Hammond, the economy and why chewing gum matters

Reuters

ReutersIt was Lyndon Baines Johnson who famously said that Gerald Ford could not walk and chew gum at the same time.

(He actually said fart and chew gum, but his words were sanitised by a US media that didn't much like uncouthness from its presidents.)

Today's Spring Statement will require a rather more accomplished ability to understand two things simultaneously, while retaining the ability to quickly check "is chewing gum made of plastic?" on Google.

First, Philip Hammond will say that, yes, the economy and the public finances are in better shape than originally forecast (though those forecasts of last year were particularly grim).

Borrowing is expected to be up to £10bn lower than expected last year, due to better-than-expected tax revenues.

Growth is also set to be higher, exports are up and manufacturing is in robust health.

But - at the same time - there are still major causes for concern.

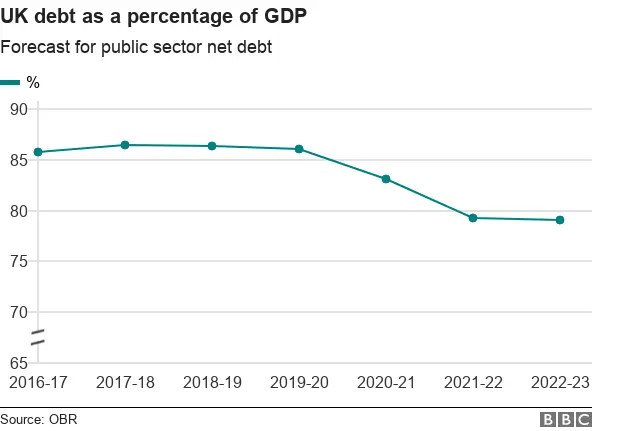

The main one, for the Treasury at least, is that public debt as a percentage of national income remains well above 80%.

Although, as government critics who would like to see more spending point out, it is falling.

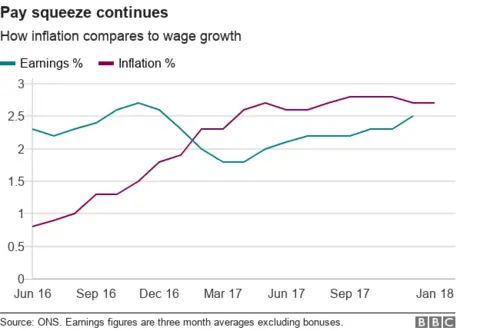

Mr Hammond also knows that whatever the better economic news, people are not experiencing a better economy.

Real incomes are still falling, as inflation - the rise in prices - outstrips earnings growth.

The latest Visa Consumer Spending Index for last month revealed that consumer spending fell again in February, the ninth time in 10 months.

That is important for one of the most important drivers of the UK economy - how much we all buy.

There is also continuing Brexit risk, which is weighing on business investment - up, but not by as much as expected.

There might be light at the end of economic tunnel, the chancellor has suggested.

But we are still in the tunnel, he insists.

And little that will be announced today will seek to shorten the journey.

That will be left to the Budget in the autumn, when Mr Hammond will reveal his tax and spending plans.

Difficult areas

Two hares will be released today.

First will be proposals to tax single-use plastics - possibly including chewing gum, made from synthetic rubber.

Here, the government is a long way from a settled approach.

There is no clear, legal definition of what a single-use plastic is.

And if there is no legal definition, then taxing it is difficult.

Once that definition is established, I am told the Treasury's approach will be similar to the one taken with the soft drinks industry.

In that instance, the government announced a tax on sugar to change behaviour as well as raise more money.

And many companies did indeed change the formulation of their products to avoid it.

The government hopes for a similar response to any proposals to tax single-use plastics - reducing production and thereby helping the environment.

Second will be more detail on a possible tax on the revenues of digital giants such as Facebook and Google.

That is a substantial change to the present tax on profits, which the technology companies have - perfectly legally - largely avoided in the UK, as they pay the bulk of their taxes in America.

Like single use, this is a fiendishly difficult area.

What constitutes a digital company?

And how might America react if the UK unilaterally decides to tax its companies at higher levels?

The economic landscape will be the meat of today's Spring Statement, setting the tone for the long flight path into the Budget.

But it is certainly interesting that two of the main areas of consultation the government is looking at are focused on raising more taxes from businesses.

In the long term, those may well be more significant than any announcements on growth and borrowing later today.