

Analysis: Kamal Ahmed, BBC economics editor

It doesn't appear that Britain's journey towards the exit door of the European Union is causing too much consternation in Brussels over whether these new tech tax proposals will ever be implemented.

The EU commissioner behind today's proposals has told me "there is no blocking attitude from the UK".

Pierre Moscovici said that whilst Britain remained a member of the EU, he expected Philip Hammond to play a positive role in supporting the changes.

He also said that he believed the plans could be agreed by the end of the year - before Britain departs - and would be discussed tomorrow at the EU summit which will be attended by Theresa May.

Some will say Mr Moscovici's timetable is overly-ambitious, and that gaining agreement from all the EU member states will prove difficult.

His answer to that? That the political direction of travel is clear, voters want to see digital giants like Facebook and Google pay more tax.

And here is a thought through plan to do it.

The tax would only apply to certain online revenue streams, such as online advertising in search engines or social media, online trading, or the sale of user data.

The proposals require backing from the European Parliament and the 28 EU countries, but they are divided on the issue.

EU tax reforms need the backing of all member states to become law.

Ireland has warned that the proposals may not yield more tax, while some countries believe smaller companies should also face a bill.

The business practices of big tech firms are facing growing scrutiny in Europe.

Competition regulators have fined Apple and Amazon, while Google is appealing against a record €2.4bn fine for abusing its dominance to favour its own shopping services.

EU agencies are also set to tighten rules on data privacy, while Germany has introduced big fines for social media firms who fail to take down extreme content quickly enough.