Would Rupert Murdoch break up his empire?

Getty Images

Getty ImagesSpeculation is swirling that the Murdoch family is open to breaking up its entertainment business.

Shares in 21st Century Fox gained more than 6% on Friday, after several sources reported interest from Comcast, Sony and Verizon.

Last week the company, which is led by the family of Rupert Murdoch, was said to have held talks with Disney.

The talk is that the Murdochs might be prepared to part with the movie studios along with some other parts of the business - an abrupt shift in strategy after years of empire building.

21st Century Fox has not directly addressed the speculation and a spokesman did not respond to a request for comment.

And analysts said it isn't clear how seriously to take the idea of a sale.

But the talk seems to have whetted rivals' appetites for a piece of Fox if it really is available.

"It's not a surprise why anyone would want the assets," "said Brian Wieser, senior analyst at Pivotal Research. "It's a surprise Fox would be listening."

He added: "Nobody would ever have thought that the Murdochs were interested in downsizing."

What would 21st Century Fox sell?

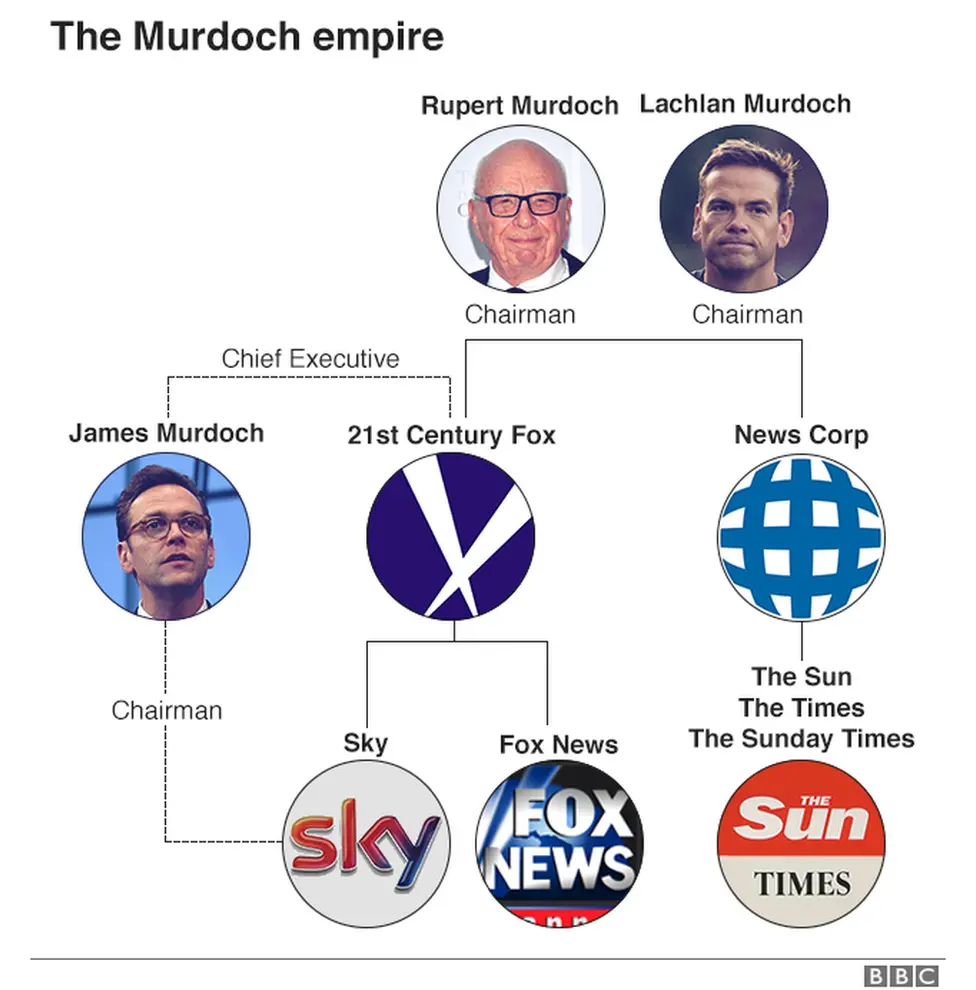

From his start as a newspaper owner in Australia, Mr Murdoch, 86, has built a media empire that spans Africa, Asia, Europe and the Americas.

His 21st Century Fox business is known for its flagship Fox News channel, as well as National Geographic, Asia-based Star TV, and a range of sports channels and local news stations.

It's also known for expanding not shrinking.

Rupert Murdoch has always "been the predator. He's never been the prey so to speak," said Steven Barnett, professor of communications at the University of Westminster in London.

The Wall Street Journal - in which the Murdoch family also has a large voting stake - reported that Fox is discussing its movie studio, cable networks and international businesses, including Europe-based broadcaster Sky.

That would leave the firm more narrowly focused on sports and news.

Those areas have been sources of growth in recent years, unlike its film entertainment unit, where revenue has declined.

"It is conceivable that [Rupert Murdoch] is thinking about retrenching into the areas that he feels most comfortable with, which have been most profitable for him, which are news and sport," Mr Barnett said.

Why would he sell?

Last year, Fox announced a deal to take full control of Sky, in which it already has a 39% stake. But the merger has been delayed, pending approval by UK authorities.

It's a sign of broader political headwinds for the firm, which has also been buffeted by a sexual harassment scandal in the US.

Getty Images

Getty ImagesThe Murdochs had to abandon a previous bid for Sky after the phone-hacking scandal in the UK.

Media analyst Claire Enders, founder of Enders Analysis, said the current speculation suggests that Fox wants to explore other possibilities should that deal fall through again.

"I think this is really Plan B," she said.

It could also signal discord within the family over the direction of the business, she added.

Are there broader market reasons?

The reports come amid upheaval in the media industry, as viewers turn increasingly towards online video, and away from subscriptions for pay-TV.

Analysts say changing consumer habits have prompted media and entertainment executives to explore more consolidation of content creation and distribution functions.

"The big success stories of the future are going to be those that can read across content and distribution," said Mr Barnett.

AFP/Getty

AFP/GettyOn a conference call with analysts earlier this month, James and Lachlan Murdoch dismissed the idea that the firm, which brought in nearly $29bn (£21.5bn) in revenue in its most recent financial year, is not big enough to compete.

But they also pointed out that the company has streamlined operations in recent years. Among other changes, the family has sold some companies and separated its newspapers into a different company.

The comments suggested the family is "not ruling out" a potential split, said Mr Wieser.

Or is this not about a sale at all?

It could all be part of a longer game plan, said Ian Whittaker, at London based investment analysts Liberum.

Three years ago, Fox tried to acquire Time Warner but was rebuffed.

Now that deal could be in the firm's sights again, as a pending merger between AT&T and Time Warner faces questions from US competition authorities.

If the Time Warner-AT&T tie-up falls apart, Fox could use sale of some assets to fund a bid for Time Warner, Mr Whittaker said. If it goes through, then he won't need the money, he added.

But any Fox deal - for Time Warner or with the other potential suitors - would face close regulatory scrutiny.

"It's quite a challenge," said Ms Enders. "It's not something that's going to happen in a tearing hurry."