Debenhams shares dive after weak Christmas trade

Reuters

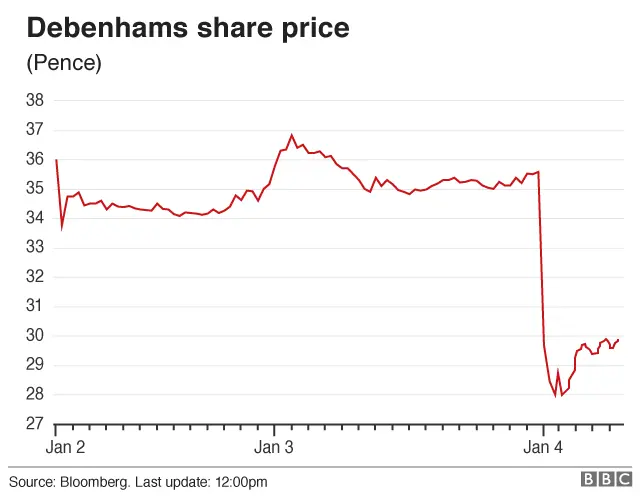

ReutersDepartment store chain Debenhams' shares have sunk 15% after it warned that annual profits would be lower than expected because of disappointing trading over the key Christmas period.

The retailer said underlying pre-tax profits were now likely to be between £55m and £65m this year.

Analysts had been expecting profits to be about £83m.

Like-for-like sales in the UK fell 2.6% in the 17 weeks to 30 December amid a "volatile and competitive" market.

Debenhams said trading had improved over the six-week Christmas period thanks to discounting, with like-for-like sales up 1.2% during that time, but the first week of the post-Christmas sale was worse than expected.

"The market has been challenging and particularly promotional in some of our key seasonal categories and we have responded in order to remain competitive for our customers, which has impacted our profit performance," said Debenhams chief executive Sergio Bucher.

Shares in the retailer dived 20% in early trade, before recovering slightly by lunchtime to stand 15% lower at about 30p.

The retailer said it was "accelerating some aspects" of its strategic plan, Debenhams Redesigned, in order to "deliver a long-term sustainable future".

It said early signs from new store format trials in Stevenage and Wolverhampton were "promising".

Debenhams added that "reorganisation and restructuring activity" and a review of central costs were expected to generate savings of £20m.

It said there had been "positive momentum in digital sales growth", with smartphone demand up 36% year-on-year following improvements to its mobile site.

However, Laith Khalaf, senior analyst at Hargreaves Lansdown, said: "Strong growth for its digital offering has failed to save Debenhams from a miserable end to the year.

"Customers turned out for Christmas, but refused to put their hands in their pockets in the lead-up to the festive period, or indeed the Boxing Day sales.

"Debenhams has been forced to cut prices to persuade shoppers to part with their cash, and as a result, margins have been squeezed, profits have been significantly downgraded and the share price has taken a massive hit."

'Damaging value'

Sofie Willmott, senior retail analyst at GlobalData, said: "Given the barrage of discounted products available in the lead-up to Christmas, including Black Friday, it's no surprise that Debenhams' end-of-season sale produced disappointing results, despite 'further markdown investment'.

"Discerning consumers with squeezed budgets are looking for value for money and by constantly reducing the price of goods, Debenhams is damaging customer perception of value, discouraging shoppers to buy from the retailer."

Analysis: Jonty Bloom, business correspondent

With hundreds of stores in expensive locations and with a constant squeeze on the average shoppers' spending power, Debenhams is caught in a classic bind.

Online and discount retailers are attracting increasing amounts of spending power and Debenhams is in a constant race to adapt quickly enough to a rapidly changing retail market.

So it slashes prices to attract sales in the run-up to Christmas, hardly a sign of confidence or strength, while accelerating cost savings and trying to roll out new outlets and improve its online offering.

Shareholders seem unimpressed and worried that Debenhams is trying to run faster and faster to catch up and yet appears still to be falling behind younger and more flexible competitors.

Debenhams is the UK's second-biggest department store operator and has 240 stores in 27 countries.

Its current fortunes contrast sharply with those of clothing retailer Next, which surprised the markets on Wednesday by raising its profit forecast.

Next said annual profits were expected to rise by £8m to £725m after cold weather boosted trade ahead of Christmas, sending full-price sales up 1.5% - far better than the 0.3% fall it had expected.