House price 'north-south divide' narrows

Getty Images

Getty ImagesHouse price growth was fastest in the North West of England in the last year, official figures show, as London again recorded the slowest rise.

Property prices have sped up in cities such as Manchester but the UK average has remained steady, the Office for National Statistics (ONS) data shows.

House prices rose by 7.3% in the year to the end of September in the North West of England.

The UK average was a 5.4% rise over the same period.

In London, the rise was 2.5%.

The average UK house price was £226,000 in September 2017, some £11,000 higher than a year earlier.

The figures were published as the ONS also revealed that general consumer prices, as measured by the CPI measure of inflation, rose by 3% in the year to October.

Cost of renting

Rising house prices and stricter demands from mortgage lenders have made things tougher for many first-time buyers to fund the initial cost of buying a home.

Figures from UK Finance, which represents mortgage lenders, showed that activity from first-time buyers has dropped. They were advanced 31,100 loans in September, down 10% on the previous month and 1% on the same month a year earlier.

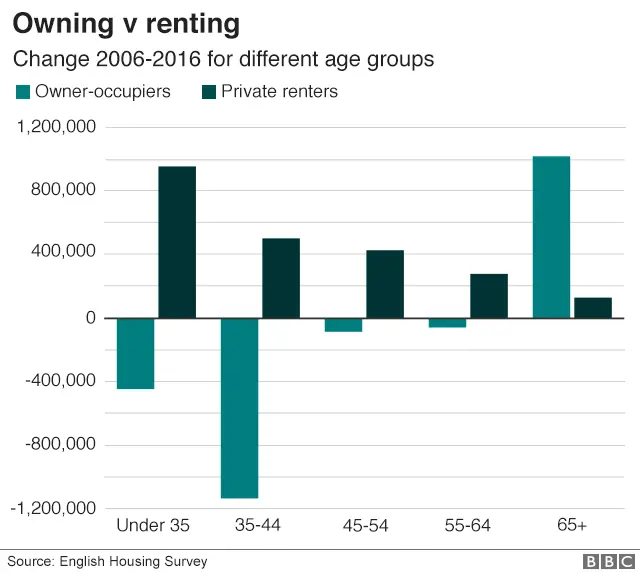

Over time, there has been a shift in younger generations renting their home rather than owning.

Private rental prices paid by tenants in Great Britain rose by 1.5% in the 12 months to October, the ONS said, slightly down from 1.6% in September.

The ONS figures show that house prices in Northern Ireland rose by 6% in the year to September, compared with a 5.7% rise in England, a 5.3% increase in Wales, and a 3.1% rise in Scotland.

Jeremy Leaf, a north London estate agent, said: "The UK market reflects all different areas working at various paces, The trend in London is quite different where an excess of supply and weak demand are combining to reduce prices consistently with no real prospect of an increase until early next year at the soonest."

Russell Quirk, founder of estate agent eMoov.co.uk, said: "The [UK] market has continued to splutter along, registering yet more marginal positive price growth despite a sustainably lower level of buyer demand.

"This is certainly promising for those on the ladder and we should see a large degree of stability return with a heightened level of buyer interest come January."