Republican tax plan to target mortgage deduction

Getty Images

Getty ImagesRepublicans have unveiled details of a sweeping tax plan, aimed at slashing rates for businesses and lowering inheritance taxes.

The proposal would lower the corporate tax rate from 35% to 20%, while retaining the top individual rate for the wealthiest at 39.5%.

It eliminates a popular mortgage interest deduction for new home loans of $500,000 (£380,000) or more.

Delivering on the plan is a priority for Republicans and the president.

Republicans said the bill, which is estimated to cost about $1.5tn over a decade, is transformational.

They say it will make US companies more competitive and simplify the tax-filing process for the average American family.

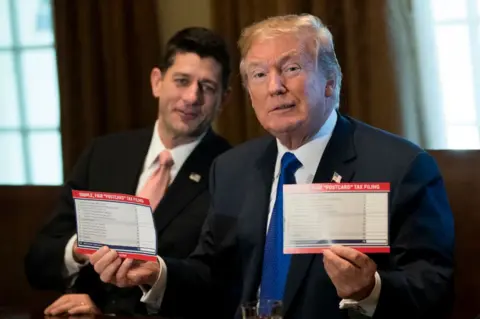

"This is our chance to make sure that generations to come don't just get by, they get ahead in this country," House of Representatives Speaker Paul Ryan said.

The most costly part of the plan is the reduction of the corporate rate.

Republicans said the bill also provides "relief" for ordinary Americans.

They said the changes will save the average family of four about $1,182 on their tax bill.

President Donald Trump and other Republican party leaders are hoping to win approval of the bill by the end of the year.

Mr Trump called it a "big, beautiful Christmas present" for families.

But Democrats say the plan favours corporations and the wealthy.

Representative Nancy Pelosi, who leads Democrats in the House, slammed the bill as "half-baked" and said it would raise taxes on the middle class.

Key elements

- The standard tax deduction increases from $6,350 to $12,000 for individuals, and from $12,700 to $24,000 for married couples

- Estate tax exemption nearly doubles to $11.2m, up from $5.49m, and will be eliminated by 2024

- Alternative Minimum Tax - which ensures the wealthy cannot entirely avoid taxes by taking advantage of deductions - will be repealed

- Corporate profits from overseas will no longer be taxed, but a minimum 10% tax will be placed on US foreign subsidiaries

- Child tax credit expands from $1,000 to $1,600 per child

- Despite speculation, there is no change to a limit on pre-tax contributions to 401(k) retirement funds

- Federal deductions for state and local income and sales taxes will be eliminated

- Local property taxes can be deducted from federal income, but are capped at $10,000

Murky details

By Anthony Zurcher, BBC News, Washington

The Republican party's outline of its new tax plan lists almost as many items that are going to stay the same as are being changed. That's the nature of tax reform - every deduction and loophole has a group that will fight to preserve it.

Republicans will boast that tax-deferred retirement plans, the credit for low-income workers and the charitable donations deduction are untouched.

They're playing a dangerous game, however, by targeting one cherished middle-class deduction - for interest on home mortgages. The powerful homebuilding lobby will wage a pitched effort to squash Republican hopes.

The tax proposal is framed as geared toward the working and middle classes - and there is some help there - but its central focus is a corporate tax reduction that, while popular among the party's corporate base, doesn't excite the general public.

Republicans will try to push the legislation through much the way they did healthcare reform - by keeping details murky and scheduling quick votes. Forces are already aligning against it, however, and Democrats are ready to paint the plan as a sop to the rich.

Donald Trump and congressional Republicans have a lot riding on a successful effort, but the road ahead is far from easy.

Who are the winners and losers?

Winners: Corporations and businesses

The bill slashes the corporate tax rate from 35% to 20%. That's expected to reduce revenue by almost $1.5tn from 2018-2027.

The bill also sets a 25% top tax rate for income from certain businesses that is taxed at the personal rate - a further $500bn reduction in revenue.

Winners: Wealthy heirs

Under current law, inheritances over $5.49m face a 40% tax rate. The Republican proposal would immediately double the amount excluded from taxes to $11.2m and repeal it entirely in 2024.

The committee expects that to reduce revenue by $172.2bn through 2027.

Winners: Some families

The plan also reduces the number of tax brackets to four from seven.

For married couples, income up to $24,000 would not be taxed under the proposal; income between $24,000 and $90,000 would face a 12% rate; earnings between $90,000 and $260,000 would be taxed at 25%; while income between $260,000 and $1m would fall in the 35% bracket. Income over $1m would face the top 39.5% rate.

For single filers, the bill sets the income thresholds at half those amounts, but the 35% rate would start at $200,000.

How those changes would affect a tax bill depends on the particulars of a person's income, residence and what benefits they claim.

In theory, for joint-filers, the proposal would mean the tax rate on income up to about $76,000 would fall from 15% under current law to 12%, while the tax rate on income between $76,000 and $90,00 would drop from 25% to 12%.

The tax rate on income between about $471,000 and $1m would also fall for joint-filers, from 39.5% under current law to 35%.

Losers: Wealthy homeowners in Democratic states

Current law permits taxpayers to deduct interest paid on mortgages up to $1m. The Republican proposal would cap that at $500,000.

Trade groups for home builders and realtors oppose the shift, but the change is favoured by some left-leaning groups, including the National Low Income Housing Coalition.

Many of those mortgage-holders are concentrated in high-cost, coastal states, such as California, New York, New Jersey, Massachusetts and Maryland.

In California, for example, more than 16% of home loans exceeded $500,000, compared to less than 1% in Iowa.

Many of those homeowners would also likely be hit by the $10,000 cap imposed on local property tax deductions.

Many of the states most affected are strongholds of Democratic voters and home to Democratic leaders, including Nancy Pelosi and Chuck Schumer.

The change would also raise revenue, but the committee did not estimate the specifics of the provision.

Losers: Ivy League universities

The bill would impose a 1.4% tax on investment income earned by certain private colleges and universities.

The shift is expected to raise $3bn over a decade.

Losers: manufacturers testing drugs for rare conditions

The bill repeals a credit granted for some drug development expenses. That is one example of how the bill aims to close "loopholes" for businesses.